Retail investors who want to prioritise a balance between conservative risk management and potential growth opportunities may find aggressive hybrid funds to be a suitable option now. In these funds, asset management companies invest up to 80% of the portfolio in equities and the rest in debt which helps in asset allocation.

During times of market volatility, fund managers rebalance the asset allocation to generate higher risk-adjusted returns. Aggressive hybrid funds have demonstrated their ability to provide downside protection during volatile market conditions, while delivering competitive returns over the long term.

Also read: Are debt mutual funds still attractive post the tax changes?

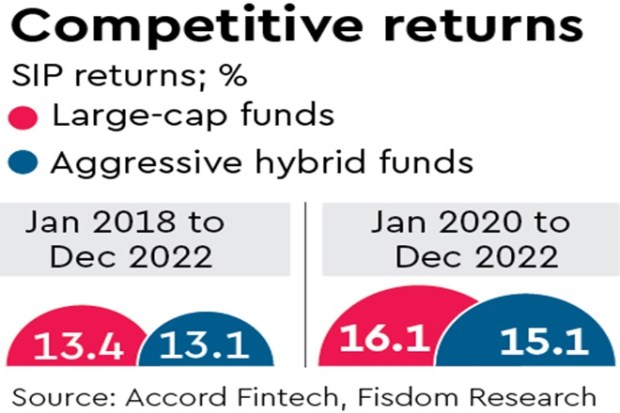

As aggressive hybrid funds carry high risk, they are suitable for mid- to long-term investment. Investors should be invested in it for a longer time so that the market can go through the whole cycle. Over the long term, these funds have generated returns comparable to even large-cap funds, demonstrating the potential for effective risk management without sacrificing returns.

Nirav Karkera, head, Research, Fisdom, says aggressive hybrid funds effectively utilise a mix of equity and fixed income securities to maximise returns while cushioning against headwinds effectively. “These funds have displayed superior downside protection comparable to a relatively less volatile equity category — large-cap funds — during market downturns. This highlights the effectiveness of aggressive hybrid funds in mitigating losses during periods of market volatility,” he says.

Building the portfolio

Given the current market valuation, experts suggest that long-term investors should consider increasing the allocation towards equity either through the equity category funds or hybrid aggressive funds and enjoy the potential benefits of growth and stability in one fund. The exposure to equity or debt at many times will give investors the upside benefit of the buoyant market or protect them from a volatile or a downward trending market.

Anil Rego, founder, Right Horizons PMS, says aggressive

hybrid funds are best for investors with a moderate risk profile if they are sceptical about the market. “As a margin of safety, to protect

the portfolio from the downside risk, fund managers leverage their portfolio up to 35% into debt

and money/cash equivalent options. The additional debt allocation is not available in a plain equity strategy fund.”

For long-term investors in equity markets, it is always a good time to start building a growth portfolio. As aggressive hybrid funds have about up to 80% of the portfolio in equity, it is the next most aggressive category after pure equity funds. The debt portion, however, helps in some

capital protection.

Harish Menon, co-founder and head of Investments and product research, House of Alpha, says the fixed income securities in aggressive hybrid funds are immune to equity market crashes or volatilities. “These funds can help in reducing the portfolio drawdown in extreme market crashes and some of the debt portion will be invested in equity at lower levels, thereby helping the averaging.”

Also read: Why senior citizens must have health insurance

However, Shrey Jain, founder and CEO of SAS Online, a deep discount broker, says as the mandate of an aggressive hybrid fund is extremely precise, the protection to the downside will only be up to 30% and the balance 70% is completely exposed to equity, which can be volatile. “And above all, you are paying a higher expense cost to manage this 30%.”

A word of caution

Investors must note that the category predominantly has equity securities which entail market risk. The returns can be volatile and they must be willing to bear some drawdown during market crashes. First-time investors or those looking for a more conservative investment approach should avoid funds with aggressive allocations to mid- and small-cap stocks. In fact, the historical data on market-cap allocation can provide insights into a fund’s past investment decisions and potential risk exposure.

Investors must consider the credit quality of the debt portfolio when evaluating a fund’s potential risks and returns. “Higher credit quality typically implies lower default risk, but may also lead to lower yields,” says Karkera and adds that investors must evaluate a fund manager’s performance and track record across different market cycles to determine their ability to navigate varying market conditions. “Consistent performance across market cycles often indicates a manager’s skill in managing risk and capitalising on opportunities,” he says.

Investors must also get a sense of whether the market is looking good or expensive in terms of valuation as these funds could be a big drawdown in case the market turns out to be extremely volatile. Investors must look at rolling returns which can help assess a fund’s consistency in generating returns over time. By measuring returns over various holding periods, investors can better understand a fund’s performance and ability to deliver returns through different market cycles.

A BET FOR THE LONG HAUL

* Aggressive hybrid funds effectively utilise a mix of equity and fixed income securities to maximise returns while cushioning against headwinds

* Over the long term, these funds have generated returns comparable to even large-cap funds