“The Only Thing That Could Tear Down The House Of The Dragon Was Itself”. House of the Dragon is a series that shows how families get destroyed due to greed. It rightly showcases how planning & well-thought-out decision-making plays a vital role when it comes to making life-related decisions.

Fans around the world, especially those who enjoyed Game of Thrones, remained glued to their televisions as the battle for family and power intensified in Season 1 of House of the Dragon. The show that debuted three years after Game of Thrones has received positive reviews and accolades from critics and viewers alike and performed incredibly well in the ratings. We examine the series from a financial standpoint to draw out the most important lessons it has to offer as viewers eagerly await the release of season 2.

Here are five money-related lessons we learned from the show.

Be fearless and independent like Princess Rhaenyra Targaryen and Queen Alicent Hightower

Rhaenyra and Alicent are strong female protagonists who are fearless, independent, and aware of their needs. In the real world, women who handle their finances independently can achieve such independence. Financial freedom inspires confidence. Women take control of their life when they take control of their finances. FinTechs must work towards enabling women to manage their finances as a first step in being aware of financial management.

Consider making plans for your children the way Princess Rhaenyra Targaryen and Queen Alicent Hightower did

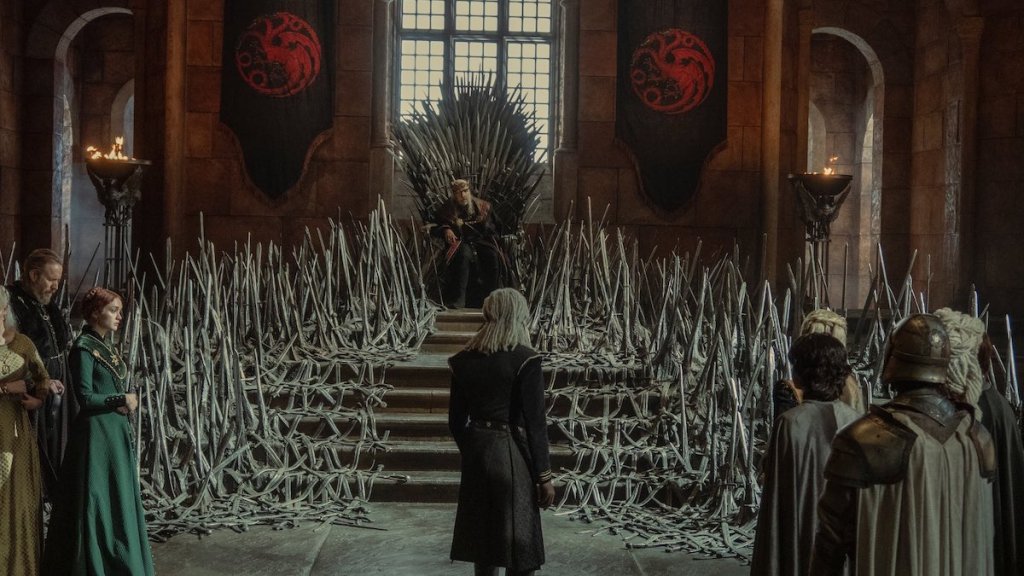

The battle on the show is for Iron Throne. While Princess Rhaenyra wants her children to stake a claim, Queen Alicent also wants her sons to do so. Just as the two women in the show protect their children, women in real life can play a pivotal role in securing their child’s future through smart financial decisions. Additionally, there are numerous programs where a parent can invest on behalf of their minor children. There are even credit cards available for minors where parents can set the spending cap to teach them about money. When the children are adults, the money will have multiplied significantly and can be used for their education, marriage, etc.

Daemon Targaryen: Taking the right decisions at the right time

He is known as the “Rogue Prince” for his erratic behaviour and is King Viserys I Targaryen’s younger brother. Although he wants to succeed his brother as king, he waits for the right moment and forms alliances with Queen-to-be Rhaenyra. Just like Daemon, in real life making the appropriate financial decisions at the appropriate time is important. Look for the best deals, the lowest rates of interest, and the most repayment flexibility before deciding on a loan of any kind. Before spending your money anywhere, do extensive research on financial matters.

King Viserys I Targaryen: Make a balance in your investments

A council of lords selected Viserys to succeed his grandfather, King Jaehaerys I Targaryen, as ruler. His only objective is to maintain harmony and strike a balance between his daughter and second wife. He teaches us that it’s important to diversify your investments to reap greater financial benefits. Spread out your investment for better results. Make an effort to balance the amount you’re investing. Learn to be a wise ‘king’ of your investments.

Aegon Targaryen: Spend wisely

Aegon Targaryen is the first son of Viserys Targaryen. He cared only about himself and is shown to overspend the riches without care. He teaches us that well-thought spending is necessary. Be careful not to go over your budget. Particularly concerning credit cards, where users occasionally overspend and are unable to make payments on time, this is true. A debt on your credit card will affect your credit score making it more challenging to obtain loans. Pay all your bills on time, get rid of debt, and save money away for the future for a higher credit score and a better life.

Conclusion

The most crucial lesson we took away from the first installment of the House of the Dragon saga is that planning is the key to success on any battlefield in life. It is important to plan your finances to secure not just yourself but the future of your loved ones as well. The show also teaches us that women must take a hold of their finances. The good news is that today many fintech platforms are now available to assist users with managing their finances, like how the House of the Dragons’ knights protects the royal family.

(By Gaurav Chopra, Founder & CEO, IndiaLends-online marketplace for credit products. Views expressed above are personal)