In the past five months, the Indian stock markets have fallen drastically due to poor quarterly earnings, geopolitical factors, among other things.

With Trump’s tariff imposition and uncertainty in the market, the stock markets could fall some more.

However, during such uncertain times, like always, investors are looking out for dividend stocks for consistent returns.

Dividend investing is a proven strategy that investors rely on. Several studies suggest that dividend-paying stocks generate higher returns in the long term compared to non-dividend-paying stocks.

Usually, dividend stocks pay regular dividends and increase them consistently every year.

Such stocks, also popularly known as ‘Dividend Aristocrats’, are considered stable, fundamentally strong, and have good growth prospects.

In today’s article we are comparing two such stocks – Vedanta and Hindustan Zinc – to see which is a better dividend stock.

Business Overview

Hindustan Zinc

Incorporated in 1966, Hindustan Zinc is the world’s 2nd largest integrated zinc producer and 3rd largest silver producer.

It is a subsidiary of Vedanta Limited, and is recognised as a industrial and market leader of zinc, silver and lead.

The company is self-sufficient with respect to power and has captive thermal power plants.

It has achieved backward integration through power production and possession of low-cost, high-grade zinc reserves.

Hindustan Zinc has a manufacturing capacity to produce 1.12 MT of metals, 16.52 MT of ore, and 603.1 megawatts (MW) of captive power through renewable and non-renewable resources.

It runs an integrated zinc-lead-silver operation with zinc, leand and silver smelting capacity of 913,000 TPA (tonnes per annum), 210,000 TPA and 800 TPA, respectively.

It has operations in India and earns the majority of its revenue (75%) from India and the rest 25% of its revenue from exports.

Vedanta

Vedanta is a diversified natural resource company engaged in exploring, extracting, and processing minerals and oil and gas.

It is engaged in the exploration, production, and sale of zinc, lead, silver, copper, aluminium, iron ore, nickel, and oil and gas.

The company is the sole producer of nickel in India, one of the largest private sector crude oil producers, and one of the largest iron ore miner in India, giving it a near monopoly status.

Vedanta has a manufacturing capacity of 2.4 MTPA aluminium, 5.6 dry metric tonnes (DMT) of iron ore, 3.5 MTPA of steel, 80 kilo tonnes (KT) of ferro alloys, 141 KT of copper, and 11 giga watts (GW) of power.

It has a strong presence in India, and also has operations in Namibia, South Africa, UAE, Australia, and Ireland.

Over the years, the company has also ventured into commercial power generation, steel manufacturing, port operations in India, and glass substrate manufacturing in South Korea and Taiwan.

If we compare the companies in terms of market cap, then Hindustan Zinc is leading with a market cap of Rs 1,802.5 billion (bn), against Rs 1,712.9 bn of Vedanta.

Hindustan Zinc is also leading in terms of zinc with a market share of 75% in India, whereas Vedanta has a 45% market share in aluminium production in India.

However, it is important to note that Hindustan Zinc is a subsidiary of Vedanta and hence Vedanta also has a market leadership in zinc production.

In terms of performance on the stock market, Vedanta is ahead of Hindustan Zinc with 62% return in the last one year, against, 37% of Hindustan Zinc.

However, both companies gave a higher return than the market index Nifty 50 (2.6%).

Revenue

For Vedanta, aluminium business is a major contributor of revenue (39%), followed by zinc, lead, and silver, (25%), copper (12%), oil and gas (9%), iron ore (5%), power (4%) and others (6%).

In the last five years, its revenue grew at a CAGR of 11.2% on account of strong growth in all its product segments, including aluminium, zinc, lead, silver, oil and gas.

For Hindustan Zinc, the majority of the revenue is earned through zinc (62%), followed by silver (19%), and lead (14%).

In the last five years, the company’s revenue grew at a CAGR of 9.3% on account of strong growth in zinc and silver production.

Between the two, Vedanta has a higher revenue number and revenue growth percentage.

| Revenue | |||||||

| Net Sales (in Rs m) | Mar -2020 | Mar -2021 | Mar -2022 | Mar -2023 | Mar -2024 | 5-Year CAGR | |

| Hindustan Zinc | 1,85,610 | 2,26,290 | 2,94,400 | 3,40,980 | 2,89,320 | 9.30% | |

| Vedanta | 8,44,470 | 8,80,210 | 13,27,320 | 14,73,080 | 14,37,270 | 11.20% | |

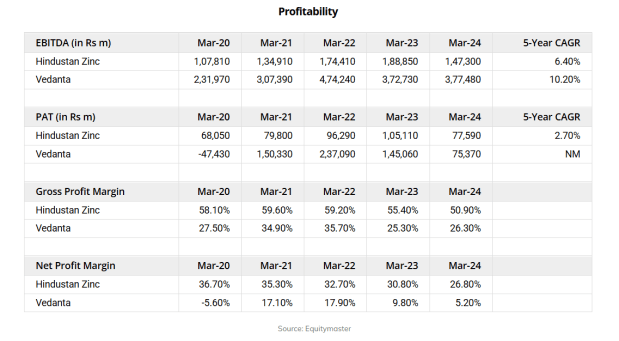

Profitability

To assess the profitability, it is important to look at the earnings before interest, tax depreciation and amortisation (EBITDA) and net profit growth.

In terms of EBITDA Hindustan Zinc and Vedanta saw a growth of 6.4% and 10.2% respectively, on account of backward integration and healthy growth in prices of zinc and silver.

In terms of net profit, Hindustan Zinc saw a marginal growth of 2.7% CAGR whereas Vedanta’s net profit turned positive on account of backward integration due to the company’s acquisition of coal at an affordable rate.

The EBITDA margins of Hindustan Zinc and Vedanta averaged at 55.2% and 29.1% respectively, whereas the net profit margins averaged at 30.1% and 11% respectively over the last three years.

With Vedanta enhancing the capacity of alumina refineries and expected commencement of captive coal/bauxite blocks over the next 2-3 quarters, the profitability is expected to improve.

For Hindustan Zinc, the low cost of production and strong zinc and silver prices are expected to improve profits in the medium term.

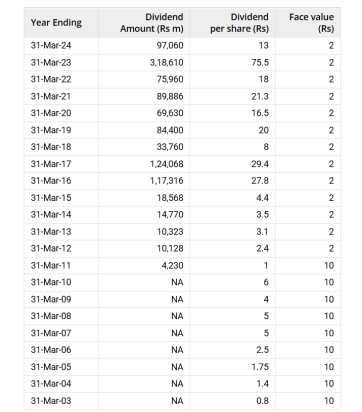

Dividend Payment Per Share

Hindustan Zinc

Hindustan Zinc has been paying dividends to its shareholders continuously since 2003.

In 2003, the company paid a dividend of just Rs 0.8 per share and in financial year 2024 it paid Rs 13 per share as dividend.

In the financial year 2025, the company already declared a dividend per share of Rs 19 and more dividends are yet to be announced.

Take a look at the table below to get a gist of Hindustan Zinc’s rich history of paying dividends.

Hindustan Zinc’s Dividend History

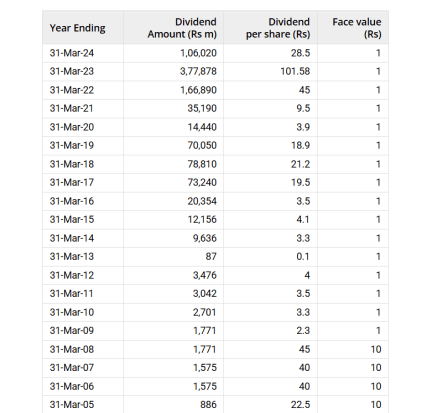

Vedanta

Vedanta has been paying dividends to its shareholders since 1994 without a gap in dividend payments.

In 1994, the company paid a dividend of just Rs 1.65 per share and in financial year 2024, the it paid a dividend of Rs 29.5.

Compared to financial year 2023, the dividend is very low. However, in financial year 2025 it already declared a dividend of Rs 43.5. More dividends are yet to be declared for the current financial year.

Take a look at the table below to get a gist of Vedanta’s rich history of paying dividends.

Vedanta’s Dividend History

If we compare the two companies in terms of dividend payments, both have consistently increased their dividend payments over the last few years.

However, if we compare the dividend per share growth in the last five years, then Vedanta is leading with a 48.9% growth as against a degrowth of 4.7% for Hindustan Zinc.

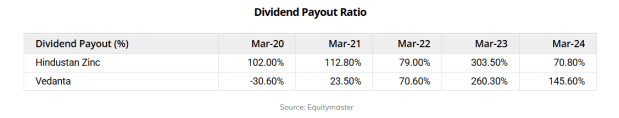

Dividend Payout Ratio

The dividend payout ratio is measured by the dividend amount a company pays in a year divided by the net profit for the year.

Investors prefer a high or growing dividend payout ratio.

In the last three years, the average dividend payout of Hindustan Zinc and Vedanta stood at 151.1% and 158.8%, respectively.

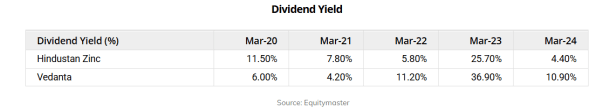

Dividend Yield

The dividend yield is the return an investor will get in comparison to the current price of a company they invested in.

A high dividend yield makes a stock attractive in comparison to others. Moreover, during a market selloff, these stocks are available at a bargain and have a high margin of safety, providing an opportunity to earn high returns.

In the last five years, the average dividend yield of Hindustan Zinc and Vedanta stood at 11% and 13.8%, respectively.

Debt Management

In terms of debt-to-equity ratio, Hindustan Zinc has a lower ratio than Vedanta.

Hindustan Zinc’s debt-to-equity ratio is 0.3, as opposed to 1.7 of Vedanta.

Hindustan Zinc’s planned capacity expansion in the past has now been commissioned and hence the production in financial year 2025 across all metals will be higher.

Apart from planned capex of Rs 50 bn, the company is not anticipating any major growth capex for financial year 2025. It also has strong cash and liquid investments of Rs 79.4 bn which will support the debt repayment, capex plans, and dividend payments.

Vedanta has invested heavily in acquiring coal mines and expanding capacities across various metals.

It plans to invest Rs 180 bn in capex in the next year to increase backward integration and ramp-up capacities in aluminium.

The company has cash and liquid investments of Rs 21.7 bn as of September 2024. The liquidity is slightly stretched given its debt repayments, capex plans, and dividend payments.

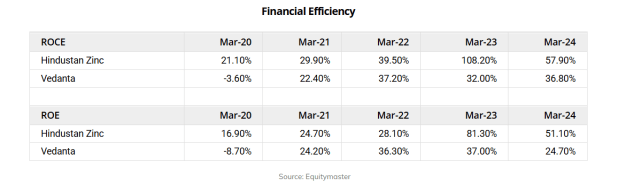

Financial Efficiency

We can measure the financial efficiency of a business by checking its return on equity (RoE) and return on capital employed (RoCE) numbers.

These return ratios indicate a company’s ability to generate returns from the equity and capital invested. A high and consistently growing ratio is considered better.

The three-year average RoE for Hindustan Zinc and Vedanta is 53.5% and 32.7%, respectively, whereas the three-year average RoCE is 68.5% and 35.3%, respectively.

Both the companies have witnessed steady growth in return ratios, primarily due to their efforts in improving the profitability through backward integration.

However, Hindustan Zinc is clearly leading in terms of financial efficiency.

Valuation

Valuation ratios help us estimate the intrinsic value of a company, and also help us analyse whether a company’s shares are overvalued or undervalued when compared to its peers.

The two popular valuation ratios are price to earnings (PE) and price to book value (PB). A high ratio indicates the shares are overvalued; a low ratio indicates the shares are undervalued.

The PE ratios of Hindustan Zinc and Vedanta are 19.2 and 9.6, respectively. In terms of PE, Hindustan Zinc’s shares are overvalued compared to Vedanta.

The PB ratios of Hindustan Zinc and Vedanta are 17.5 and 4, respectively. Even in terms of PB, Hindustan Zinc’s shares are overvalued compared to Vedanta.

When compared to their three-year average, both the company’s shares are overvalued.

Hindustan Zinc or Vedanta: Which Dividend Stock is Better?

A company pays dividends from its earnings, and hence, dividends are only sustainable until the company is making profits.

Also, dividend payments are highly dependent on the management’s policy.

Therefore, even a dividend paymaster can become a dividend dud.

For Vedanta, high profits in financial year 2023 on account of rising commodity prices have paved way for high dividends. However, in 2024, the profits fell almost 50% and the dividend per share also fell by 72%.

Although in financial year 2025 the company has declared a higher dividend when compared to the previous year, the company’s plans to cut debt levels, and sizable repayments in financial year 2026 and 2027 may not allow Vedanta to pay high dividends in the coming financial years.

Vedanta has also invested in growth capex for its aluminium, zinc, and oil and gas businesses and will incur a significant capex in the next financial year as well.

The company is slowly diversifying its operations and foraying into high-growth sectors. It recently forayed into the manufacture of semiconductor and display units.

Recently, the company has received approval for demerger of Vedanta ltd into 5 separate entities namely Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Iron & Steel, and Vedanta Ltd.

This demerger will better allow the company to manage its operations.

Hindustan Zinc, on the other hand, has paid high dividend to its shareholders in financial year 2023. However, in financial year 2024, the dividend fell by 70% on account of lower profits.

In financial year 2025, the company declared Rs 19 dividend, but it might not be similar to FY23 levels.

It has a planned capex of Rs 50 bn and has a healthy cash and liquid investments of Rs 79.4 bn. Given its low debt, and low growth plans, the company has a good chance of paying a higher dividend in FY25 when compared to FY24.

Although both companies will continue to pay good dividends, Hindustan Zinc has a higher chance of paying better dividends in the long term than Vedanta.

In case you are solely looking for dividend stocks for your portfolio, then it is better to do a thorough research of the fundamentals and corporate governance along with dividend ratios before considering an investment.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.