It seems that long waits and weeks of uncertainty after filing income tax returns (ITRs) have become the thing of the past, at least for many individual taxpayers. This year, many taxpayers are receiving their income tax refunds within mere hours of e-filing their income tax returns.

This is a major shift from past years, where refunds used to take more than 90 days. In the current assessment year (AY 2025-26), some taxpayers have received their tax refunds in their bank accounts within 4 hours of filing their return. One might recall the time some 12-13 years ago when this refund used to take more than 90 days to come. Now, thanks to fast digital processes, this time is getting reduced to hours.

Refund came in a few hours! Taxpayers’ experience

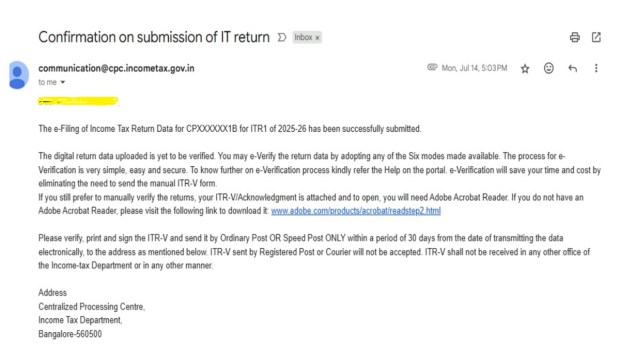

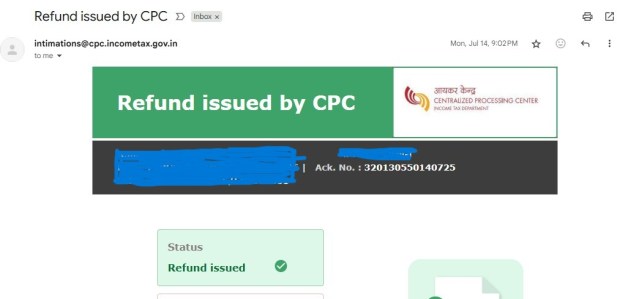

One media professional, Arun Prakash from Noida, received his tax refund within 4 hours of submitting ITR on the e-filing portal of the Income Tax Department. He says, “I filed my return using ITR Form 1 at around 5.03 pm, and by 9.02 pm on the same day, the refund came in my bank account.” He shared with us timestamped proof of both the ITR submission and the refund credit to back his claim. Below are screenshots of the confirmation messages showing the exact filing and refund times.

Tax professionals are saying that previously it was taking the income tax department an average of 30–40 days to issue refunds, but this time some taxpayers have got their refunds on the same day of filing their ITR.

Deepak Verma, a tax professional, said, “Many of my clients got their fastest-ever refunds the same day they filed their ITR. This is a great example of the department’s digital efficiency.”

That said, these are just a handful of tax return filers who have received their refunds in record time — some on the same day. Whether a large number of taxpayers are getting their ITRs processed and refunded this quickly is still uncertain, as there is no large data to support that claim yet. However, what’s undeniable is that the system has become far more efficient. After all, who would have imagined a decade ago that tax refunds could be settled within just a few hours of filing.

However, the Income Tax Department’s website still shows that “it takes 4-5 weeks for the refund to be credited to the account of the taxpayer.”

ITR refunds: From over 90 days to 10 days and now a few hours

Finance Minister Nirmala Sitharaman told Parliament last year that in FY 2013–14, it took an average of 93 days to get income tax refunds. Whereas in FY 2023–24, it has come down to just 10 days.

Strictness has also increased: Strictness on fake claims, keen eye on old returns too

While on the one hand, the government has expedited the refund process, on the other hand, the system has been made more robust and vigilant to prevent tax evasion and catch fake tax deduction claims. This year, the Income Tax Department is seen to be much more strict in the scrutiny of ITR, not only the current returns, but the department is also keeping a close eye on the returns of previous years.

The department is matching the information given in the ITR with third-party data sources like AIS (Annual Information Statement) and Form 26AS. If a difference in income and expenses is found in any return or an excessive refund has been claimed, the system ‘flags’ them. Apart from this, if a taxpayer’s assessment or tax demand of old years is pending, then the department has the right to stop the refund of the current year or adjust it with the old dues.

What is the reason behind the speed in refund credit to taxpayers’ bank accounts?

Fully digital processing: The Income Tax Department has completely automated the processing and verification of returns.

JSON based filing: Now JSON format is used in place of the old Excel system, which makes data reading fast.

Refund processing starts immediately after electronic verification (e-Verify).

Steps like bank account pre-validation and PAN-Aadhaar linking have ensured that the refund is delivered directly and in the correct account.

ITR Filing Process: Online and Offline

Steps for Online ITR Filing:

-Login to incometax.gov.in

-Go to ‘e-File > Income Tax Return’

-Select Assessment Year and Form (e.g. ITR-1)

-Fill in income and tax details

-Submit form and e-Verify

Offline ITR Filing:

-Download Excel/Java utility

-Fill form and generate JSON file

-Upload on portal

-e-Verification is mandatory

Note: Refund process does not start until e-Verification is done.

How to track your income tax refund?

-Login to incometax.gov.in

-Select ‘e-File > View Filed Returns’

-Click on the relevant AY

-Check the refund status in ‘View Details’

If the refund is getting delayed, check these things:

-Whether the bank account is pre-validated or not

-Whether PAN–Aadhaar is linked or not

-Whether there is any error in e-filing

Summing up…

The digital transformation process of the Income Tax Department has given great relief to taxpayers. The refund coming down from 90 days to just a few hours is an indication that e-governance is showing rapid effect in India. Although this facility is not for everyone, the speed at which improvement is happening gives a positive signal for the future. Also, the strictness of the department makes it clear that there is no room for fraud now – every return is being checked layer by layer.

Filing your tax return this year? Head to our detailed ITR Guide for everything you need to know.