The Congress on Wednesday questioned SEBI regarding its enforcement of the new disclosure norms for Foreign Portfolio Investors (FPIs).

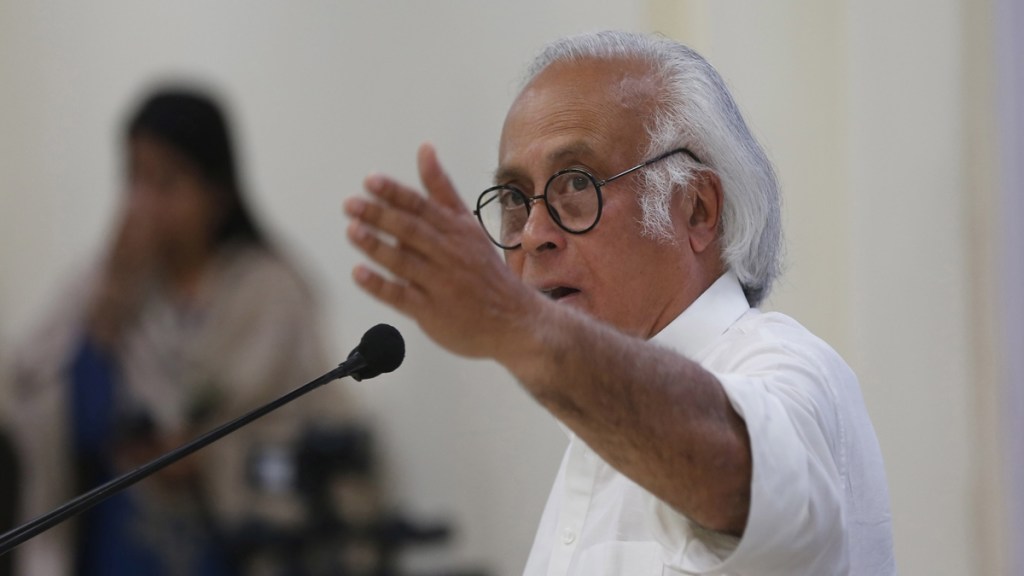

In a post on X, Congress general secretary Jairam Ramesh questioned that the deadline for FPIs to reveal the beneficial owners of their holdings was September 9, and asked why it has taken SEBI 18 months to implement this regulation.

Congress general secretary in-charge communications Jairam Ramesh said it is September 11 today, two days after the SEBI’s September 9 deadline for Foreign Portfolio Investors (FPIs) – those who stand accused of holding concentrated portions of their equity portfolio in a single corporate group – to disclose the beneficial owners of their holdings.

“We had raised this issue a few days ago, in light of information that two Mauritius-based FPIs that were part of the revelations in the still-unfolding Modani mega scam, have petitioned the Securities Appellate Tribunal to seek urgent relief from complying with these new foreign investor norms,” he said in a post on X.

“Some questions to the SEBI on the current status of these disclosures – have all FPIs required to comply with these norms disclosed the details of their ultimate beneficial owners to SEBI? Which FPIs have complied, and which ones have failed to do so?” the Congress leader said.

In particular, have the FPIs implicated in the “Modani mega-scam” revealed the details of their owners to SEBI, he asked.

“As part of its initial rulings on the Modani mega scam, the Supreme Court had mandated that SEBI investigate the violations by these FPIs within a timespan of two months – why has it taken SEBI 18 months to enforce this new norm?” Ramesh said.

Did this extended timespan of 18 months between the Supreme Court ruling and the compliance date for the FPIs allow these funds and their owners to divest from stocks and frustrate the transparency-seeking intent of these norms, he asked.

“If so, what is SEBI’s plan to ensure that norms of integrity are met, especially in the investigation into the Modani mega-scam?” Ramesh said.

His remarks come days after the Congress said the SEBI investigation into “the Adani Group’s brazen attempt” to bypass regulations is still languishing and the capital markets regulator has a lot to explain.

On Sunday, Ramesh criticised SEBI following reports that two Mauritius-based FPIs, mentioned in a January 2023 Hindenburg Research report on the Adani Group, have sought relief from SEBI’s new foreign investor rules.

This criticism follows fresh allegations from Hindenburg Research against SEBI Chairperson Madhabi Buch and her husband, claiming they have stakes in offshore funds linked to the Adani money scandal. Both Buch and her husband have denied the accusations, calling them baseless.