India’s digital economy is running on invisible engines: data centres. They are the “buildings” where the internet lives — where streaming, payments, cloud storage, and AI models are running every second. Every click, message, or transaction today passes through one of these massive facilities filled with servers, cooling systems, and uninterrupted power.

The scale of this opportunity is staggering: according to a Jefferies report, published in September 2025, India’s data-centre capacity is set to grow fivefold to 8 GW by 2030, supported by US $ 30 billion in capital expenditure and creating a revenue pool of nearly US $ 8 billion.

This boom has been triggered by exploding data traffic – up 30 times since FY17 – and policies mandating sensitive data to stay within Indian borders. As AI adoption increases, every new server rack requires five to six times more power and cooling than in the past, adding to infrastructure demand.

This story is captured in two sections in this article. While the first highlights pure-play operators, or those companies that own and operate India’s growing network of data centres, the second focuses on infrastructure and technology enablers that build, power and equip such facilities.

The companies selected for this article represent every layer that is critical: operators running India’s expanding colocation network, builders building hyperscale campuses, and technology providers supplying servers, power, and cooling systems. This ensures each company is thematically relevant and verifiably a part of the US$30 billion capex wave shaping India’s data-centre growth story.

Pure-play operators

#1 Tata Communications

Tata Communications, a Tata Group company, is a leading global digital ecosystem enabler. It has a leadership position in emerging markets, and an infrastructure that spans the globe. It delivers managed solutions to multinational companies and service providers.

Tata Communications is sharpening its focus on India’s fast-expanding data centre ecosystem by leveraging its leadership in data centre-to-data centre connectivity, where it leads with more than 40 per cent market share. The company expects India’s overall data centre capacity to double within five years, aided by surging AI driven workloads and hybrid cloud adoption.

To capture this shift, Tata Communications is investing in software-defined, low-latency network links and exploring international data centre-data centre propositions for global enterprises. It continues to hold a 26% stake in ST Telemedia Global Data Centres, reaffirming long-term commitment to the sector despite short-term dilution of returns.

Management said AI and private-cloud expansion will keep data centre connectivity a structural growth driver for the company.

In the past one year Tata Communications share price is up 9%.

Tata Communications 1 year share price chart

#2 Bharti Airtel

Bharti Airtel, a Sunil Mittal Group company, is one of the world’s leading providers of telecommunication services with a presence in 18 countries representing India, Sri Lanka, 14 countries in Africa.

Bharti Airtel is aggressively expanding its services in the data centre and cloud services market of India via Nxtra and Airtel Cloud. The company operates 14 large and 120 edge data centres, and hosts over 250 petabytes of data on its own cloud infrastructure, all built and managed in India.

Airtel’s modular expansion model includes two active cloud regions: Delhi and Chennai, while a third is planned as demand goes up. Recent partnerships with Singtel and Globe Telecom herald the global foray by the company in enterprise cloud solutions.

Management estimates the addressable market of Rs 60,000 crore, placing Airtel in a good position to earn high margins in enterprise connectivity, cybersecurity, and cloud services. The firm also intends to list its Nxtra data centre unit in the coming years.

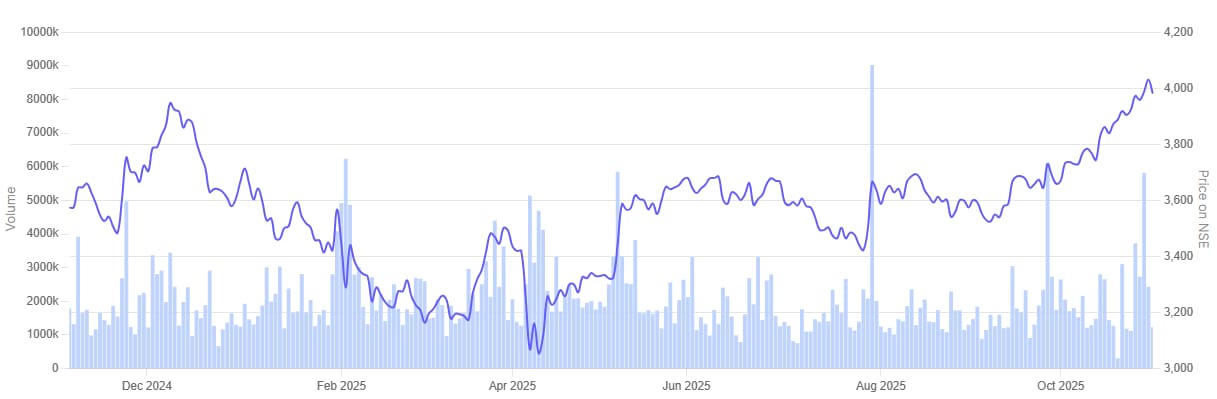

In the past one year Bharti Airtel share price rallied 30.5%.

Bharti Airtel 1 year share price chart

#3 Adani Enterprises

Adani Enterprises , a Adani Group company, has business interests in various economic areas such as mining, integrated resources management (IRM), infrastructure such as airports, roads, rail/ metro, water, data centres, solar manufacturing, agro and defence.

In order to meet the surging demand, Adani Enterprises is building a network of hyperscale data centres across India, through its joint venture with US-headquartered EdgeConneX called AdaniConneX.

The company plans to develop up to 1 GW of capacity over the next decade starting with major hubs at Chennai, Navi Mumbai, Noida, Vizag, and Hyderabad, the company’s media release said. The project is part of Adani’s bigger push into new-age infrastructure in addition to green energy and logistics.

Jefferies, in its India Data Centres (Sept 2025) report, said AdaniConneX was well-positioned among the top three developers in India and was set to contribute nearly a third of new domestic capacity over the coming years, underscoring its strategic role in the country’s digital expansion.

In the past one year Adani Enterprises share price tumbled 14.8%.

Adani Enterprises 1 year share price chart

Infrastructure and Technology Enablers

#1 Larsen Toubro

Larsen Toubro is a multinational conglomerate. The L&T group is primarily engaged in providing engineering, procurement and construction (EPC) solutions in key sectors such as infrastructure, hydrocarbon, power, process industries and defence, information technology and financial services in domestic and international markets.

Larsen & Toubro is expanding its footprint in data centres through strategic investments and EPC execution under the Buildings and Factories business. The management believes that private sector traction is increasing, especially in commercial real estate, data centres, and hospitals, indicating an improvement in domestic capex momentum.

The company also confirmed that it has acquired a strategic stake of 19% in E2E Networks, a move aimed at complementing its entry into the data centre space and enhancing its technology-focused offerings. L&T intends to leverage the competencies of E2E for the delivery of integrated solutions across design, build, and operations.

With strong execution visibility, L&T expects steady growth in this segment as India’s digital infrastructure expands.

In the past one year Larsen and Toubro share price rallied 11.4%.

Larsen and Toubro 1 year share price chart

#2 ABB India

ABB India is an integrated power equipment manufacturer supplying the complete range of engineering, products, solutions and services in areas of automation and power technology

ABB India said that demand from the data centre segment continues to remain strong, supporting growth in its electrification business. The company said it is supplying power distribution and automation systems to large data centre projects across India.

Management said that the order pipeline from data centres has expanded meaningfully, reflecting increased investment in digital infrastructure and reliable power systems. ABB India added that its electrification products are being deployed in several ongoing projects in this segment.

Management has remained adamant that this vertical remains one of the most important growth drivers for the company in the overall infrastructure portfolio.

In the past one year ABB India share price tumbled 28.6%.

ABB India 1 year share price chart

#3 Anant Raj

Anant Raj was incorporated in 1985 as Anant Raj Clay Products by Ashok Sarin. It is primarily engaged in the development and construction of IT parks, hospitality projects, SEZs, office complexes, shopping malls and residential projects in the State of Delhi, Haryana, Andhra Pradesh, Rajasthan and NCR.

Anant Raj is intensifying its presence in India’s fast-expanding data-centre market through its wholly-owned subsidiary, Anant Raj Cloud. By the end of FY25 the company had operationalised a 6 MW IT-load facility at Manesar, with another 15 MW nearing completion and 7 MW at Panchkula set to go live in FY 2025-26. It is also upgrading its Rai campus to support 100 MW, part of a 307 MW multi-site pipeline across Haryana.

In partnership with Orange Business Services, the firm launched “Ashok Cloud”, in FY25, India’s first sovereign public cloud platform, offering Infrastructure-as-a-Service and expanding toward PaaS and SaaS. These collaborations with RailTel, TCIL, and CSC Data Services India further strengthen its go-to-market strategy. With owned land and approvals in place, Anant Raj expects this digital-infrastructure vertical to become a key earnings driver over the next few years.

In the past one year Anant Raj share price is down 10.5%.

Anantraj Technologies 1 year share price chart

Valuations

Let’s now turn to the valuations of the data center companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Data Centre Companies in India

| Sr No | Company | EV/EBITDA | 10-year Median EV/EBITDA | ROCE |

| 1 | Tata Communications | 14.3 | 8.4 | 32.4% |

| 2 | Bharti Airtel | 12.1 | 9.6 | 23.2% |

| 3 | Adani Enterprises | 22.8 | 20.9 | 9.4% |

| 4 | Larsen and Toubro | 16.9 | 14.2 | 14.5% |

| 5 | ABB India | 41.4 | 40.8 | 38.6% |

| 6 | Anant Raj | 40.6 | 28.7 | 11.2% |

The numbers reveal a clear premium across the board. Each of these companies is trading above its 10-year median multiple, reflecting how sharply investor sentiment around digital infrastructure has strengthened in recent years.

Two companies — Tata Communications and Anant Raj— are trading well above their 10-year median multiples, indicating a clear re-rating on the back of the data-centre narrative and improving operating metrics.

Bharti Airtel and Larsen & Toubro also sit above their decade medians, but the gap is more moderate, suggesting the market is pricing in steady, rather than explosive, growth from digital-infrastructure capex.

Adani Enterprises is only marginally above its long-term band, which is notable given its incubating Data Centre business. ABB India is almost exactly in line with its historical valuation range, so the market is not paying an extra premium here for data-centre exposure.

Overall, the sector shows a broad upward shift in multiples, but the degree of re-rating is uneven. Investors should therefore evaluate whether current prices leave enough room for returns, especially in names where the multiple has already run far ahead of the 10-year median.

Conclusion

India’s data-centre buildout is no longer a niche story—it is the digital infrastructure equivalent of what highways were two decades ago. From telecom carriers and hyperscale operators to engineering giants and automation specialists, the ecosystem is expanding across every layer of connectivity, construction, and computing.

This enthusiasm, however, has also fanned a sharp re-rating in valuations. With most stocks currently above their 10-year EV/EBITDA medians, the easy gains may thus already be priced in. The long-term opportunity remains intact, supported by policy push, AI adoption, and rising data localization needs; investors, however, must separate the structural potential from cyclical exuberance.

The investment decision in this rapidly changing digital infrastructure theme needs a comprehensive review of each company’s fundamentals, leverage, and project execution.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.