The decision to invest in bonds or fixed deposits or post office schemes should be made after analysing several factors like one’s risk appetite, investment goals, liquidity situation and investment horizon. A bondholder earns money in two ways – through coupon payments and appreciation or depreciation of the instrument in the secondary market.

Fixed deposits earn you a fixed rate of interest on a lump sum money parked with a bank or an NBFC for a predetermined period.

The third instrument is post office schemes, also called small saving schemes. Post office offers schemes like Kisan Vikas Patra, National Saving Certificate and Post Office Saving Account, among several others. These schemes are considered risk-free and dependable by most investors.

Also read: Good news for fixed-income investors! Now you can buy bonds for just Rs 10,000

Bonds offer high returns but entail additional risk. FDs, on the other hand, offer relatively lower but guaranteed returns.

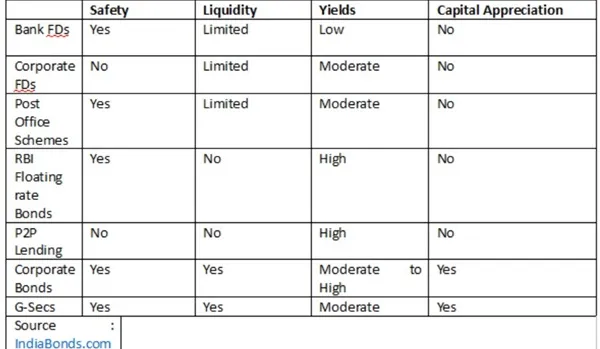

Vishal Goenka, Co-Founder of IndiaBonds.com, compares in the below table bonds, FDs and post office saving schemes based on three parameters liquidity, risks and returns.

Goenka said once-prominent bank FDs are archaic now; with inflexible options, lock-ins, penalties and usually high rates available only for short term. Consequently, investing in bank FDs lacks viability, he added.

“Regarding RBI floating rate bonds, the 8.05% yield is enticing, yet committing for a seven-year lock-in period restricts liquidity, despite the attractive yield. These bonds lack tradability and exhibit limited liquidity. Investors considering this option should possess a seven-year horizon without requiring immediate access to funds,” he said.

In contrast, G-Secs offer superior yields and exceptional liquidity, Goenka emphasised. “These instruments, being government-backed, entail zero default risk, providing sovereign guarantee. On the other hand, post-office schemes prove unattractive due to penalties, liquidity issues and a cumbersome investment initiation process, coupled with mediocre customer experiences compared to contemporary FinTech innovations.”

Corporate FDs might hold promise, yet their unsecured nature and the limited number of players in the market suggest caution, he opined. Historical experiences have been less than satisfactory; further compounded by the presence of penalty clauses for premature withdrawals in FDs. P2P lending is primarily a short-term instrument and not made for long-term investing, he further said.

“It operates on a direct lending model, placing the entire risk burden on the lender. Neither interest nor principal has a guarantor, contributing to default rates ranging from 2-7% in P2P lending. Turning attention to corporate bonds, even holding AA or AA+ rated papers aligns with various investment objectives.”

Another advantage in the current high-interest-rate environment is the potential for capital gains when rates eventually decrease in the next 1.5-2 years, he said, adding that beyond earning interest, the possibility of earning alpha through capital gains sets corporate bonds apart from other investment options.