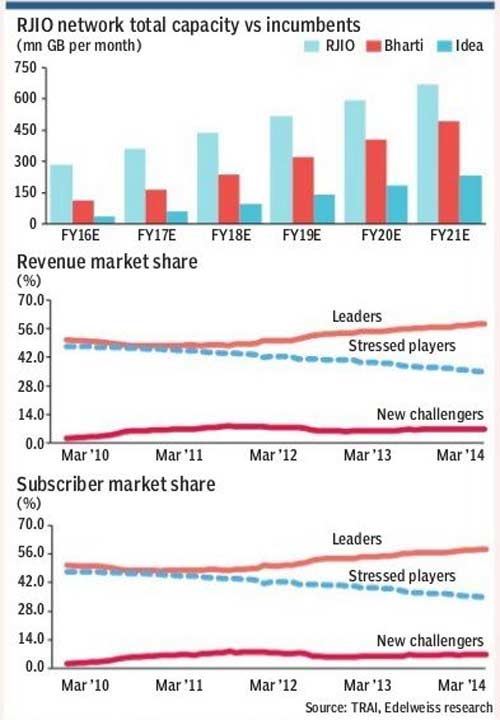

We expect Reliance Jio’s (RJio’s) launch to be disruptive—a key objective will be to enforce a data revolution which bypasses 3G altogether. RJio’s strategy will therefore have its data capacity (6x of competition) and speed (8x) at its core. Sub-scale LTE eco-system could be addressed through a large scale subsidisation of ‘MiFi’ dongles—targeted at incumbent’s high data usage subscribers. RJio’s pricing strategy will be to target absolute ARPU(average revenue per user) while incentivising very high data usage. Lower per unit/data prices will be incidental to this strategy.

If executed well, RJio will be able to churn out the most profitable subscribers—and profitably. Critically, competitive response by incumbents will be likely restricted by capacity bottlenecks. We believe incumbents are underprepared for data explosion—in a non-RJio world this would have worked well. We believe heightened competitive activity to reflect in high demands on capex and industry ROEs (returns on equity) will remain in sub economic zone for the foreseeable future. Investors may await more details to buy into RJio’s strategy, but to stay invested with incumbents is now risky.

We believe RJio has credible options to build LTE (long-term evolution) eco-system in India. Incumbent’s state of preparedness to counter with 4G offering is suspect, perhaps fostered by legacy investments in 2G/3G networks and of course poor LTE eco-system. Bharti has just launched its LTE services commercially while Idea will offer it only in 2016. RJio will exploit this window to build market share rapidly. Eventually incumbents will be forced to upgrade capacity.

Data revenues will explode nearly 3.6x through FY19 even as voice cannibalisation impact is moderated by higher rural penetration. The problem though is incessant capex demands—capex/revenues ratios will remain elevated at 18-20% through FY19. Expect ROEs to remain sub-par in a 11-13% band.

High data capex would pressure RoCEs (return on capital employed) for Bharti and Idea (12.4% and 10.7% by FY18, respectively). Valuations for Bharti/Idea at FY17 EV/Ebitda (enterprise value/ ear-nings before interest taxes depreciation and amortisation) multiple at 6.9x/7.5x are expensive. We maintain Hold rating on Idea (TP R167) and downgrade Bharti to Hold, from Buy (TP R415).

Mukesh Ambani, CMD, Reliance Industries during the AGM, announced grandiose plans to roll out LTE services. He highlighted that the launch will cover 80% of the population to start with and over the next three years target 100% population. Bharti’s network, in comparison, covers 86.7% population. To reduce the cost of delivery, RJio has also acquired international capacity which will ensure that it carries 50% international traffic on its own network.

Low penetration of 4G handsets will be the key challenge for RJio. Although the company has elaborated its strategy of making LTE handsets available across all price points starting from Rs 4,000, it will have to start with a minuscule addressable market. We expect RJio to aggressively promote LTE Hotspot (Mi-Fi) devices to expand its LTE services market.

MiFi devices will be a lynchpin in driving LTE penetration. We expect the company to cut prices of MiFi devices, which currently retail at Rs 2,300, by economies of scale to Rs 1,500. It may further subsidise them by 50% to make them available at low price points.

Since heavy data users are on incumbents networks, RJio’s strategy will primarily rest on incentivising churn. We estimate Bharti’s, Vodafone’s and Idea’s combined data subscriber base to be 163.3m (24.9% of total) and 3G/LTE subscriber base at 83.1.1m (12.7% of total) by FY16. RJio will specifically target this segment of subscribers and may subsidise MiFi devices. By FY20, RJio will target shifting 25% of incumbents’ 3G data subscriber base to its network.

If RJio manages to scale rapidly, it will turn Ebitda positive by FY19 and Ebit positive by FY20. Our estimates indicate that the company will have to incur Ebitda loss of Rs 130 bn before turning Ebitda positive.