Vijay Kedia is a very well-known name in the Indian investor space. An ace investor, he’s often seen on social media singing his favourite songs. Well, for someone who has made it a habit to laugh his way to the bank, thanks to his stock picks, it is not unusual to have some leisurely time for himself. The stock picking part is what has an even wider following.

Honestly, Kedia is nothing short of being a guru. He’s got the knack for picking winning stocks and just seems to “get” how markets work. Also, he’s not one to shoot in the dark; he does his research, ignoring the noise until he spots something solid. Navigating the roller coaster the Indian stock market is, he has many a times pulled moves that most investors just wish they’d thought of first. No wonder he’s also called the ‘Market Master’.

And this market master currently holds 15 stocks in his portfolio, worth over Rs 1,300 cr. But which are the two stocks that can be called his favourite? Let us look at the two biggest holdings in his current portfolio…

Atul Auto Ltd

Incorporated in 1986, Atul Auto Ltd is in the business of manufacturing and sales of three-wheeler automobiles and spare parts. It also provides after-sales support to the customers through the dealership network.

With a market cap of Rs 1,244 cr, Atul Auto Ltd boasts of an impressive market share. About 5% of the domestic market share and 3% of the overall market share in the three-wheeler industry. Talk about picking leaders the Kedia way.

This company is not only one of the biggest, but also one of the oldest holdings in Vijay Kedia’s portfolio. He has been holding a stake in the company since as early as 2004 either individually or through his company Kedia Securities Private Limited. As for the quarter ending March 2025, he holds a 18.21% stake in the company through his individual portfolio and another 2.15 through Kedia Securities.

This makes Kedia an owner of over 20% in Atul Auto worth Rs 260 cr, which only proves the kind of trust Kedia has on the company.

The company’s sales went from Rs 625 cr in FY20 to Rs 723 cr in FY25, which is a compounded growth of 3%. The 3-year sales CAGR is however 33%. What must be considered here is the slump most companies witnessed due to covid in and after 2020. The number fell in FY21, but it has been on the upwards since then.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) also has a similar trend…

EBITDA Performance (FY20–FY25)

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA (Rs Cr) | 71 | -8 | -16 | 36 | 40 | 52 |

The drop might be due to the pandemic, but the company has shown it can turn things around.

Now let’s look at the profits for Atul Auto, which seem like a turnaround story unveiling.

Net Profits (FY20–FY25)

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit (Rs Cr) | 54 | -8 | -25 | 3 | 7 | 18 |

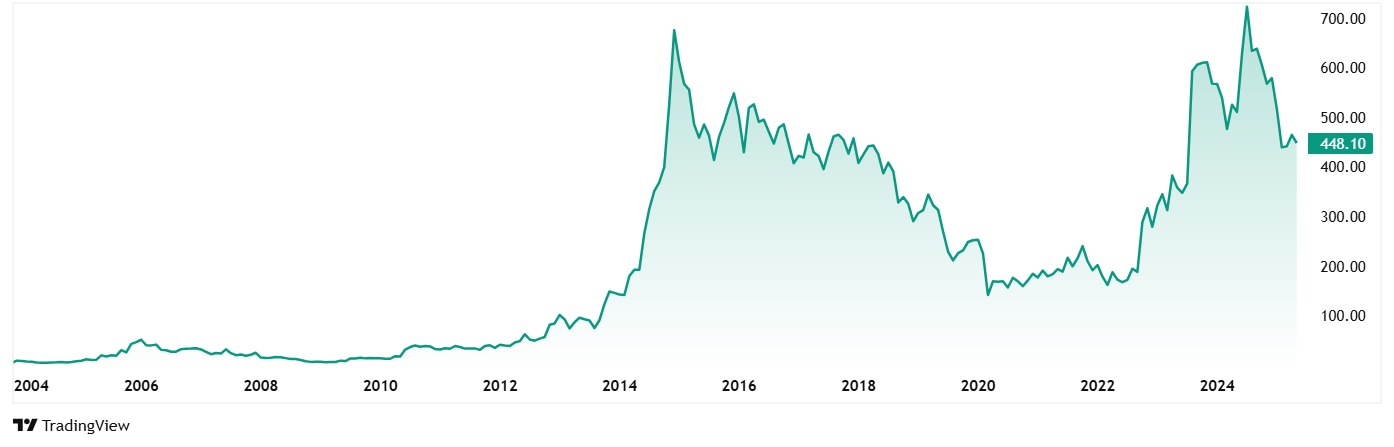

Atul Auto Ltd’s share price has surged 184% from Rs 158 in April 2020 to Rs 448 as of market close on May 9, 2025. At the current price of Rs 448, the stock is trading at a 47% discount from its all-time high of Rs 844.

The company’s share is trading at a current PE of 68x, while the industry median is 28x. The 10-year median PE for Atul Auto is not available as it is in the negative, but the industry median for the same period is 20x.

Neuland Laboratories Ltd

Incorporated in January 1984, Neuland Laboratories Limited is engaged in manufacturing and selling of bulk drugs such as salbutamol sulphate, terbutaline sulphate, labetalol hydrochloride and ciprofloxacin. Neuland Drugs & Pharmaceuticals Pvt. Ltd., a company set up by the same promoters to manufacture bulk drugs was merged with the Company in April 1992.

With a market cap of Rs 15,946 cr, Neuland’s products are exported to more than 35 countries including Germany, Italy, Switzerland, the UK and the Netherlands.

Kedia has held a stake in Neuland Laboratories at least since December 2019 (since records were available), per Trendlyne.com. Currently he holds 1% stake in the company worth Rs 162 cr for the quarter ending March 2025.

Apart from Vijay Kedia, another Warren Buffet of India, Mukul Agarwal also holds 3.12% stake in Neuland Laboratories as per the exchange filings filed for the quarter ending March 2025.

Neuland Laboratories’ sales have grown at a 19% CAGR over the past five years, rising from Rs 667 cr in FY19 to Rs 1,559 cr in FY24. Between April and December 2024, the company has recorded sales of Rs 1,149 cr already.

EBITDA grew from Rs 58 cr in FY19 to Rs 463 cr in FY24, logging in a compound growth of almost 52%. For the three quarters from April to December 2024, the company logged Rs 272 cr in EBITDA.

The net profit is an area that could have probably held Kedia and Mukul Agarwal with the company. From Rs 16 cr in FY19 all the way to Rs 300 cr in FY24, the profits grew at a compounded rate of 79%. For the quarters between April and December 2024, the company has recorded profits of Rs 233 cr.

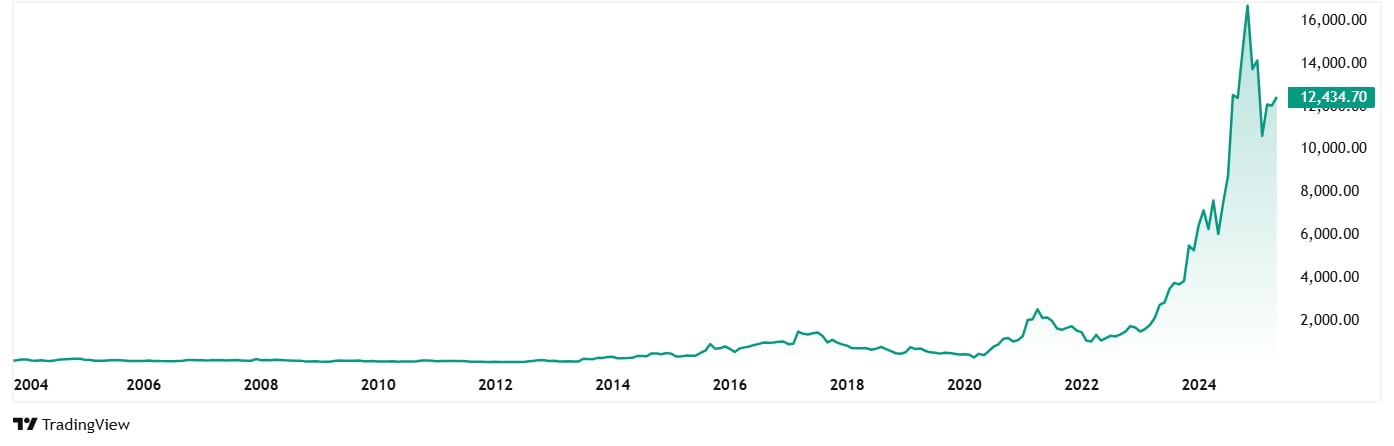

Neuland Laboratories share price was around Rs 403 in April 2020 and as of the market closing on 9th May 2025, the share was trading at Rs 12,429, which is almost a 3,000% jump. In just 5 years. If Rs 100,000 were invested in the stock 5 years ago, it would have turned to almost Rs 31,00,000!

And here is shocker. Even at the price of Rs 12,429, the share is trading at a 31% discount from its all-time high price of Rs 18,100.

The company’s share is trading at a PE of 66x while the industry median is 27x. The 10-Year median PE for Neuland Laboratories is 32x while the industry median for the same period is 22x.

Follow The Market Master?

Vijay Kedia known for picking winners has done it time and again. With his biggest holdings like Atul Auto Ltd and Neuland Laboratories Ltd he probably only aims to repeat history. His huge stake in these companies is possibly a testimonial to his ability to spot diamonds in the rough.

A 184% surge in Atul Auto’s stock price and a 3,000% jump in Neuland Laboratories’ share price are compelling reasons for investors to take these stocks seriously. However, if one looks beyond the numbers, Kedia is all about trusting his research and riding the market’s ups and downs like a pro.

Both the stocks are trading at a discount, giving rise to the question: are these stocks poised for another breakout? Only time will tell. But for now, having these stocks on the watchlist could prove to be a good decision.

Discliamer

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.