By UBS estimates

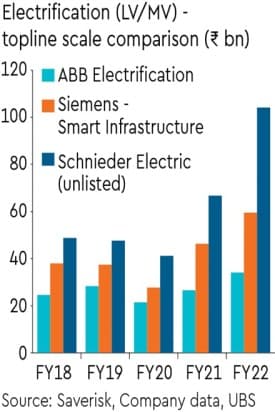

We have upgraded abb to a Buy rating based on several factors. Firstly, the demand for ABB’s industrial products in the short-cycle segment has surpassed expectations due to its deeper geographical penetration. Secondly, the electrification and motion segments are expected to drive margin improvement, despite ABB’s reliance on imports in process automation and robotics. Additionally, ABB’s Indian leadership is strategically focused on expanding market opportunities, particularly in low voltage electrification. Notably, while consensus margin forecasts have already increased by 120 bps in the past year, we believe ABB’s true potential from value-accretive electrification and motion initiatives has yet to be fully priced in. The company’s growth prospects are further supported by the contribution of highly scalable new segments and products, leading to growth in operating profit margins (OPM). Active capital expenditure efforts also provide additional support to ABB’s growth trajectory.

Despite the moderation in global growth, both long- and short-cycle orders momentum in India has been tracking strong growth. ABB has seen a 13% upgrade in consensus earnings in the past three months, reflecting a strong outlook beyond pent-up demand.

ABB’s ability to win more mandates from its parent (such as, the recent low voltage products), deepening tier-2/3 market penetration, and significant scope to expand its addressable market in low voltage electrification add to our confidence that earnings can grow at a high double-digit trajectory.

Also read: Recovery from bad investments: How Peter Lynch, George Soros bounced back from failure

With wide innovation-driven moats and high value-added products, ABB is extending its geographical reach in its leadership segments, such as motors, drives, low and medium voltage switches, and switchgears, which in our view have a lot more room to grow profitably. Further momentum in service-layered long-term projects points to medium-to long-term growth in revenue share from high margin services. We remain bullish on industrial automation and low voltage electrification demand and see an improving case for further OPM growth. We lift margins by 130 bps and earnings by 10-17% for CY23-25E, which we believe realistically reflects the sustainability of margins, driven by volume and revenue mix benefits from electrification and motion.