An electrodes and refractories company has captured the interest of two mega investors – Rekha Jhunjhunwala and Mukul Agarwal. Together, they hold more than 5% stake in the stock, which has proved to be one of their best performing bets.

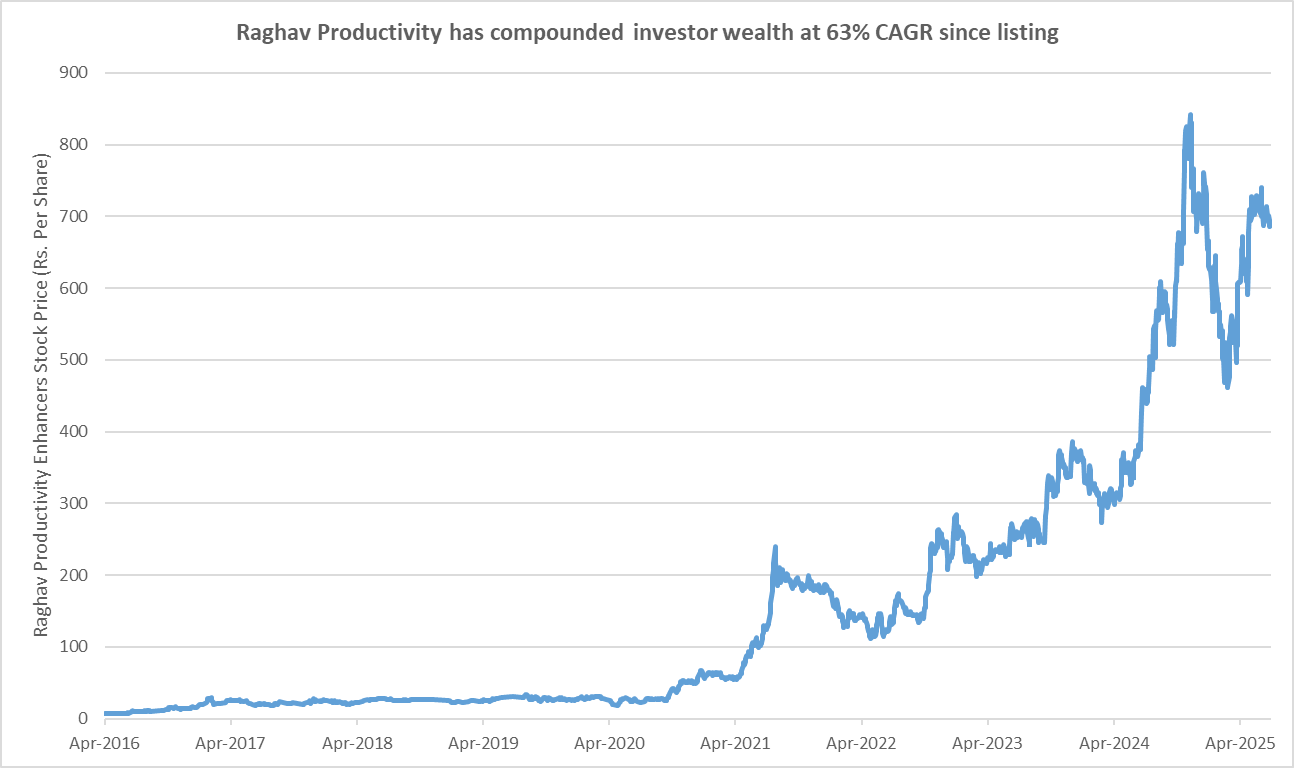

Delivering a CAGR of 63% since its listing in 2016, Raghav Productivity Enhancers has emerged as a multibagger. The small-cap counter has appreciated by almost 50% over the last 4 months.

Is the stock overheated, or is there still time to jump on the bandwagon?

Fundamental strength runs deep

Established in 2009, Raghav is the world’s largest manufacturer of silica ramming mass, a vital refractory material used in induction furnaces. It also manufactures quartz powder and tundish board for industrial applications.

As the only listed organized producer of silica ramming mass in India, it has established itself as a market-leader in the segment. Through in-house proprietary technology along with a technical collaboration with JWK AB Sweden, the company has set up the world’s first fully automatic silica ramming mass manufacturing plant in Rajasthan.

With a consolidated capacity of 288,000 MTPA (metric tonnes per annum), the plant is now equipped with the superior SORT-EX technology. It is also the only player in the industry with the capability to customize solutions based on the client’s plant parameters, thereby ensuring higher heats. It also benefits from the quality of quartz in the state, as Rajasthan is home to the densest quartz in the world. It markets its ramming mass as an end-to-end solution complete with trials, knowledge transfers, and installations.

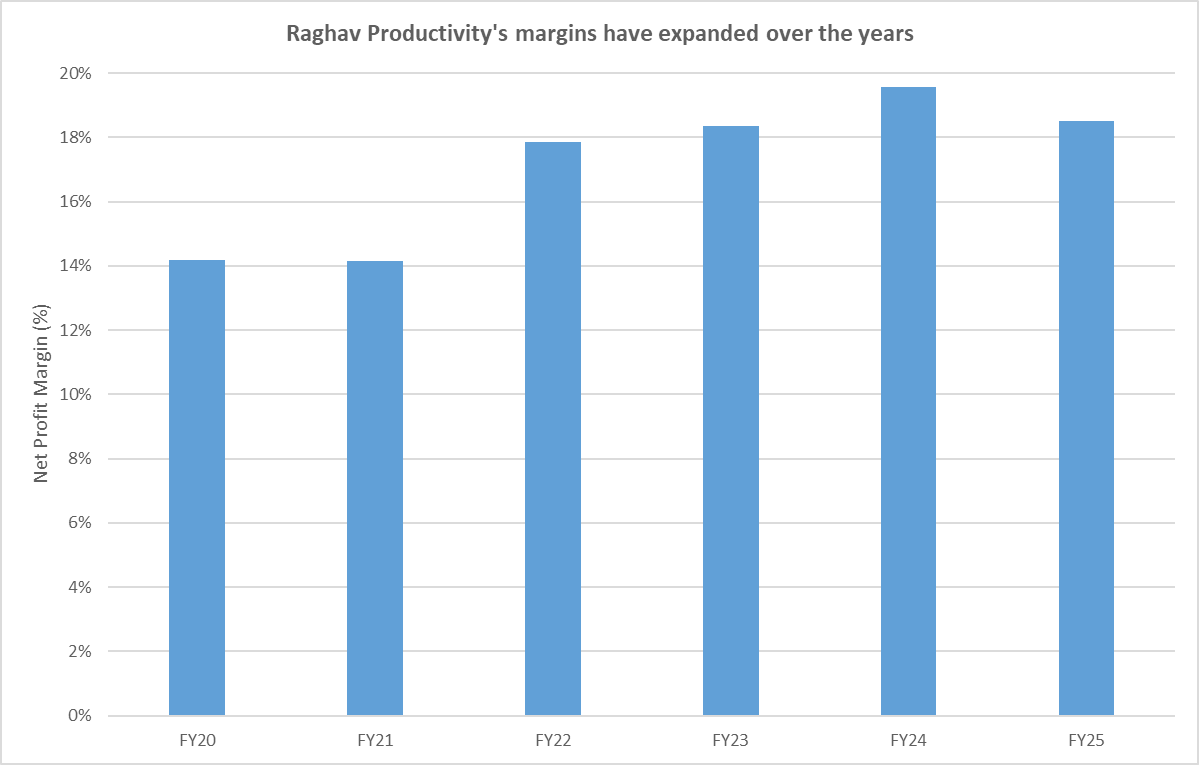

With superior raw-material quality, capability for customization, and a technological upper hand, Raghav’s silica ramming mass offers at least 25% more heats than competitors. Thanks to the superior product quality, it commands premium pricing power and achieves superior realizations. Consequently, its margins have expanded over the years.

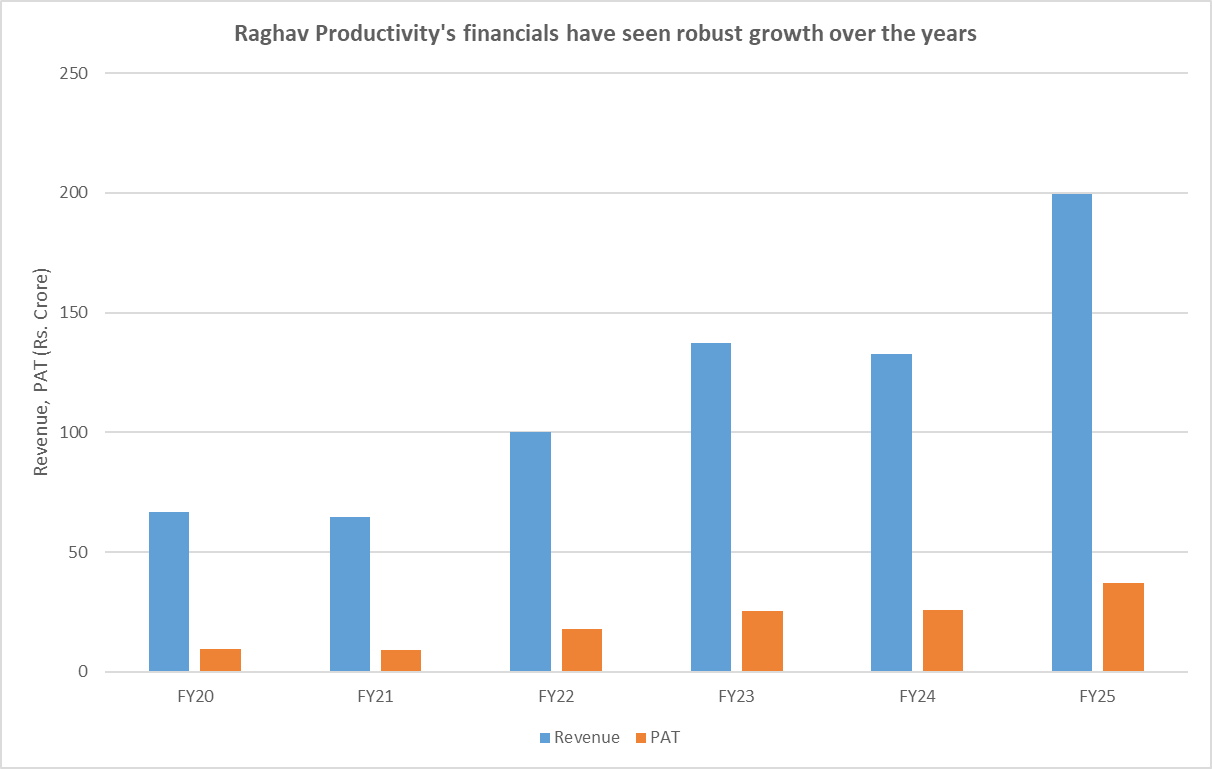

Result? Its topline has grown at a robust 25% CAGR between FY20 and FY25, and its profits have grown even faster.

Industry tailwinds driving growth

The government’s undeterred focus on infrastructure expansion has pushed the pedal on the demand for smelting, mining, and steel manufacturing. About 70% of the demand for ramming mass comes from crude steel manufacturing plants. Each ton of steel production requires about 30 kg of silica ramming mass.

Add to this the facts that India is the world’s second largest manufacturer of steel, and that domestic steelmakers prefer locally sourced silica ramming mass due to easier availability, procurement, and lower logistic costs. As the leading manufacturer of ramming mass used in induction-furnace lining, Raghav is a direct beneficiary.

Government initiatives such as the National Steel Plan that is targeting 300 MTPA in steelmaking capacity by 2030, would push up demand further. The government’s Atmanirbhar Bharat campaign and production-linked initiatives also encourage the use of domestically manufactured silica ramming.

The segment is also sitting bang in the middle of ongoing R&D investments. While research is underway to improve the thermal insulation properties of silica ramming for high-temperature applications, demand is also accelerating for customized silica ramming mass for enhanced furnace efficiency.

Prospects look promising

The company had expanded its capacity by a massive 60% two fiscals back. It was running on 64% utilization in Q4 FY24, which improved to 85% as of September 2024. This is to say that subject to demand holding up, further expansion is possible. While the new plant has been designed to enable easy capacity expansion, the company’s low net debt also leaves room for debt-funded expansion if needed.

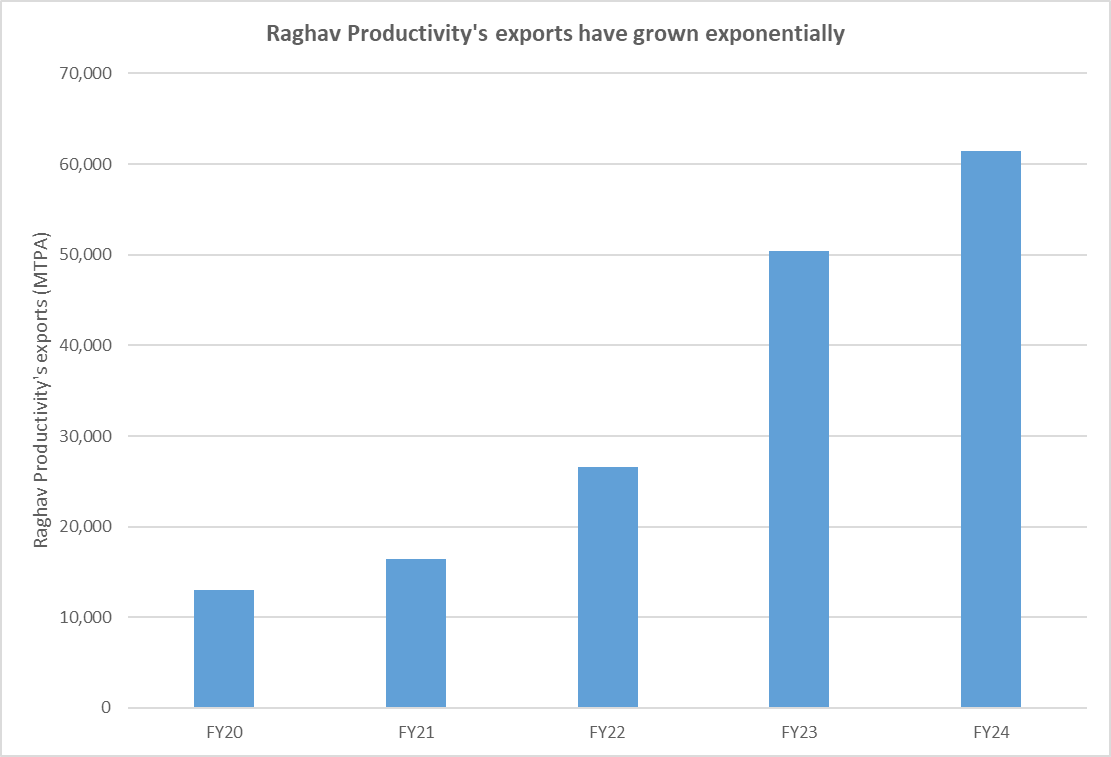

Despite foraying outside India only a few years back, the company’s exports have grown exponentially over the years. Buoyed by its partnership with UK-based Capital Refractories for global distribution, is export volumes have grown at a CAGR of 47% from just about 13,000 MT in FY20 to almost 61,500 MT in FY24.

It exports to more than 35 countries across Asia, Africa, and the Middle East. Given the higher demand potential and margin-accretive nature of exports in the industry, Raghav plans to expand its global footprint by forging further partnerships with global refractory leaders and tapping new export markets.

But risks loom large

With geopolitical uncertainty weighing on economies around the world, the demand for steel and other industrial applications for silica ramming mass could see a slowdown. Stubborn slowdown in China’s real estate market could make matters worse. With tariff uncertainty plaguing trade, cheap Chinese steel being dumped into India can lead to lower demand for domestic steel, and consequently lower demand for silica ramming mass.

Amid muted demand, competition appears to be finally catching up with Raghav’s superior financials. The company’s net profit margin shrunk from 19.6% in FY24 to 18.5% in FY25. The topline grew by more than 50% to almost touch Rs.200 crore, while profit expanded by 42% to Rs.37 crore. How revenue-growth and margins evolve going forward, will need to be closely monitored.

The stock is trading at 85 times its trailing twelve-month earnings, and appears priced to perfection. Mukul Agarwal has booked profits in the stock, taking his stake down to 1%. This has followed close on the heels of Ashish Kacholia’s apparent exit from the counter. This indicates profit-booking by the big bulls, and reaffirms the limited scope for further price appreciation. Of course, fundamental triggers such as large strides in exports, acceleration in domestic demand, or tangible technological advancement can lead to earnings upgrades, thereby moderating valuations.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ananya Roy is the founder of Credibull Capital, a SEBI-registered investment adviser. An alumnus of NIT, IIM, and a CFA charter-holder, she pens her views on the economy and stock markets.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.