Infrastructure, as you may know, plays a pivotal role in the country’s economic growth, and more importantly, in the case of emerging and developing economies such as India.

Since the boom in India’s infrastructure and construction sector, there has been remarkable progress in infrastructure development, be it roads & highways, bridges, economic corridors, railways, metros, civil aviation, shipping & ports, urban affairs & housing, warehousing, etc.

Today, spending on India’s infrastructure has significantly increased to around Rs 11.21 trillion (t) in the Union Budget 2025-26, representing 3.1% of GDP.

Development of infrastructure has a multiplier effect on the economy and may help it to achieve its target of being a US$ 7 tn economy by 2030.

With the National Infrastructure Pipeline (NIP) progressing steadily, infrastructure mutual funds emerge as a compelling thematic investment avenue for investors with a long-term horizon.

If you are considering riding this infra-backed economic boom, you may look at infrastructure mutual funds.

One such fund is HDFC Infrastructure Fund, an open-ended thematic equity fund launched in March 2008 amid the infrastructure boom in India.

Fund Overview

HDFC Infrastructure Fund is one of the oldest infrastructure mutual funds in India, with a mandate to invest predominantly in equity and equity-related securities of companies engaged in or expected to benefit from the growth and development of infrastructure.

Around 80-100% of the assets are invested in infrastructure & infrastructure-related companies. And up to 20% of the assets it invested in companies other than infrastructure-related ones.

Further, it has the mandate to invest up to 35% of the total assets in overseas securities.

It also has the mandate to invest up to 10% in non-convertible preference shares.

The fund also invests up to 10% in units issued by REITs and InvITs for diversification.

Other than the above, for defensive consideration, the fund invests up to 20% in debt & money market instruments and fixed income derivatives.

Besides, the fund may invest up to 5% of the net assets of the mutual fund (i.e. across all the schemes of the Fund).

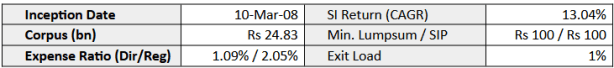

Since its launch, the fund has demonstrated a decent track record, and today, the Assets Under Management (AUM) of this fund is nearly Rs 25 bn.

The domestic portfolio of HDFC Infrastructure Fund is managed by Srinivasan Ramamurthy (Senior Fund Manager – Equities) since January 2024. Before that, star fund manager Prashant Jain, along with Rakesh Vyas, managed the fund.

The overseas investments of the fund are currently managed by Dhruv Muchhal.

HDFC Infrastructure Fund – Snapshot

Investment Strategy

HDFC Infrastructure Fund, while predominantly investing in companies engaged in or expected to benefit from the growth and development of infrastructure, broadly invests in the following sectors:

- Airports

- Banking and Financial Services

- Cement & cement products

- Construction & related industries

- Electrical & electronic components

- Energy

- Engineering

- Metals/Mining/Minerals

- Housing and related industries

- Industrial Capital Goods

- Industrial Products

- Oil & Gas and allied industries

- Petroleum and related industries

- Telecom

- Urban Infrastructure, including Transportation, Water, etc.

Together, these sectors, among others, constitute what is known as the ‘infrastructure theme’.

The portfolio of the fund can be classified into three segments:

- Asset Financiers – Banks and infrastructure financing companies

- Asset Creators – Engineering and construction companies

- Asset Owners/Developers – Companies that own infrastructure projects

The fund also uses derivative instruments, such as futures and options, or any other derivative instruments for hedging and non-hedging purposes.

Portfolio

The fund holds a decently diverse portfolio of 55-60 stocks. As per the August 2025 portfolio, the fund has 55 stocks, of which 52% are largecaps, about 4% midcaps, and 34% smallcaps. The fund is currently holding around 8% in cash & cash equivalents.

The top 10 stocks are 39.6% of the total portfolio and include heavyweights such as ICICI Bank (7.3%), L&T (5.5%), HDFC Bank (5.4%), etc.

Among the various sectors within the theme, the top 3 are infrastructure (19.1%), banks (17.2%), and logistics (6.1%).

Other than that, the fund is holding about 2% in REITs & InvITs, namely the Embassy Office Parks REIT and the Nexus Select Trust.

The fund follows a buy-and-hold approach as reflected by its low portfolio turnover ratio, which has ranged around 13-14% in the last one year.

The portfolio of the fund is mainly skewed to cyclical infrastructure-related sectors in India, helping it to benefit from engines of economic growth.

Historical Returns

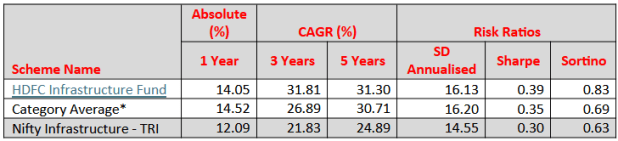

HDFC Infrastructure Fund has fared decently over long time period of 3 years and 5 years.

The compounded annualised rolling returns delivered by the fund are 31.8% and 31.3%, over 3 years and 5 years, respectively, which are the category average and the Nifty Infrastructure – TRI.

At this rate, a lump sum investment of Rs 1 lakh would have turned into around Rs 2.29 lakh in 3 years and Rs 2.26 lakh in 5 years.

Rolling period returns are calculated using the Direct Plan-Growth option. Returns over 1 year are compounded annualised.

Standard Deviation indicates total risk, while the Sharpe Ratio and Sortino Ratio measure the Risk-Adjusted Return. They are calculated over 3 years, assuming a risk-free rate of 6% p.a.

*All infrastructure mutual fund schemes are considered to compute the category average returns.

Please note that this table represents past performance. Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

However, over 10 years, the fund has clocked 11.9% CAGR, underperforming both its category average and the Nifty Infrastructure – TRI.

Since its inception, the fund has clocked a CAGR of around 13% under the Direct Plan.

Risk Profile

Being a thematic fund, HDFC Infrastructure Fund falls under the very-high-risk category.

Despite a buy-and-hold strategy being followed, it has exposed its investors to high risk. The fund’s standard deviation at 16.13 is higher than the Nifty Infrastructure – TRI but a tad lower than the category average.

On a risk-adjusted basis, it has compensated its investors well, as reflected by the sharpe and sortino ratios of 0.39 and 0.83, respectively, which are better than the benchmark index.

So, it is a decent performer on a risk-adjusted basis.

Conclusion

If you are looking to ride the infrastructure theme, HDFC Infrastructure Fund is one fund to add to your watchlist among many other peers. It comes from a fund house following robust investment processes and systems.

However, keep in mind that the fortune of the fund will be closely linked to how the infrastructure theme and the underlying sectors fare.

Compared to diversified equity funds, this fund being a thematic one, carries high risk. It is suitable only if you have a high-risk appetite, are looking for long-term capital appreciation, and having an investment horizon of 7-8 years or more.

Keep in mind that since thematic funds are basically equity-oriented funds, selling their units within 12 months will attract short-term capital gains (STCG) tax at 20%.

Similarly, for units sold after completion of one year, the gains will be subject to long-term capital gains (LTCG) tax of 12.5% for gains in excess of Rs 1.25 lakh in a financial year.

Invest wisely, be a thoughtful investor.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.