Akshaya Tritiya, as you may know, is one of the most auspicious days or muhurat to buy gold.

The word Akshaya in Sanskrit means “never decreasing”, and since it is the third lunar day of the bright half of the spring season, it is called Tritiya.

Akshaya Tritiya falls on the third day of the month of Vaishakh, where the sun and the moon are the acme of their brightness.

It is believed that investing in gold on this day brings good fortune and eternal growth. Gold is also symbolic of Goddess Lakshmi, the Goddess of wealth and prosperity.

Last year, in May 2024, a couple of days before the Akshaya Tritiya muhurat, PersonalFN wrote a piece suggesting making some investment in gold. The price per 10 grams of gold then was over Rs 71,000 (US$ 3,200 per troy ounce) – an all-time high.

The precious yellow metal was grabbing the spotlight.

The key reasons were:

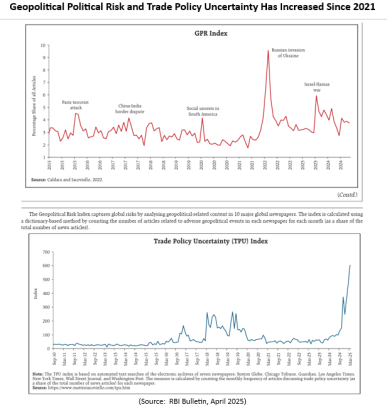

- Looming geopolitical tensions – the war between Israel and certain militant groups of the region, the attack on more than 60 vessels by Houthis in the Red Sea, the Russia-Ukraine war, strained relations between the US and China, China and Taiwan, India facing military stands offs with Chinese troops at the Line of Actual Control, and more.

- The risk of geopolitical fragmentation.

- Major central banks signalling rate cuts supported by the disinflation process.

- Burgeoning debt-to-GDP in several countries.

- Uncertainty around elections – early half of the world’s population headed to polls in 2024.

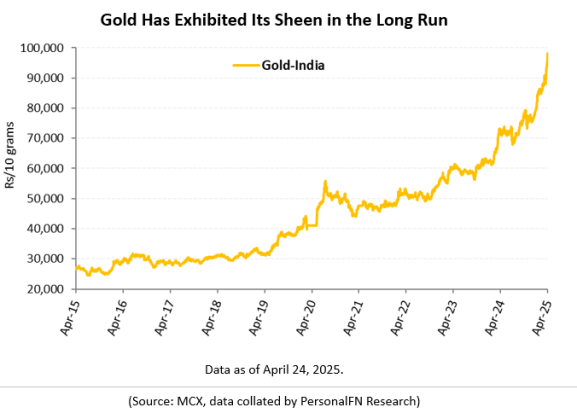

Now, in April 2025, the price of gold in India has crossed Rs 100,000 per 10 grams (over US$ 3,400 per troy ounce) recently.

Since the last Akshaya Tritiya, which was on May 10, 2024, gold has clocked a stunning 31.3% absolute returns as of April 24, 2025.

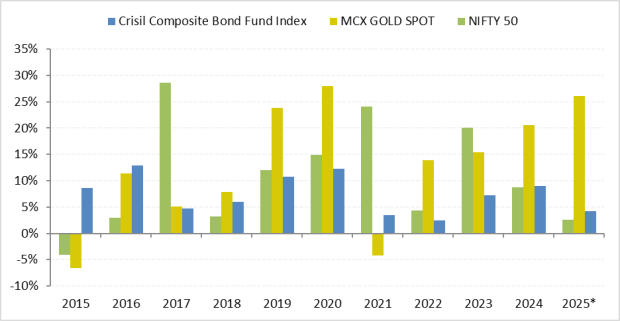

Annual Performance of Equity, Debt, and Gold

Data as of April 24, 2025.

(Source: ACE MF, data collated by PersonalFN Research)

In 2025, so far, gold has clocked 25.4% absolute returns so far in Rupee terms, whereas in the US Dollar terms, the gain is 26% (as of April 24, 2025).

Simply put, the precious yellow metal is exhibiting its sheen. In the past as well, i.e. in 2019, 2020, 2022, and 2024, when we witnessed a pandemic, wars, and geopolitical tensions in many parts of the world, gold has done well.

Everybody is enquiring if gold would move further up and if it still makes sense to invest in gold.

Factors Keeping the Spotlight on Gold

Well, there are a variety of factors but mainly it is the geopolitical tensions. Since Donald Trump was re-elected and announced several protectionist policies, mainly steep tariffs, it brought a lot of uncertainty around the world.

While the Trump 2.0 administration has currently put a 90-day hold period on steep reciprocal tariffs (which ends on July 9, 2025), the uncertainty remains.

The RBI’s April 2025 Bulletin remarked that the global economic landscape is rapidly evolving, and trade policy uncertainty is emerging as the key driver of the near-term outlook.

Besides, geopolitical risks has caused heightened volatility in financial markets. As per the RBI, geopolitical conflicts remain one of the top risks to financial stability.

The International Monetary Fund’s (IMF’s) recent report on financial stability also highlights this point. It says geopolitical risk can affect the prices of financial assets through an increase in uncertainty and disruptions to trade and financial transactions, which can be mutually reinforcing.

In such times of geopolitical risk and trade policy uncertainty, the market sentiments are also nervous or risk-off, and smart investors have looked up to gold as a safe haven.

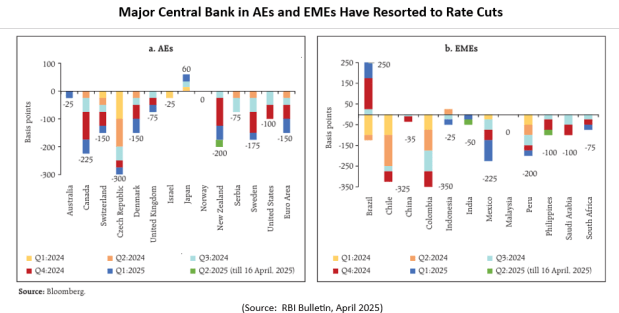

Major Central Banks Have Resorted to Rate Cuts

To support growth and keep markets buoyant, major central banks around the world have cut their policy interest rates in 2024 and addressed liquidity conditions, which also has augured well for gold.

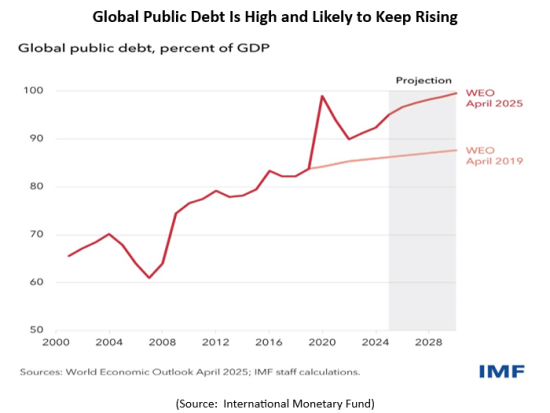

The IMF, in its blog on fiscal policy and management, has observed an increase in debt levels in many countries. It is estimated that global public debt to increase by 2.8% this year—more than twice the estimates for 2024—pushing debt levels above 95% of GDP.

With an upward trend, by the end of the decade, the debt level could be nearing 100% of GDP surpassing the pandemic level.

Debt levels may rise even further if revenues and economic output decline more significantly than current forecasts due to increased tariffs and weakened growth prospects.

Moreover, as per the IMF, rising yields in major economies and widening spreads in emerging markets further complicate the fiscal landscape.

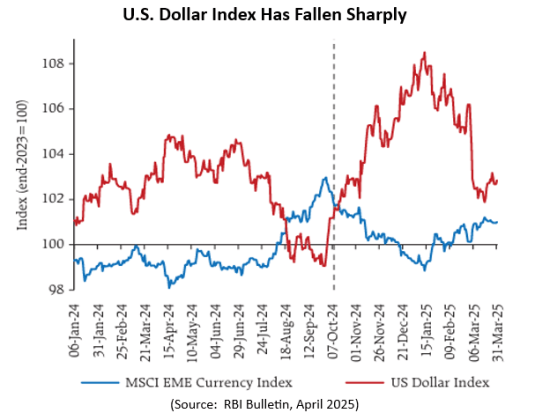

The US Dollar index, amid high debt and tariff tantrums of President Donald Trump, has been battered and bruised. In March 2025, the Dollar index fell 3.2% and a further 4.6% in April (as of April 24, 2025).

This decline is the most since late 2022, as investors have dumped US assets fearing a recession in the US and preferred to take refuge in gold.

A further fall in the Dollar index could to even higher returns in gold. The past data shows that even a stronger dollar hasn’t been able to curb the long-term uptrend of gold. This is because, unlike financial assets, gold is a real asset – meaning gold does not carry credit or counterparty risk.

What Kind of Returns Gold Has Clocked in the Long Run?

The CAGR returns clocked by gold are 13.6% in the last decade (as of April 24, 2025). Clearly, gold has fared remarkably well in the long term.

Gold Has Exhibited Its Sheen in the Long Run

If we consider the returns since India’s independence, gold has clocked a CAGR of decent 9.4% as of April 24, 2025.

Will It Be Worthwhile Buying Gold This Akshaya Tritiya?

Considering the risks and uncertainty, it makes sense to allocate around 10-15% of your investment portfolio towards gold and hold with a long-term view (over 5 to 10 years) by assuming moderately high risk. Invest in gold the smart way – in the form of Gold ETFs and/or Gold Savings Funds.

When investing in gold, be mindful of the risks involved. Like any other investment, the gold price too can witness volatility, short-term corrections, as well as phases of stagnant growth – particularly after a fast run-up, which may dampen the demand at elevated prices.

So, make sure you aren’t investing with a short-term view.

Remember that past instances of superior performance may not be sustained in the future. Thus, be rational in your return expectations. Consider gold as a portfolio diversifier, a hedge, a safe haven, and a store of value in times of uncertainties and risks.

If you have already been investing in gold and your allocation has exceeded 10-15% of your portfolio amid the rally it would be prudent to book profits to bring back the allocation to the desired level.

Be Mindful of the Tax Implications of Investing in Gold Mutual Funds

If you have been investing in Gold ETFs and/or Gold Saving Funds, be mindful of the tax implications when selling the units held.

Gold ETFs and/or Gold Saving Funds are considered non-equity-oriented funds for tax purposes. Thus, returns earned on gold mutual funds are now taxed at the marginal rate of taxation, i.e., as per your income-tax slab, irrespective of Short Term Capital Gain (STCG) or Long Term Capital Gain (LTCG).

Be thoughtful in your approach and buy gold sensibly this Akshaya Tritiya.

Happy Investing.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.