The first two months of 2025 were dreadful for the market, with mid-cap and small-cap indices falling by more than 20%.

The benchmark NSE Nifty also set a record with negative returns for five consecutive months.

This correction is the most brutal since the 2020 pandemic, which has hit the broader market more heavily than the benchmark indices.

Consequently, most stocks have fallen sharply from their respective 52-week highs in a short period. As such, investors are tempted to buy on dips to make fresh investments or average up the prices of stocks they already own.

However, not every stock is worth buying on dips, as there is uncertainty about how low the price will go. Most of the time, only stocks with strong fundamentals and earnings prospects recover, while others languish.

Therefore, it is essential to know that some stocks may not be worth considering, even if the stock price has fallen 40-50% from the top.

This article highlights five such companies.

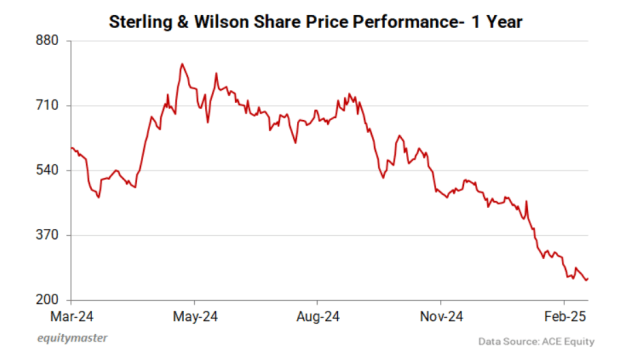

#1 Sterling & Wilson Renewable Energy

First on the list is Sterling & Wilson Renewable Energy.

Sterling & Wilson is a leading end-to-end renewable energy EPC solutions provider with a presence in 28 countries, including India, South-East Asia, the Middle East, Africa, and Europe.

The company provides EPC services for utility-scale solar, floating solar, hybrid, and energy storage solutions and has a total portfolio of 21.7 Gigawatts peak (GWp).

Moreover, it also manages an operations and maintenance (O&M) portfolio of 8.8 GWp solar power projects.

The company’s financial position is very bad. Profit and revenue growth are inconsistent. It has been a loss-making company in the last four financial years ending FY24.

While it turned profitable in FY25, with consistent profits in all three quarters, its sustainability is still to be seen.

The company faces several other issues as well.

The biggest concern is the ongoing selling by the company’s promoters, who have sold 7.25% of their stake in the last four quarters ending December 2024.

From June 2023, the selling has become more intense as they have sold 23.7% stake.

In addition, the company has recently seen several senior leadership resignations, raising another concern among shareholders.

As a result, its share price has dropped 66% from its 52-week high, despite 215% revenue growth in Q3FY25 and a return to profitability.

In addition, uncertainty remains over Trump’s policies on the renewable energy sector.

Trump has halted federal funding for clean energy projects, which could impact renewable energy companies worldwide.

Nonetheless, the company had an unexecuted order book of Rs 101.7 billion (bn) as of Q3FY25 and is looking to achieve its revenue guidance of Rs 80 bn in FY25.

The company is confident that it will grow in the years ahead due to the rising demand for clear energy.

However, its poor past performance, and continuous promoter selling make the stock risky.

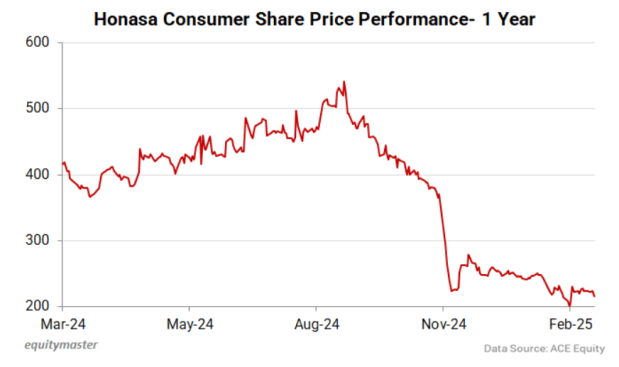

#2 Honasa Consumer

Second on the list is Honasa Consumer.

Incorporated in 2016, Honasa Consumer provides beauty and personal care (BPC) products through its omni-channel platform, Mamaearth.

Mamaearth is the company’s flagship brand, focusing on developing toxin-free beauty products made with natural ingredients.

It was India’s largest digital-first BPC brand by revenue in FY24. According to Euromonitor, Mamaearth is the third-largest skincare brand in India as of 2023.

The company got listed in November 2023, and thereafter rapidly jumped over 50%.

However, it has been on a downward trend since then, as its performance deteriorated sharply in FY25.

In the first nine months of FY25, its revenue grew just 5.8% to Rs 15,330 million (m), while its profit fell from Rs 800 m to Rs 480 m.

One-time inventory correction linked to strategic changes in its distribution model was a major contributor to this performance.

As a result, its stock price has crashed about 60% from the top.

The main reason behind avoiding this stock is the increasing competition in the BPC sector, with many big players entering the market. This is worrisome as BPC is a very fragmented market.

Mamaearth also wants to expand through physical stores, which could keep its margins low due to the need for regular capital expenditure.

Moreover, it is also in dispute with RSM General Trading, a former distributor of Mamaearth in the Middle East and Africa.

It sued Honasa for the sudden termination of distributor rights. A Dubai court has asked Mamaearth to pay Rs 570 m compensation, which could significantly hamper its financials.

However, this matter is sub judice in the Indian court.

Nevertheless, it is focused on long-term growth by strengthening its position in key categories and improving its distribution strategies.

The company aims to become a top 3 national player or market leader in fast-growing categories such as face wash, sunscreen and face serum, which currently contribute to around 50% of its business.

It plans to achieve this within 3-5 years by leveraging product innovation, enhanced marketing investments and targeted consumer engagement.

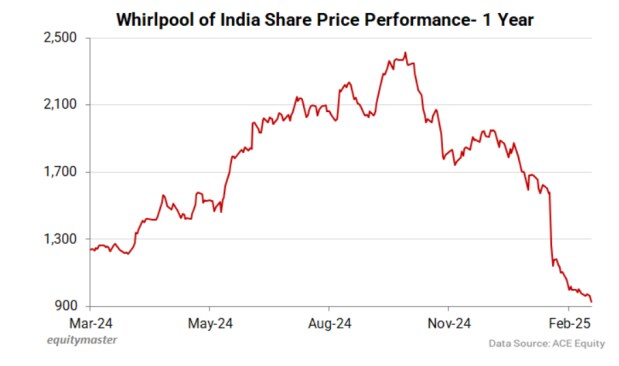

#3 Whirlpool of India

Third on the list is Whirlpool of India.

Whirlpool of India Limited, a subsidiary of the Whirlpool Corporation, is a leading manufacturer and marketer of home appliances in India.

It remains a trusted name in the Indian home appliances market, offering various products, including refrigerators, washing machines, and air conditioners.

It derives 59% of its revenue from the sale of refrigerators, 27% from washing machines, 6% from air conditioners, etc. 95.8% of its revenue comes from the domestic market, while 4.2% comes from the rest of the world.

However, despite its strong brand, Whirlpool has not performed well over the past few years. Due to intense competition, its market share has declined, leading to stagnant revenues, declining profits, and margins.

Revenue has grown at just 5% CAGR over the last five years, while profit has declined at 11.5%.

Moreover, promoter stake dilution remains the biggest overhang for the stock. As of Q3FY24, Whirlpool Mauritius held a 75% stake in the company. Of this, they sold 24% in the fourth quarter of FY24, reducing their stake to 51%.

However, they intend to sell their stake down to 20% by mid or late 2025. This means a 31% stake sale is pending, putting pressure on the stock.

As a result, its stock price has lost 61% of its value in the past one year alone, and is trading below all-time high seen in 2021.

Looking ahead, the company has seen improved product demand compared to last year, including strong volume growth in refrigerators and washers.

In addition, Whirlpool focuses on premiumisation by adding new offerings in the premium segment and aims to improve product launches to meet demand in tier 2 and tier 3 cities.

The company expects good results from these initiatives in the coming years. Nonetheless, the promoter stake sale remains a big overhang for the stock.

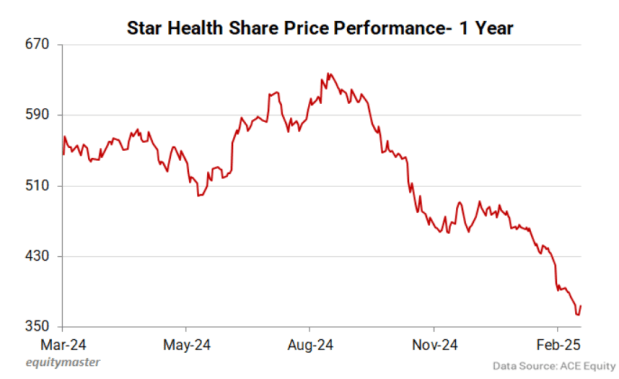

#4 Star Health & Allied Insurance

Fourth on the list is Star Health & Allied Insurance.

Star Health is India’s first Standalone Health Insurance (SAHI) provider and is the largest private health insurer in India with a market share of 13% as of Q3FY24.

The company is a retail-focused player, with retail business accounting for 93% of total health gross written premium (GWP). The rest comes from group health and others.

However, despite being a leading health insurance company, it has faced persistent challenges due to high claim payouts, which have mainly led to underwriting losses.

Higher medical inflation and the frequency of claims have risen considerably for the company, affecting its business.

This has also negatively affected Star’s combined ratio, which climbed to 96.7% in FY24 from 95.3% last year, thus affecting profitability.

The combined ratio measures an insurance company’s profitability and is a crucial metric for insurers. A ratio of below 100 shows that the insurer is making a profit by paying fewer claims than it earns through premiums.

However, it has raised premiums and reduced businesses with high claim ratios to compensate for the losses.

The company continues to struggle with high claim payouts, and constant underwriting losses. As a result, its share price has declined 58% from its listing in December 2021.

Even in Q3FY25, the company reported an underwriting loss of Rs 490 m, despite net earned premium growing by 15.4% compared to the same quarter last year.

As a result, its earnings before interest, tax and depreciation (EBITDA) declined 46%.

It is also struggling on the profitability front. Its profit in the first nine months of FY25 fell to Rs 6,450 m from Rs 7,030 m in the same period last year.

Besides deteriorating financials amid higher payout and combined ratio, there is a threat of a potential disruption from the composite license.

A composite license will allow insurers to offer life and non-life insurance, which could disrupt Star Health’s business, especially since it does not have diversified revenue.

Given its dominant market share, Star Health will be most affected as life insurance companies enter the health insurance segment, increasing competition and potentially eroding its market share and pricing power.

#5 Easy Trip Planners

Fifth on the list in Easy Trip Planners.

The company ranks as India’s second-largest OTA, providing travel-related products and services under its brand, ‘Ease My Trip‘.

Additionally, it has recently expanded into the insurance sector and charter solutions.

The company offers comprehensive travel solutions, including airline, train, and bus tickets, accommodations, holiday packages, and additional services without charging convenience fees, setting it apart from competitors.

The company has seen promoter selling in recent months. The promoter has sold about 14% of Easy Trip’s stake in the last two quarters. In addition, Nishant Pitti, the co-founder, also recently exited the company.

The second reason is unrelated diversification into the electric vehicle manufacturing sector. Easy Trip intends to invest Rs 2 bn in this sector over the next three years.

Nevertheless, the company’s financial performance also reached a peak. Its revenue fell from Rs 1,608 m in Q3FY24 to Rs 1,506 m in the recent quarter.

Its profit declined from Rs 457 m to Rs 340 m during the period, despite the booming travel and tourism sector.

As a result, its stock price has been on a downward slide, falling 76% from a high of Rs 49 to its current market price (CMP) of Rs 11.7.

Moving ahead, the company intends to expand into international markets to maintain its growth momentum. Significant progress has been made in Dubai, where it is gradually gaining traction.

To attract new customers, it has integrated India’s first metasearch engine, ScanMyTrip.com, into the ONDC network.

Additionally, it has signed an exclusive agreement with PhonePe to enhance the hotel segment and broaden access to millions of users.

Furthermore, it has launched co-branded cards. The company believes these initiatives will support its customer acquisition efforts in the future.

The company remains hopeful about future profitability and anticipates that the pressure on the net profit will ease as its new ventures and subsidiaries develop.

Conclusion

Buying the dip can be tempting, as it helps average down the purchase price.

However, not all stocks recover with the market, making this strategy risky for retail investors.

It only works when a company has strong fundamentals and clear earnings growth potential. Such stocks tend to rebound first.

Conversely, buying a fundamentally weak stock just because it has fallen can lead to further losses. Some companies struggle due to high debt, poor financials, or industry headwinds that a price drop alone cannot fix.

Therefore, investors should be cautious when averaging down and ensure the company has strong fundamentals and long-term growth potential.

They should also assess factors like corporate governance while performing due diligence.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.