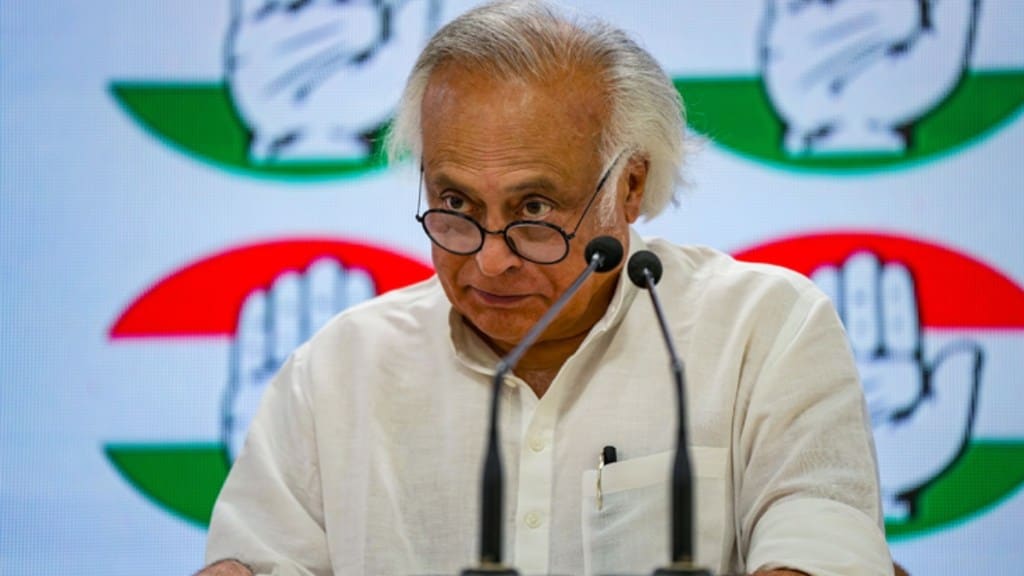

Congress General Secretary Jairam Ramesh highlighted what he termed “fresh conflict of interest allegations,” claiming that Buch, both as a whole-time member and later as chairperson of SEBI, traded securities worth Rs 36.9 crore between 2017-2023.

The latest allegations follow Buch’s recent defence, where she asserted that she had made all necessary disclosures and adhered to recusal guidelines in cases involving companies such as the Mahindra Group, which employs her husband. Buch dismissed the allegations as “false, malicious, and motivated.”

In response to opposition charges, Buch and her husband Dhaval Buch issued a joint statement addressing concerns about her dealings with Agora Advisory and Agora Partners. They stressed that Buch never handled files related to these advisories while serving as a SEBI member since 2017.

Ramesh questioned Prime Minister Narendra Modi, asking if he is aware of Buch’s high-value investments abroad and her investments in Chinese firms amidst ongoing tensions with China.

“Is the PM aware that the SEBI Chairperson has been trading in listed securities while in possession of Unpublished Price Sensitive Information?,” Ramesh asked.

“Is the PM aware that Ms. Madhabi P. Buch has made high value investments outside India? If yes, what is the date of this investment and date of disclosure?,” he asked in his second question.

“Is the PM aware that the SEBI chairperson has been investing in Chinese firms at a time when India is facing geopolitical tensions with China?,” the Congress leader asked.

Meanwhile, speaking at a press conference, Congress spokesperson Pawan Khera alleged that Buch traded securities worth Rs 36.9 crore from 2017 to 2023, violating SEBI’s conflict of interest code.

Khera also claimed that Buch held foreign assets from 2017 to 2021 and questioned when she first declared these assets to government agencies. He pointed to her investments in US and Chinese funds.

The Congress also revisited previous allegations, including Buch’s substantial earnings from ICICI Bank and ICICI Prudential while adjudicating complaints against these entities. They also accused Buch of misleading the public about her involvement with Agora Advisory, which continues to receive payments from SEBI-regulated entities.

The Congress further demanded clarifications from Mahindra & Mahindra regarding payments made to Dhaval Buch and Agora Advisory, questioning whether proper due diligence was conducted.

“Mahindra & Mahindra must clarify whether they paid large sums to both Dhaval Buch personally and his joint consultancy, Agora Advisory Private Limited, in which Madhabi Buch holds a 99% stake. If yes, did Mahindra & Mahindra fail to conduct KYC and due diligence before transferring substantial public funds to Agora Advisory Private Limited?” Khera said.

“If Dhaval Buch was paid Rs 4.78 crores personally, they must also clarify the payment of Rs 2.59 crores to Agora Advisory Private Limited, a supposedly ‘dormant’ company,” Khera added.