By Sameet Chavan

After a strong recovery in the week gone by, we began Monday’s session on a strong note almost towards the 17950 mark. In absence of follow-up buying, the benchmark index consolidated in a range of merely 100 points to conclude tad above 17850. On a subsequent day, the Nifty opened in green but failed to hold early morning gains right from the word go. In fact, the selling worsened as we progressed to tank below 17800 first and then 17600. The action wasn’t over yet, as we saw Nifty witnessing a sharp bounce back to trim a major portion of the intraday losses to almost reclaim 17750 at the close.

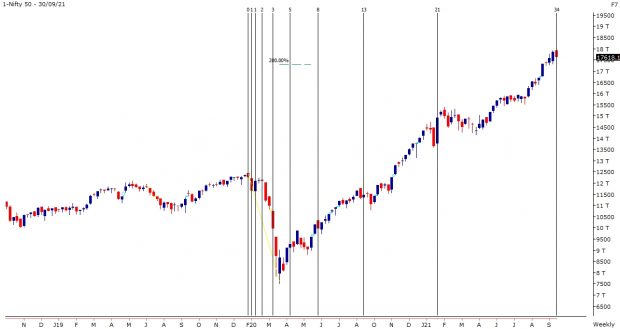

In the last couple of sessions of the monthly expiry, the benchmark index remained in a tight range with some hint of profit booking towards the fag end of Thursday’s session. Although this week so far, Nifty came off a bit from all-time highs, the September expiry panned out extremely well for the bulls as they added nearly 6% to their kitty. Honestly, for the second half of this September month, we maintained a cautious stance on the market and it moved much more than we had expected. In such a strong bull run, it may not be wise to stay with the cautious stance; but the kind of time-projections and negative divergence in momentum oscillators we are observing, we would continue with the same.

The overstretched market can surprise us any time and hence we reiterate staying light in the market. As we step into the new series, it would be interesting to see how things take place going ahead on the domestic as well as the global front.

Now let’s take a quick look at the overall F&O activities. This week, we did see FIIs pulling back their hands a bit as we witnessed a good amount of selling in Equities as well as in index and stock futures. In addition, the fear index, India VIX, surged in the last three sessions, indicating a rise in volatility going ahead.

In the F&O space, the only factor that is indicating an oversold position is the Nifty PCR, which has dropped below 1. Let’s see how things shape up going ahead. As far as levels are concerned, 17800 – 17950 remains to be an immediate hurdle; whereas on the lower side, 17450 – 17300 are to be seen as key supports. The first sign of weakness would be visible only after breaking the lower range.

(Sameet Chavan is Chief Analyst – Technical and Derivatives, Angel One Limited. Views expressed are the author’s own.)