The Reserve Bank of India (RBI) on Wednesday proposed that foreclosure charges or pre-payment penalties will not be levied on loans to micro and small enterprises (MSEs) by banks and non-banking financial companies (NBFCs). The decision was taken in the latest bi-monthly monetary policy “with a view to safeguard customers’ interest through better transparency and customer centricity by lenders,” the central bank said.

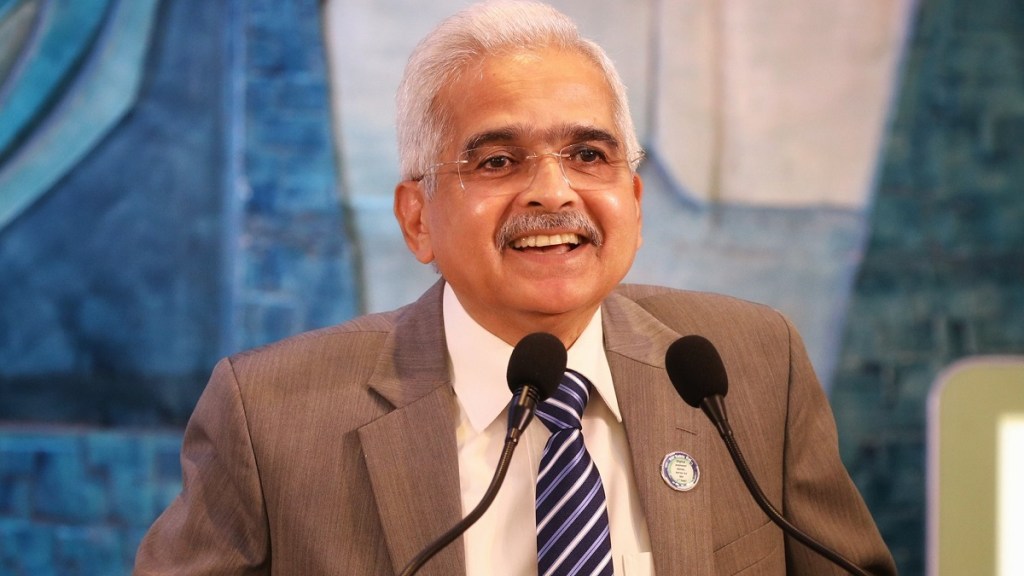

In his statement, RBI Governor Shaktikanta Das said the Reserve Bank has taken several measures over the years to safeguard consumer’s interest and as part of these measures, banks and NBFCs are not permitted to levy foreclosure charges/ pre-payment penalties on any floating rate term loan sanctioned to individual borrowers for purposes, other than business.

“It is now proposed to broaden the scope of these guidelines to include loans to Micro and Small Enterprises (MSEs). A draft circular in this regard shall be issued for public consultation,” Das added.

MSEs are required to pay loan foreclosure or pre-payment charges levied by certain lenders in the range of 2-4 per cent.

Earlier this year, ahead of the budget, MSME body FISME had urged the government for reforms in the banking sector including removing foreclosure charges on loan prepayment by MSEs and non-compliance charges sought by banks if an enterprise wants to change its bank.

However, according to the credit rating agency ICRA, the move by RBI proposing zero foreclosure charges or pre-payment penalties on MSE loans will impact lenders.

“MSEs typically take unsecured business loans, which are normally on a fixed rate, as well as loan against property, which is on floating rate. While positive for customers, the RBI’s move will have a negative impact on the profitability of lenders, and could also potentially increase the loan prepayments and balance transfer,” said Anil Gupta, Senior Vice President, Co Group Head – Financial Sector Ratings, ICRA.

Importantly, the Banking Codes and Standards Board of India (BCSBI) by RBI and banks, which had set the minimum standards of banking practices for lenders when dealing with MSEs, had called for permitting prepayment of floating rate loans and fixed rate loans without levying any pre-payment penalty. The BCSBI, however, was dissolved in 2021.

According to RBI, all member banks of BCSBI had voluntarily adopted the code for implementation. Nonetheless, post dissolution of BCSBI, the central bank had informed in July 2022 in an update on the master direction on lending to MSMEs that banks may continue to follow their commitments as hitherto under the code.