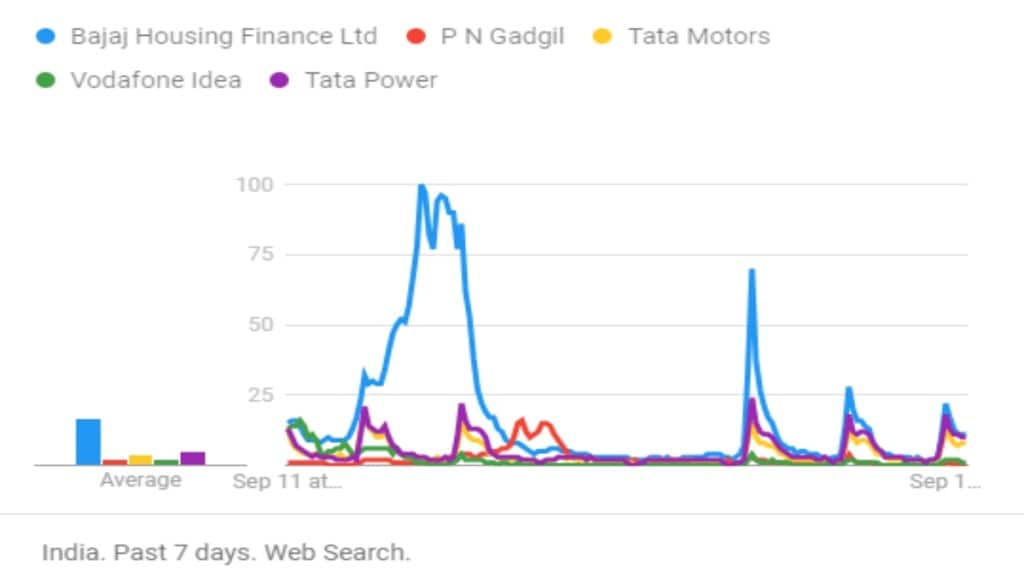

What’s the most trending stock or IPO that you would want to bet on? Here is a list of stocks and IPOs that saw maximum traction on Google Trends.

The stock market has been hitting new highs and the euphoria is driving the action across primary markets too. As investor interest continues to rise, here are the 5 most searched stock and IPO names that have been trending on Google in the past 7 days.

Bajaj Housing Finance IPO

Bajaj Housing Finance IPO was the most searched topic on Google the previous week. The issue was listed with a 114% premium to the issue price. In intra-day trade on Day 1 of trade, the stock surged as much as 130% premium to the issue price of Rs 70. The stock closed its first day with a gain of 10% or locking in the upper circuit, ending the day’s trade at Rs 165. For the second day too the Bajaj Housing stock clocked brisk gains through the trading session.

P N Gadgil Jewellers IPO

P N Gadgil Jewellers IPO was another extensively searched term in the finance category on Google. The IPO closed on September 12. It was opened to investors on September 10. P N Gadgil Jewellers operates under the brand name “PNG” and offers a diverse collection of jewellery made from gold, silver, platinum, and diamonds. The company collected Rs 1,100 crore via fresh capital and selling of secondary shares. The IPO will be listed on September 16. The stock was listed with a 73% premium to the issue price on September 17.

Tata Motors shares fell as much as 13% to a low of Rs 976.30 after a brokerage house, UBS, gave a “Sell” rating on the stock, while seeing a 20% downside. The brokerage house gave a price target of Rs 825 per share. The report hit the D-street on August 28 after which the stock has been on a continuous downfall. UBS raised the issue that JLR’s premium models have driven average selling prices higher, however, the strong demand for these models is beginning to slow down.

Vodafone Idea

The company’s shares fell 14% intraday after the brokerage house Morgan Stanley in a research report gave 83% downside to the stock price while maintaining a “Sell” rating, along with a target price of Rs 2.5 per equity share. Goldman Sachs expected that the company’s free cash flow would remain negative at least until FY31.

Tata Power

The stock remained in the news after the company’s subsidiary TP Solar started commercial production from the 2 GW solar cell line at its manufacturing facility at Tirunelveli, in Tamil Nadu. The company’s shares rose as much as 6%, intraday, to a high of Rs 441 on BSE.