We had brought back Britannia among our top picks six weeks ago; the stock has since moved up 18% (outperforming FMCG index by 600bp). Even so, we argue any weakness in the stock due to likely QoQ weaker demand in Q2FY22 (off a strong base) can be an opportunity to add. We list out the key reasons for our rationale.

We remain positive on Britannia as on-the-go categories recover due to rising mobility, market share gains from regional players, and expanding addressable markets, not to mention gradual price hikes and favourable base in H2FY22. ICDs at Rs 4.7 bn are lower than Mar-21 level of Rs 7.9 bn, which is a good development. Retain ‘Buy’ with a TP of Rs 4,670.

12 reasons why we see more upside

(1) Getting aggressive on WIMI (Win in Many India’s) strategy; (2) gains in market share to sustain; (3) huge room in e-commerce (targets 5% versus 2% currently); (4) growth potential in adjacencies are attractive; (5) rising mobility, reopening of malls will drive OOH products, sampling of new products and premiumisation; (6) most innovative company due to R&D capability; (7) rural growth to revive in most states; (8) ramping up capacity in Maharashtra, Tamil Nadu, UP; (9) commercialised partnership in Egypt and Uganda for manufacturing; (10) price hikes and improving mix to drive more balanced growth; (11) upping smartness and ESG quotient; (12) Go Airlines’ Rs 36 bn IPO likely to get SEBI nod.

Key risks are inflation in cashew and palm oil. Q2 base for firm is high, so good growth on a y-o-y basis is likely from H2FY22.

Outlook: Improving

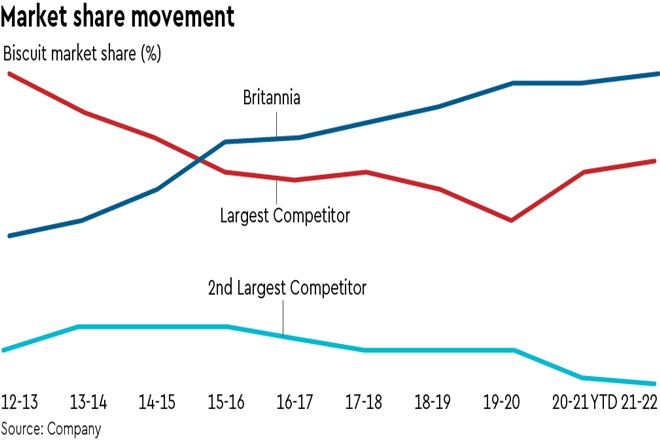

Britannia is the value leader in the biscuit category and has sustained market share gains. We believe its growth will continue to outstrip the industry well. Its deepening distribution network, particularly in rural, with focus on driving growth in weak states – Gujarat, Madhya Pradesh, Uttar Pradesh and Rajasthan – will hold it in good stead. The company’s aggregate growth has improved with the rise in its market share.

Britannia’s cost-saving initiatives (targeting ~2.1% of revenue per year) continue to be robust, helping it sustain margin expansion. A gradual improvement in the product mix will also aid gross and Ebitda margins. A key variable is Parle gaining market share from other players and narrowing the market share gap. We maintain ‘BUY/SO’ with a TP of Rs 4,670.