Imagine an old but sturdy Ambassador car. It is not like a flashy SUV, but it is reliable, powerful and built to last. That’s what Canara Bank feels like in the Indian banking system.

Canara Bank is a prominent institution with deep roots, now gearing up for a new journey in the fast-changing economy.

With over 100 years of legacy, Canara Bank is not just another public sector bank, it’s one that has weathered financial storms, policy shifts and credit cycles.

But the real question today is, can this bank keep up with the high-speed reforms and changing digital landscape in the Indian banking sapce?

Read on…

About Canara Bank

Canara Bank, started in 1906 and nationalised in 1969, is a major public sector bank based in Bangalore.

Canara Bank offers a broad suite of banking services—not just for individuals, but also for businesses and NRIs. From loans and savings accounts to investment options and digital banking solutions, it caters to a wide range of needs.

As of March 2025, the bank’s global business stood at an impressive Rs 25.3 trillion. However, its loan book remains somewhat concentrated, with a major focus on agriculture, retail, and MSMEs.

With 9,604 branches and over 12,000 ATMs across India (as of FY24), the bank has a strong presence, especially in rural and semi-urban regions. This widespread network allows it to serve millions across various income levels and occupations, reinforcing its commitment to financial inclusion and rural development.

Canara Bank’s Post-Merger Journey

The merger with Syndicate Bank in 2020 marked a turning point, making Canara Bank the fourth-largest public sector bank in the country. The integration significantly widened its footprint, with a combined network of 17,672 banking outlets across India—boosting its capacity to deliver services on a much larger scale.

This integration helps both the bank operate effectively because now they are using the same software, enhanced customer access, operational reach, and efficiency.

By unlocking value from subsidiaries and scaling operations, the bank is now moving towards a stronger market presence and increased shareholders’ value.

Key Subsidiaries and Associates

Canara Bank has built a solid ecosystem through its subsidiaries and associates, strengthening its presence across financial services.

- Canara Robeco Asset Management Company Ltd: One key arm is Canara Robeco Asset Management Company Ltd, one of the oldest mutual fund houses in India. As of Q4FY25, it manages assets worth Rs 1 trillion, placing it among the top 20 AMCs in the country at 17th rank.

- Canara HSBC Life Insurance Company Ltd: A joint venture between HSBC and PNB, this life insurer operates mainly via the bancassurance model i.e., a partnership between a bank and an insurance company in which the bank sells insurance products through its channels.

- Other Subsidiaries: These include Canbank Factors, Canbank Computer Services, Canara Bank Securities, Canbank Financial Services, and Canbank Venture Capital Fund.

- Key Associates: Can Fin Homes, Andhra Pragati Grameena Bank, Kerala Gramin Bank, and Karnatka Vikas Grameena Bank are important contributors to its profit pool and regional reach.

These subsidiaries and associates offer long-term value and help Canara Bank diversify risk while growing its earnings outside of traditional lending.

Canara Bank Financial Performance

Let’s now dive into the financial numbers to know the real story:

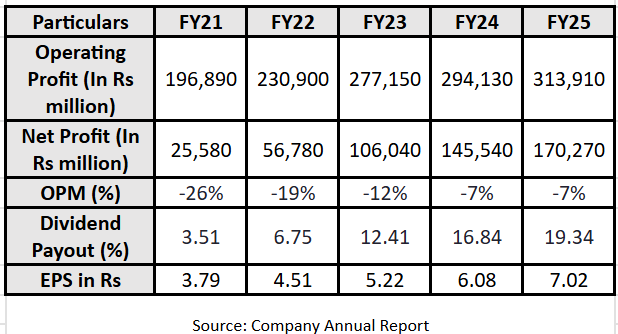

Canara Bank Financial Snapshot (2021-25)

Canara Bank numbers show two strong stories: a solid and consistent growth in operating profit with a CAGR of 12.31% and an explosive rise in net profit with a CAGR of 60.49% over five years.

The increasing dividend payout also indicates a strong shareholders’ focus.

With rising profits, the bank is steadily reinforcing its fundamentals.

To know more, let’s dive into its FY25 results:

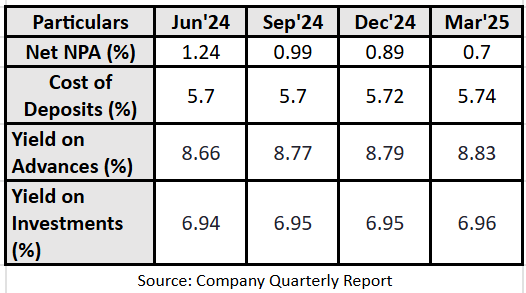

Canara Bank’s key ratios show steady improvements and sound financial health.

The NPAs (bad loans) have reduced, showing the bank is recovering more loans and reducing bad ones, a strong sign of credit quality improvements.

The cost of deposits has remained stable, showing the bank is managing its deposit rates efficiently without putting extra pressure on margins.

On the other hand, the yield on advances has improved, meaning the bank is earning more from the loans it gives out, which adds directly to the profitability.

Sectoral Trends Favouring Canara Bank

- NPA Under Control: Gross NPAs have fallen drastically, and for PSBs, this cleanup has unlocked capital, reduced provisioning needs, and improved profit visibility. The Insolvency and Bankruptcy Code and other stronger recovery mechanisms are also working properly.

- Banking Sector on a Stronger Note: India’s banking sector is seeing a shift where asset quality is improving and becoming better, digital adoption is rising, and regulations are getting sharper. All this is giving PSBs like Canara Bank a fresh edge to scale operations and improve profitability.

- Lending Growth: Credit growth is moderated to 12% in FY25 (down from 16% last year), largely due to the RBI’s tightening on unsecured loans. But industrial credit stayed strong at 8%, and with retail steadying, Canara stands to benefit from this balanced and sustainable growth path.

- PSB Recapitalisation: If you look at the current data, over Rs 2.87 tn has been pumped into PSBs in recent years. This capital helps banks strengthen their balance sheet, expand lending power and give a solid platform to scale.

- Regulatory Backbone Strengthens: RBI is actively looking for any loopholes that might end up giving losses to people’s hopes in the banking industry. For that, it is focusing on various parameters such as digital KYC adoptions, stable BASEL-III compliance, and enabling banks to operate structurally in the long term.

Key Risks Every Investor Must Watch

While Canara Bank is riding a strong wave with good financials and sectoral tailwinds, there are risks that investors should consider.

- Exposure to Vulnerable Sectors: Canara Bank previously lent money to some of the distressed sectors like iron, steel, infrastructure, and MSME. While the risk management improves but still some of the sectors carry inherent slipping risks, especially those which are linked to weak state-owned entities.

- Margin Pressure from Deposit Costs: The cost of deposit risk is not rising exponentially, but it’s rising, and it can lower the margin. Around 44% of Canara loans are benchmark-linked; the fluctuation in repo rate (at which RBI lends short-term funds to banks against government securities) instantly reflects in lending rates.

- Competition from the Private Players: Private players such as HDFC, ICICI, which use advanced tech, are better positioned in terms of efficiency and customer experience. Also, fintech sectors are growing and reshaping the world of banking services in how people save and invest. These all lead to huge pressure on PSBs.

- Digital Transformation and Cybersecurity: Rising digital banking services come with lots of responsibility and a greater vulnerability to cybersecurity as well. Giving security for all phishing, OTP fraud, and online scams is a must-do thing for banks. Delays in the execution will not only create RBI pressure but also a loss of credibility.

- Compliance: Being a PSU bank brings its own set of challenges. Such as slower decision making and a social lending mandate. Despite fulfilling all the rules and regulations, even a single negative news item will create lots of scrutiny, and previously, Canara Bank faced RBI penalties for compliance lapses.

Conclusion

Canara Bank has proven it can adapt and accelerate even in a fast-evolving banking environment. It has transformed from a loss-making entity to a profitable PSB.

With NPAs decreasing day by day, record high provisioning, improving shareholders’ return and focus on digitalisation, Canara Bank is on the right path.

Yet, investors must remain mindful. It’s not just about how fast the bank grows, but how it lends, how it manages rising deposit costs, and how it handles competition are all important.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary