To help people with their loan EMI installments due during the COVID-19 pandemic, the Reserve Bank of India (RBI) had announced a 3-month moratorium on the loan EMIs ending on May 31, 2020. The moratorium on loan EMIs was further extended by 3 months, i.e. till August 31, 2020. This total 6-months’ moratorium on repayment of term loans (starting from March 1, 2020, to August 31, 2020) means that borrowers who wish to avail the moratorium would not have to pay the loan EMI installments during the moratorium period.

This extension will help many people both the salaried as well as the self-employed, who are finding it difficult to service their loans like car loans, home loans, etc. due to loss of income during the pandemic and the lockdown period.

Missing an EMI payment means risking adverse action by banks which can impact borrower’s credit score. Having said that, even after the lockdown has been lifted, there are a lot of people are not financially back on track. Hence, people are still finding it hard to keep up with paying their dues, being under cash crunch. People who are now able to make partial payments are confused about what dues to pay first.

Adhil Shetty, CEO, BankBazaar, says “If your income is strained and you have to pick between paying your EMIs and continuing your SIPs, pay your EMIs. Even though you have the option of delaying your EMIs with the RBI-mandated moratorium of 6-months, you should prioritize paying your EMI dues.” Hence, if you were to choose between continuing your mutual fund SIP and loan repayments, prioritize your premium payments.

EMI is an obligation whereas investment is optional

While investments are critical to an individual’s long-term wealth-creation goals, experts suggest they often tend to be optional. These investments can be paused or even canceled, whereas, repaying a loan is an obligation that must be met mandatorily.

Pause your SIPs in order to pay your loan EMIs. Remember that only pausing your SIPs does not require you to liquidate your mutual fund units. You can resume them again, once you have income stability.

What does one missed EMI mean?

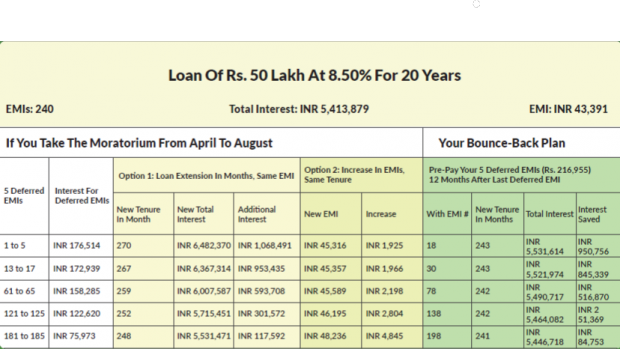

According to experts, one should avoid using the moratorium while one has the means and the income to pay the EMIs. This is because even one missed EMIs could potentially lead to several more EMIs during the tenure of a loan. For instance, if you have deferred the first 5 EMIs of a 20-year home loan, you’ll end up paying 30 more EMIs. Hence, using the moratorium while you can pay your EMIs, is a costly option.

Source: BankBazaar

Should you liquidate your savings to pay EMIs, during the moratorium?

Firstly, consider the lowest risk instrument for a retail customer is a bank FD or high-yield savings accounts, followed by a liquid mutual fund. The category returns for 1-year (forward-looking) FD today is around 4-6 per cent depending on the bank you choose, and the 1-year (backward-looking) liquid mutual funds returns is around 5-6 per cent. Hence, the post-tax return on low-risk instruments will be around 4.20 per cent on the fixed deposit and 5.64 per cent on the liquid mutual fund. However, your interest rate on your home loan will be closer to around 8 per cent per annum and your personal loan will be more than 10 per cent and credit card debt around 40 per cent.

Shetty of BankBazaar, says “Consider the liquidation cost of breaking your investments and calculate this basis your specific circumstance. For instance, if you are breaking an FD and thereby paying 1 per cent penalty on the breakage which is an effective loss of principle. Despite the liquidation cost, you may be better off liquidating that deposit earning 4.2 per cent and additionally incurring 1 per cent penalty, and paying off your home loan accumulating interest at 8 per cent. Therefore, it may be in your long-term interest to liquidate your savings to pay your EMIs, even during the moratorium.”