A quiet disruptor in India’s travel-tech sector just made a big splash in the stock market. On July 22, Le Travenues Technology (Ixigo), best known for helping users check PNR status and live train updates, saw its shares jump 14% in a day, reaching a 52-week high of ₹231. Coincidence?

We think not. The surge was driven by a strong Q1 FY26 earnings report and increased institutional interest.

What started as a scrappy train travel assistant for small-town users has quietly changed into a money spinner among digital travel platforms in India.

Ixigo’s strategy was differentiated. While flashy competitors rushed to capture the metros, Ixigo went the other way.

It built deep roots in Tier-II and Tier-III markets, which now make up 94.05% of its user base.

And the numbers back it up. The Q1 revenue rose 73% year-on-year to ₹314 crore, net profit surged 58.33% to ₹19 crore (excluding special items), with a consistent rise in margins.

Ixigo is sending a clear message to the market: we are not just growing. Instead, we are growing with discipline.

But beyond the headlines lies a deeper story. A travel company that’s building a digital infrastructure for the next 500 million internet users. One train ticket, one refund, and one AI-powered service interaction at a time.

Q1 FY26 Performance

| Metric | Q1 FY25 | Q1 FY26 | YoY Change |

| Revenue from Operations | ₹182 cr | ₹314 Cr | 73% |

| Net Profit (excl spl items) | ₹12 Cr | ₹19 Cr | 58.33% |

| Gross Transaction Value (GTV) | ₹2,988 Cr | ₹4,645 Cr | 55.44% |

| Adjusted EBITDA | ₹15 Cr | ₹23 Cr | 53.33% |

Like we mentioned before, these figures suggest Ixigo isn’t just growing; it’s growing with discipline. Margins are improving, profits are rising, and operational efficiency continues to sharpen. It also means the company is slowly transitioning from a volume-driven strategy to one that can get more value per user.

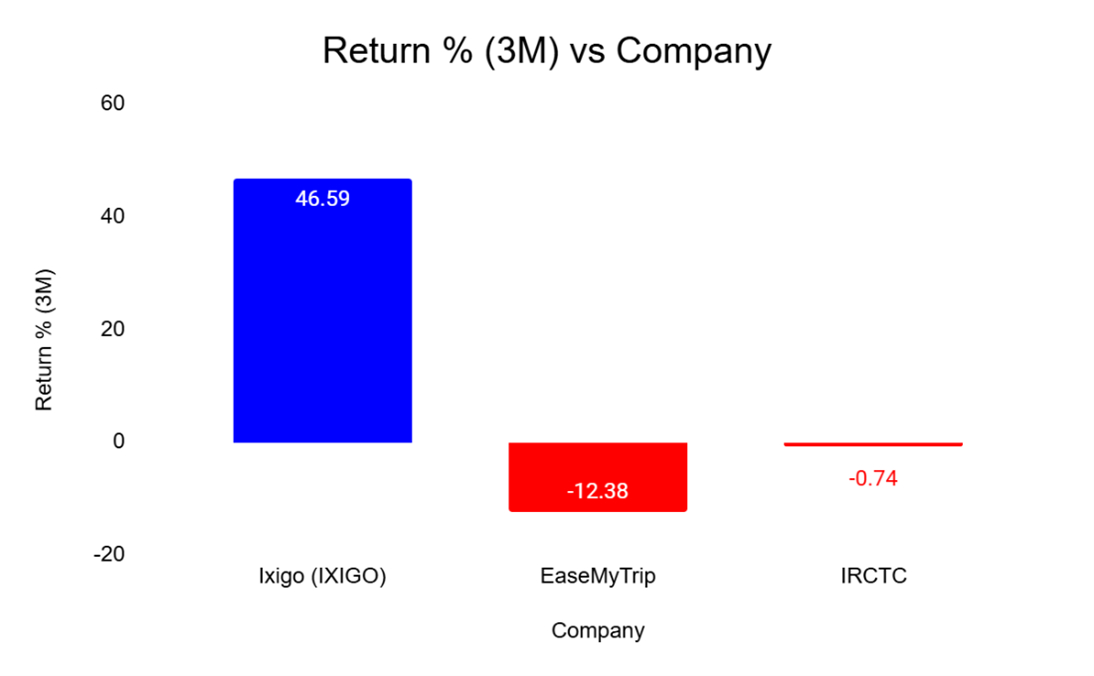

Ixigo’s Stock Performance vs Peers (Past 3 Months)

What Drove This Quarter’s Outperformance?

1. Built for Bharat Strategy

Ixigo understood early that India’s next wave of internet users wasn’t looking for luxury holidays. They wanted simple, reasonably priced travel solutions. And so, the company built a platform around train bookings, bus travel through AbhiBus, acquired in 2021, and low-cost flights with different refund options.

Ixigo created a network where users could plan any journey, no matter how remote or low-budget, within a single app. And once inside, Ixigo’s customers stayed.

Ixigo’s three main verticals strategically complement each other:

a. Train Booking Platform

Train travel forms the backbone of Ixigo’s user base. With over 9.6 crore passenger segments processed in FY25, this segment brings repeat users. Customers check PNR status, train routes, or delays often, making Ixigo part of their everyday life.

This constant engagement allows Ixigo to cross-sell flights and buses without extra marketing expenses. It also improves brand trust, which is crucial in a country where train travel is the main mode of transport.

Ixigo continues to dominate the online rail ticketing space through its IRCTC-authorized platform. In Q1 FY26, rail ticketing Gross Transaction Value (GTV) rose to over ₹2,055 crore from ₹1,579 crore in Q1 FY25, making for a large slice of the total bookings pie.

b. Flights

Flights might not be Ixigo’s biggest segment, but it brings in the most revenue per booking. In Q1, Ixigo continued to grow, boosted by value-added services like “Ixigo Assured,” which provides refund guarantees and cancellations.

Targeting first-time or budget flyers, Ixigo converts train users, moving up the travel chain. Its flight booking revenue grew from ₹41.51 crore in Q1 FY25 to ₹103.19 crores in Q1 FY26, which is a 148.59% growth YoY.

c. Buses

Often overlooked by Online Travel Agencies (OTAs), buses have become Ixigo’s most profitable segment. It’s supported by AbhiBus, which Ixigo acquired in 2021. Abhibus reported high contribution margins and a strong jump in user penetration in southern India.

With bus contribution margins around 55.15% in Q1 FY26, the AbhiBus platform provided scale and pricing control, especially during peak seasons, to Ixigo. It also fills the gaps where rail and air connectivity are weaker.

The Ixigo platform increases cross-sell opportunities, lowers acquisition costs, and drives profit without hefty discounts. Together, these three segments encourage consistent use by active users.

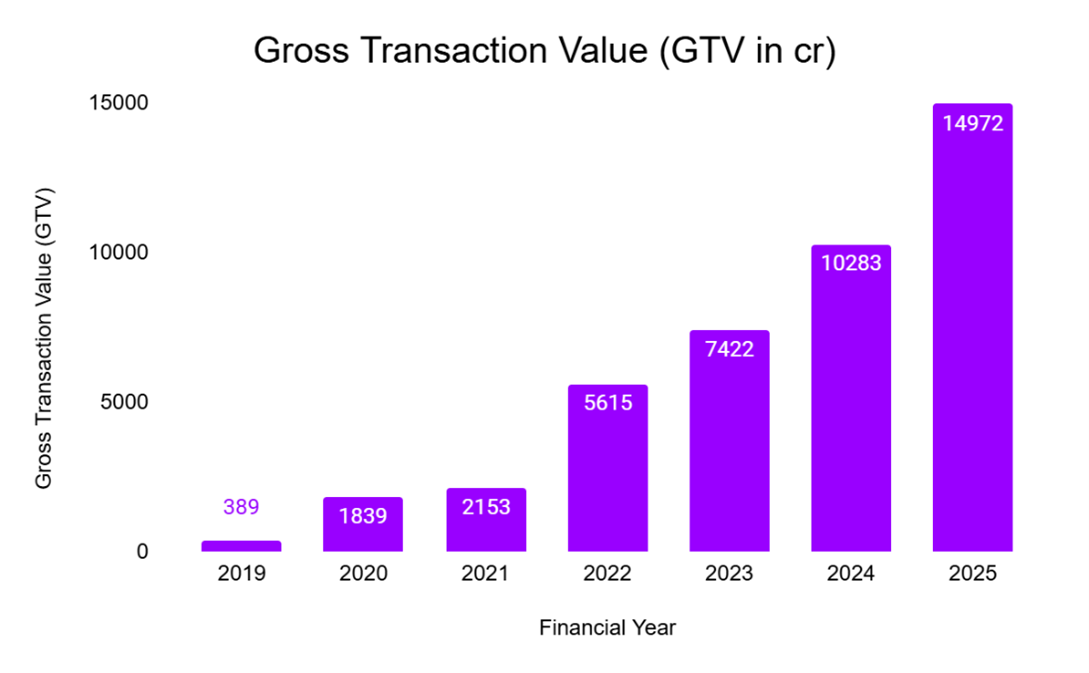

23x Growth vs Pre-COVID (FY19)

2. AI-Driven Cost Efficiency and Service Scaling

Ixigo’s AI-driven customer service is a strategic advantage in a cost-sensitive segment. It has resolved ~88.48% of customer service queries through AI in Q1 FY26. The refund times have reduced to 3h:13m this quarter from over 49h:07m in FY21, improving user experience and retention.

This automation has helped Ixigo reduce dependency on support teams while ensuring customer satisfaction, driving loyalty, and transaction frequency, especially among price-conscious users.

3. Ancillary Revenues Drive Margin Expansion

Nearly 29.37% of travel bookings now include paid add-ons, including seat selection, insurance, food on trains, flexible refund options, and more. This change has helped enhance revenue per user and gross margins, creating product stickiness.

Why Is the Market Repricing Ixigo Now?

Consistent Profits

Ixigo’s steady profits over the last three quarters stand out in a sector where most players either spend a lot of money or rely heavily on discounts to increase volume. Ixigo’s revenue from operations grew from ₹ 181.98 crore in Q1Fy25 to ₹314.47 crore in Q1 FY26.

New Highs Post IPO

The stock has now gained over 148.39% from its IPO price of ₹93, hitting an all-time high of ₹231 in July 2025. This growth signals investor confidence that the company is not just surviving but growing into a comprehensive travel-tech business.

Ixigo’s Moats: Do They Matter?

Ixigo’s forte lies not in loud advertising or deep discounts, but in a firmly woven ecosystem of technology, product utility, and consumer understanding. It matters, especially in Tier-II and Tier-III cities, where consumer behavior is different from metro markets.

This is not just an advertising moat; it is an organizational advantage.

Platform Stickiness Creating Value

Unlike old-style OTAs that serve purely as booking platforms, Ixigo’s utility tools, live train status, PNR prediction, price locks, and alternate train route suggestions make it an everyday use app. Such regular use means higher retention and cross-selling.

First-Mover Advantage

Ixigo focused on smaller towns and regional languages early. By doing so, it created profound brand recall in regions where digital adoption is still rising. Competitors now entering these markets will face a rooted player with years of user behavior data and app loyalty.

Is Ixigo’s Economic Moat Durable?

What makes Ixigo stand out are its multiple modes, allowing customers to not just book trains, flights, and buses, but also opt for valued-added services on a single platform. This approach, supported by a strong presence in India’s next-billion-user base, is tough to replicate.

The company’s product depth, like PNR prediction, alternate travel routes, and AI trip planners, is helping it build trust and stickiness, creating a flywheel that rewards frequent users.

It’s a business model that doesn’t rely on spending cash. Instead, it creates useful products that help it scale quickly.

What Investors Should Watch For

The Q1 performance may seem impressive. However, long-term investors must keep an eye on a few crucial factors:

1. Dependence on IRCTC For Revenue

Ixigo train bookings account for the bulk of its volumes today. This dependence exposes it to a platform risk. Ixigo has a tie-up with IRCTC until 2028. Any change in the commission structure, API access, or IRCTC policies could affect operations and user loyalty. Diversifying across verticals could help.

2. Rivalry and Price Conflicts

Ixigo may currently be leading in the train segment while building share in flights and buses. However, competition from established players like MakeMyTrip, EaseMyTrip, and regional aggregators is rising. Heavy discounts by larger rivals could burden Ixigo’s margins, especially if it tries to protect its share in low-margin industries.

3. Viability vs Growth

The company is profitable today, but keeping that balance while moving into new verticals like hotels and international travel could stretch its resources. What Ixigo needs is to execute these developments carefully without diluting the current unit costs or losing focus on its audience.

4. Evaluation and Market Outlook

At a market cap of nearly ₹8,582 crore and a P/E ratio of 135x, Ixigo’s present valuation shows a substantial hopefulness. Any quarterly target misses or dip in margin expansion could mean sharp stock corrections. Investors should track not just income, but also contribution margins and operating trends thoroughly.

5. Technology and AI

A large part of Ixigo’s benefit comes from AI integration and automation. But as AI becomes more about commodities, the company will need to continue investing in different experiences and services to deliver real user value. Stagnation in such differentiators could reduce cost benefits and retention.

More Than A Booking App

Ixigo’s victory lies in a modest fact: it has made travel planning a breeze for the regular Indian. While most travel businesses focused on rich metros, Ixigo quietly built a brand recall in India’s heartland. With trains as its base, flights as its upgrade, and buses as its budget play, this travel platform has created a robust business model that’s reaping rewards now.

The Q1 FY26 results are not an irregularity; they show a scalable, lucrative strategy that blends product innovation, automation, and user insight. With institutional investors showing interest, the stock’s performance may be just catching up to the business story.

But it’s not without risks. High valuations, government platform dependence, and competition are real. That said, for those ready to ride the ups and downs, Ixigo offers something rare in Indian tech: a revenue-making growth story, built for the next 500 million users.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling, and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.