By Shailesh Kumar

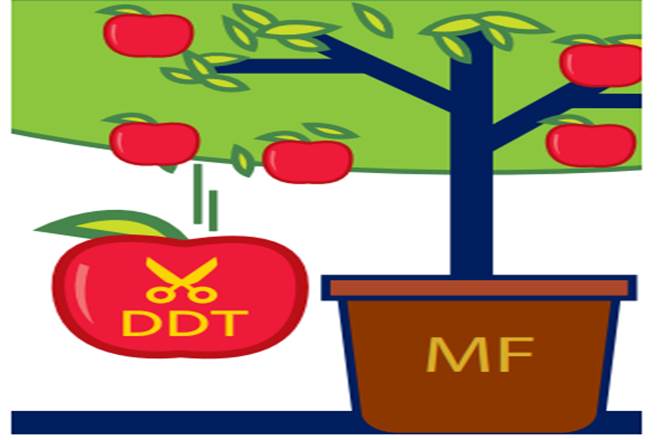

Though abolishing the Dividend Distribution Tax (DDT) may have left companies with extra distributable funds, the receipt of dividends/income from mutual funds may burn a hole in the pockets of individuals. DDT was payable by the company for the shareholder’s income.

However, with effect from FY 2020-21, DDT chargeable on companies has been abolished and income from dividends and mutual funds shall now be subject to tax in the hands of shareholders, as per their tax status. The government has shifted to a classical system of taxation again with effect from this year.

While companies will now need to ensure compliances for withholding tax at source, individuals may need to shell out extra tax on receipt of dividend income and income from mutual funds. Companies will need to check residency status of investors to determine the amount of taxes to be withheld. If non-resident shareholders intend to seek any tax treaty benefits, then for withholding tax purposes, payer companies will need to obtain necessary documents from shareholders such as Tax Residency Certificate in the home country, declaration in Form 10F, etc.

Dividends from mutual funds

Dividends and income from mutual funds shall be subject to 10% TDS if the amount received by the individual exceeds Rs 5,000 in a year. However, no TDS shall be withheld in case the income is in the nature of capital gains from the sale of units of mutual funds. The tax so deducted shall be available as credit against the tax payable by taxpayer on dividend income.

Till FY 2019-20, for high net-worth individuals with dividend income o exceeding Rs 10 lakh, there was additional income tax liability besides DDT paid by the company. Further, individual shareholders could not claim credit of DDT paid by the company against its tax liability on dividend income. However, under the new regime, this anomaly of double taxation is removed. Deduction of interest expense incurred to earn the dividend income can be claimed against taxable dividend income but quantum of such deduction cannot exceed 20% of dividend income.

Investors should therefore choose wisely from shares or units of mutual funds. It may be beneficial to invest in growth oriented funds as the income shall be chargeable to tax on sale of the units under the head “capital gains” in the year of sale while income from dividend oriented funds shall be taxable at the tax rate of ordinary income in the year of receipt. Further, there are companies, which believe in distributing regular income by way of dividend, while others prefer to plough back profits into business, accumulating and appreciating the share valuation giving long term benefits in valuation to shareholders, whenever they plan to liquidate the investment.

The writer is partner, Nangia & Co LLP. Inputs from Vaishali Dua, manager, Nangia & Co LLP