In India’s electronics manufacturing world, Dixon Technologies is the benchmark. With a Rs 38,000 crore topline and a PLI-fuelled scale-up strategy, Dixon embodies the “India manufacturing” bull case.

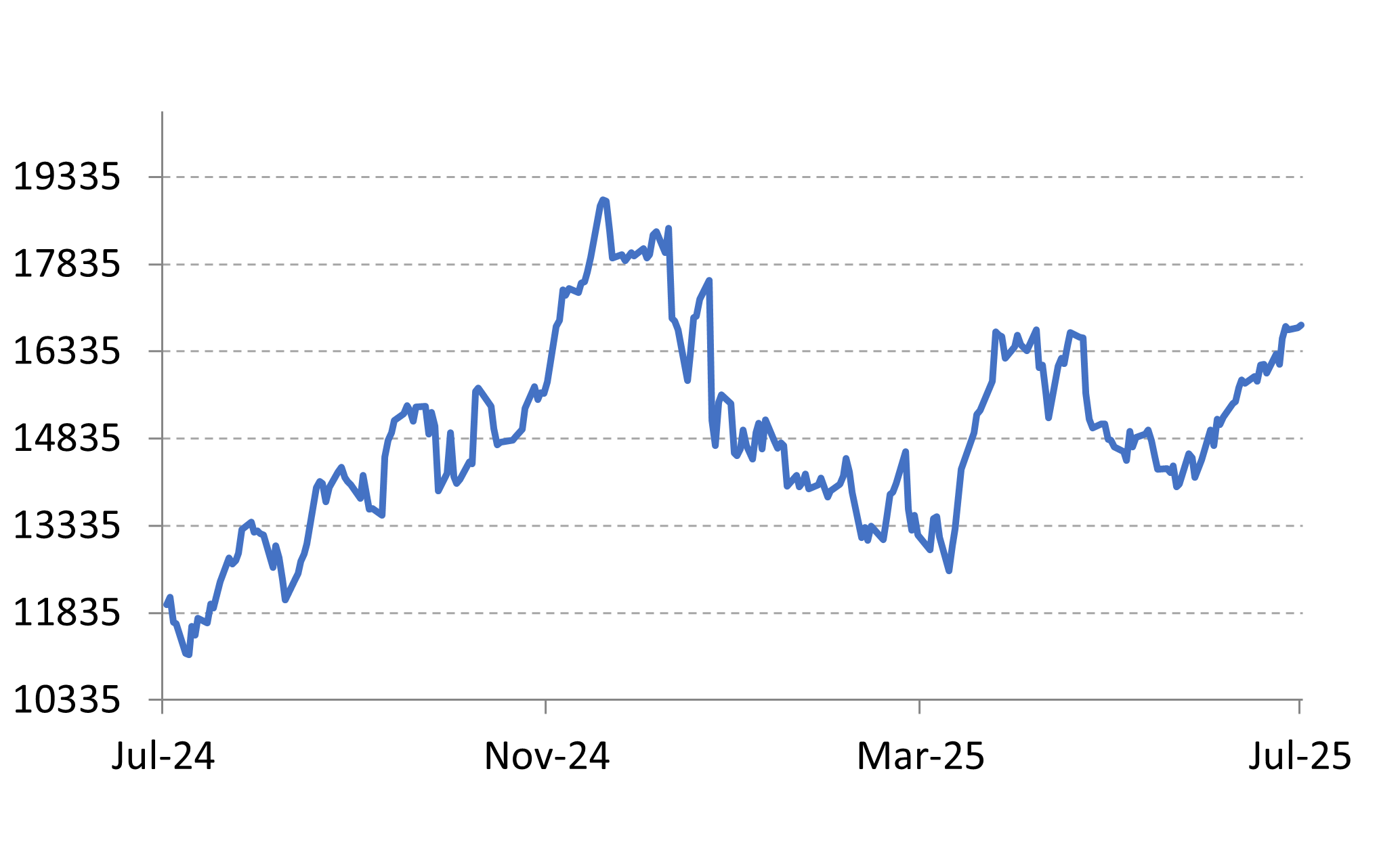

Dixon Technologies – 1 Year Share Price (Rs)

But when the markets get crowded at the top, the more interesting opportunities often lie a few rows below.

Syrma SGS Technology, an approx Rs 4,000 crore midcap Electronics Manufacturing Services (EMS) firm, is one such story. Syrma is trying to become India’s go-to partner for complex, design-integrated, export-friendly electronics manufacturing. And it’s getting there, piece by piece.

A diffrent EMS model – Margins over mass

Dixon is built on scale. It produces smartphones, TVs and washing machines. Contracts are massive, margins are razor-thin and success is measured in units per day.

Syrma plays a different game. It focusses on printed circuit board assemblies (PCBAs), RFID modules, sensor-based products, industrial systems and medical electronics. Items in these categories are often produced in smaller batches, but with greater complexity. These are low-volume, high-margin products.

In fact, Syrma was one of the first movers in RFID product manufacturing in India and holds a leadership position there. That gives it a solid base in the consumer electronics vertical, even though that vertical is now being deliberately pruned.

Not because it couldn’t scale, but because it chose to prioritise value over volume. Consumer categories, while large, are highly commoditised and margin-dilutive. By shifting toward industrial, automotive and healthcare electronics, Syrma is repositioning itself for higher margins, longer-term contracts and more defensible growth.

A high-margin mindset

Dixon’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margin for FY25 stood at 3.8%. Syrma’s? A much healthier 8.6%.

In Q1FY26, it touched 10.3%, while FY26 guidance stands at 8.5–9.5%. This isn’t a fluke.

Syrma’s business model is shifting from plain-vanilla EMS to partial product design. And that’s a game-changer.

When a player designs the product, from PCB layout to firmware, it gains more control, more pricing power and more room to innovate. This improves both stickiness and profitability.

Sector mix tilts toward resilience

Syrma’s business mix has undergone a deliberate shift over the years. From a consumer-heavy EMS profile to one that’s far more balanced and future-ready.

In FY25, the revenue breakdown stood at:

- Consumer electronics: 35%

- Industrial: 29%

- Automotive: 22%

- Railways & IT: 7%

- Healthcare: 8%

This is a marked change from FY22, when consumer electronics made up more than half of Syrma’s revenues. That segment has steadily shrunk to 35% as the company consciously steers away from low-margin, high-volume products.

At the same time, industrial has become the company’s largest vertical. Automotive now contributes 22% (up 26% YoY in FY25) and healthcare electronics has grown 15% year-on-year.

Apart from being higher-margin categories, they are also more export-friendly, less seasonal and offer longer visibility.

Unlike Dixon, which leans heavily on mobile phones and white goods, Syrma is building a portfolio that’s less prone to pricing pressure and volume volatility. It’s a shift from chasing scale to prioritising stability, complexity and capital discipline.

Why does this matter? These sectors are higher-margin, less seasonal and offer more scope for export-oriented contracts. Unlike Dixon, Syrma is not overly reliant on commoditised white goods or mobile phones.

Exports, not just for show

Dixon may still be largely domestic. Syrma isn’t.

Exports now form a meaningful chunk of Syrma’s business, 30% of revenues in FY23, up from just 20% in FY21. And the momentum is only picking up. Export revenue surged 54% year-on-year in FY25 to Rs 873 crore. Management expects this to cross Rs 1,000 crore in FY26.

But this isn’t just a case of riding the China+1 wave. Syrma works with global OEMs across Japan, the US and Europe. It even owns a facility in Germany, which not only adds credibility but also offers logistical access to the EU market.

This is structured, institutional demand. For Syrma, global markets aren’t just a hedge, they’re a core part of the strategy.

Capital discipline matters

Unlike some of its PLI-chasing peers, Syrma isn’t building mega factories for headlines.

In FY25, it spent Rs 180 crore to expand capacity in Pune, Chennai and Bawal. Pune is now operational. Brownfield expansion continues.

And it’s managing this growth without stretching the balance sheet. Net debt stands at Rs 264 crore; treasury assets at Rs 347 crore. FY25 operating cash flow was Rs 176 crore. Working capital cycle is 69 days (target: 65). Asset turnover: 5.5x. Return on Capital Employed (ROCE): 16%.

So what’s the downside?

At 66x PE, Syrma is priced like a proven midcap compounder. That might be fine if it were already delivering on every front. Dixon, by comparison, trades at 100x PE but has scale, brand and more aggressive topline growth.

For Syrma, margin strength alone won’t justify this premium unless revenue growth remains strong and capital returns improve.

Moreover, Syrma’s export growth is impressive. But global demand is cyclical. Currency swings, geopolitical tensions, or customer concentration could derail momentum.

At 16%, ROCE is decent for a growing company but Dixon is at nearly 48.5%. Syrma’s recent capex could help improve this, but it will need to demonstrate clear returns soon. Otherwise, premium valuations will be tough to justify.

The Verdict: Not Dixon 2.0 and maybe that’s a good thing

Syrma SGS doesn’t want to be the next Dixon. And that might be the smartest thing about it.

It’s not chasing mobiles. It’s not banking on subsidies. It’s not in the volume race.

Instead, it’s building an export-heavy, high-margin, design-influenced platform. It’s focussing on medical, industrial and auto electronics where the stakes are higher and so are the rewards.

If it delivers on its FY26 guidance of Rs 5,000+ crore in revenue, 30–35% growth, 7-8% EBITDA margins, the re-rating argument gets stronger. The PE gap with Dixon is already narrowing.

For investors willing to look past the noise, Syrma isn’t just a mini-Dixon. It’s a differentiated EMS story in the making. One that may not beat Dixon at its own game, but might just win a game of its own.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Manvi Aggarwal has been tracking the stock markets for nearly two decades. She spent about eight years as a financial analyst at a value-style fund, managing money for international investors. That’s where she honed her expertise in deep-dive research, looking beyond the obvious to spot value where others didn’t. Now, she brings that same sharp eye to uncovering overlooked and misunderstood investment opportunities in Indian equities. As a columnist for LiveMint and Equitymaster, she breaks down complex financial trends into actionable insights for investors.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s) and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.