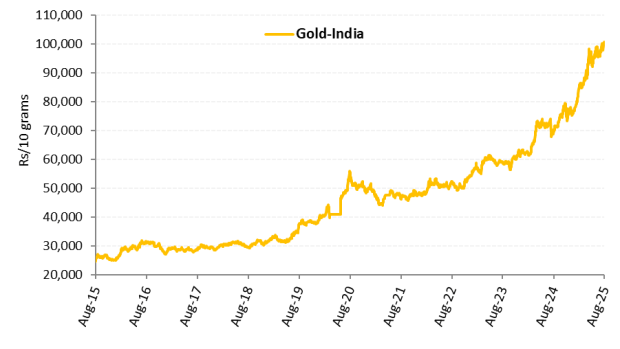

The precious yellow metal, gold, has been exhibiting all its sheen of late. The price per 10 grams of gold crossed over Rs 100,000 level recently in India on the MCX.

The key reasons behind this are the looming uncertainty caused by higher tariffs imposed by US President Trump, potential trade wars, geopolitical tensions, and the effect of all this on inflation, global economic growth, and capital markets.

When market volatility and macroeconomic risks increase, smart investors look to gold as a hedge due to its trait of being a safe haven and store of value.

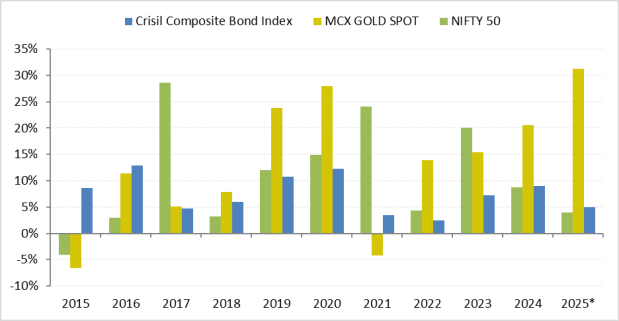

In the year 2025, gold has so far clocked 31% absolute returns, significantly higher than equities and bonds, as of 11 August 2025. Equities have reeled under pressure due to the uncertainty around tariffs and its effect on corporate earnings.

Annual Performance of Equity, Debt and Gold

(Source: ACE MF)

If tensions continue over tariffs and other geopolitical risks emerge, and that weighs down on global growth, it is possible that gold may get even bolder.

Moreover, if the US Federal Reserve potentially cuts interest rates going forward, bowing to pressure from Trump, it would be supportive for gold.

The US dollar, which is traditionally used by central banks as part of their reserve management, has weakened of late.

Central banks instead are buying gold recognising the risks involved on account of steep tariffs, geopolitical tensions, inflation, high debt-to-GDP ratios of certain economies, and the possibility of a global economic slowdown.

In 2024, they bought 1,054 tonnes (t) of gold, and this year, too, they are expected to buy around 1,000 t of gold, which would be their fourth year of massive purchases. This again would augur well for gold prices.

When it comes to your investment portfolio as well, gold plays an important role.

The graph above shows that in years when equities haven’t fared well — like in 2015, 2016, 2018, and 2022 – gold was a saving grace, a store of value, and an effective portfolio diversifier.

The spotlight has turned on to gold, after the COVID-19 pandemic, the start of the Russia-Ukraine war, military conflicts in the Middle East region, and recently because of Trump’s tariff tantrums.

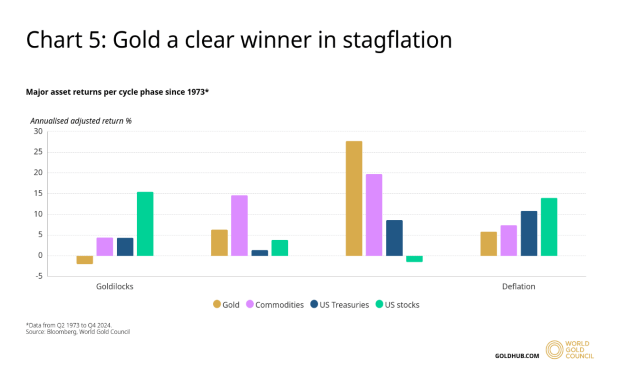

As per the World Gold Council (WGC), sooner or later, we will feel the pinch of stagflation – a phenomenon where economic growth slows down, inflation moves up, and unemployment rises. Such a scenario historically has worked in favour of gold.

Gold a Clear Winner in Stagflation

Even a stronger US Dollar in the recent past hasn’t dampened the sentiment toward gold.

The main reason for gold doing well in uncertainty is that it’s a real asset. Meaning, gold does not carry credit or counterparty risk. It’s a high-quality liquid asset with less volatility than equities.

In contrast to a bumpy road ahead for equities due to global economic risks, its potential impact on corporate earnings, and valuations being a concern, the prospects for gold seem bright in the current uncertain times.

Gold Has Exhibited Sheen in the Long Run

(Source: MCX)

In the short term, as prices move up, some profit booking cannot be ruled out. It is also possible that higher prices may deter some investors from buying gold.

But overall, the current macroeconomic and geopolitical backdrop points in favour of gold.

What Should You Do?

The long-term secular uptrend gold has exhibited cannot be ignored and highlights the importance of owning gold.

In the last decade, gold has clocked a CAGR of 15% and since India’s independence, it has delivered a CAGR of nearly 9.4%, both returns as of 11 August 2025.

It makes sense to allocate around 10-15% of your investment portfolio to gold with a long-term view (5 to 10 years) by assuming moderately high risk. It may serve as a portfolio diversifier.

But make sure that you are investing in gold the smart way – in the form of Gold ETFs and/or Gold Savings Funds, which are essentially gold mutual funds.

Gold ETFs are passively managed and make direct investments into gold. The units of gold ETF purchased by you are backed by 0.995 fineness of physical gold by the respective fund house, and 1 unit of gold ETF is equivalent to 1 gram of gold.

Their investment objective is to generate returns in line with the domestic price of gold. When gold appreciates, the net asset value (NAV) of gold ETFs goes up, and vice versa. If you have a demat and trading account, it makes sense to consider the gold ETFs.

Want to know which are the 5 best gold ETFs in India? Click here.

On the other hand, if you do not have a demat account and want to take the systematic investment plan route, then the gold savings funds may be considered.

They function like a fund of fund scheme that invests in the underlying gold ETFs, which benchmark their performance against the price of physical gold.

In other words, a gold savings fund invests in gold ETFs. And, therefore, the portfolio of a gold ETF becomes the portfolio of a gold savings fund.

Note, the profits you make out of your investments in gold mutual funds will be subject to capital gain tax at the time of redemption. Both Short Term Capital Gains (STCG) and Long Term Capital Gains (LTCG) on gold mutual funds will be taxed as per your income-tax slab, i.e. at the marginal rate.

Invest thoughtfully in the interest of your financial well-being.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.