Union Budget 2024 Highlights: Finance Minister Nirmala Sitharaman unveiled nine key priorities in the Union Budget 2024-25 aimed at bolstering economic opportunities. In her seventh consecutive budget presentation, Sitharaman highlighted the government’s focus on productivity, job creation, social justice, urban development, energy security, infrastructure, innovation, and reforms. She noted ongoing implementation of schemes outlined in the interim budget from February.

Budget 2024 Highlights Live Updates: Finance Minister presents Union Budget 2024-25

The Union Budget for 2024-25 has allocated Rs 1,248.91 crore for expenses related to the Council of Ministers, the Cabinet Secretariat, the Prime Minister's Office, and for hosting State guests, marking a decrease from Rs 1,803.01 crore allocated in 2023-24.

Specifically, Rs 828.36 crore has been allotted for the expenses of the Council of Ministers, compared to Rs 1,289.28 crore in the previous fiscal year. This allocation covers expenditures such as salaries, allowances, and travel costs for cabinet ministers, ministers of state, and former prime ministers, including provisions for special VVIP flight operations.

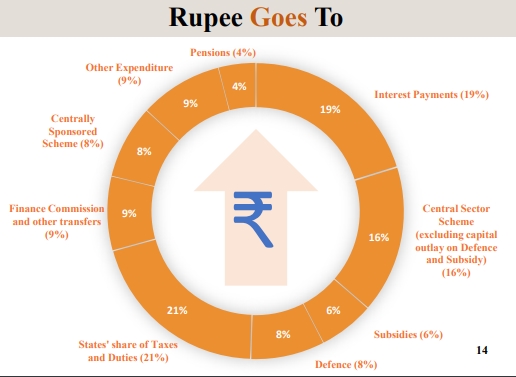

The Budget Estimates for 2024-25 is Rs 48.20 lakh crore.

📍Central Government Expenditure

— PIB India (@PIB_India) July 23, 2024

▶️Budget Estimates for 2024-25 (in ₹crore)#unionbudget2024 #budgetforviksitbharat #budget2024 pic.twitter.com/2q7DnXjLTY

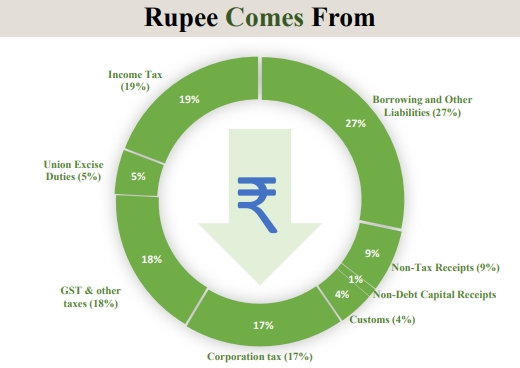

-Total receipts other than borrowings: Rs 32.07 lakh crore

-Total expenditure: Rs 48.21 lakh crore

-Net tax receipt: Rs 25.83 lakh crore

-Fiscal deficit: 4.9 per cent of GDP

On promoting Investment, Employment & Social Security, Union Budget 2024-25 proposes Angel tax for all classes of investors to be abolished, to bolster Indian start-up eco-system. Read more.

On promoting #investment, #employment & #socialsecurity, Union Budget 2024-25 proposes:

👉 Angel tax for all classes of investors to be abolished, to bolster Indian start-up eco-system

👉 Corporate tax rate on foreign companies to be reduced from 40% to 35%

👉 Simpler tax… pic.twitter.com/MxHEQ6cBQU

— Ministry of Finance (@FinMinIndia) July 23, 2024

Second, in the new tax regime, the tax rate structure is proposed to be revised, as follows:

0-3 lakh rupees - Nil

3-7 lakh rupees - 5 per cent

7-10 lakh rupees - 10 per cent

10-12 lakh rupees - 15 per cent

12-15 lakh rupees - 20 per cent

Above 15 lakh rupees - 30 per cent

As a result of these changes, a salaried employee in the new tax regime stands to save up to Rs 17,500/- in income tax.

Finance Minister Nirmala Sitharaman says, "Coming to Personal Income Tax Rates, I have two announcements to make for those opting for the new tax regime. First, the standard deduction for salaried employees is proposed to be increased from Rs 50,000/- to

Rs 75,000/-. Similarly, deduction on family pension for pensioners is proposed to be enhanced from Rs 15,000/- to Rs 25,000/-. This will provide relief to about four crore salaried individuals and pensioners."

• Limit of exemption at capital gains proposed at Rs 1.25 lakh a year

• STT on F&O hiked to 0.02% and 0.1%

• Corporate tax rate on foreign companies reduced to 25%

• Limit of LTCG hiked from 10% to 12.5%

• Short term gains on certain financial assets will be 20 percent, rest is applicable tax rate

• Long term capital gains will be 12.5 percent

• Listed financial assets held for more than a year will be classified as long term

• TDS rate on e-commerce operators to be reduced to 0.1 percent from 1 percent

• Tax rate of 20 per cent on certain assets. Rest to attract applicable rates

• Listed financial assets held for more than a year will be classified as long term

• Unlisted bonds and debentures, irrespective of holding period, to attract CGT as pwer applicable rates

• Abolishment of Angel Tax announced for all classes of investors

• Professionals in MNCs who get esops and then invest in movable assets abroad of upto Rs 20 lakh decriminalized / non-penalised

• Under new tax regime, standard deduction hiked to Rs 75,000 from Rs 50,000

• Deduction on family pension for pensioners to be enhanced to Rs 25,000

• Salaried employee will save Rs 17,500 in income tax

Under PM Awas Yojana Urban 2.0, housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of Rs 10 lakh crore.

On Customs Duty, Union Budget 2024-25 proposes:

-BCD to be reduced to 5 % on certain broodstock, polychaete worms, shrimp & fish feed

-BCD to be reduced on real down filling material from duck or goose

-BCD on methylene diphenyl diisocyanate (MDI) for manufacture of spandex yarn to be reduced from 7.5 to 5%

-Custom duties on gold and silver to be reduced to 6% and on platinum to 6.4%

PTI INFOGRAPHIC | Union Budget 2024: Highlights of Finance Minister Nirmala Sitharaman's (@nsitharaman) budget speech in Lok Sabha (n/49) #budget2024withpti #budget2024 pic.twitter.com/Up2mNT73U5

— Press Trust of India (@PTI_News) July 23, 2024

Union Budget 2024-25 proposes:

-Customs duty on three more medicines to be fully removed, to provide relief to cancer patients

-Basic customs duty #bcd on mobile phone, mobile PCBA and mobile charger to be reduced to 15%

-25 critical minerals to be exempted from customs duties & BCD on two of them to be reduced

-List of exempted capital goods for use in the manufacture of solar cells & panels in the country to be expanded

As part of next-generation reforms, Union Budget 2024-25 proposes:

-Technology to speed up digitalisation of economy

-Jan Vishwas Bill 2.0 to improve Ease of Doing Business

-States to be incentivized to implement Business Reforms Action Plans and digitalization

-Committee to review New Pension Scheme to evolve solution which addresses relevant issues while maintaining fiscal prudence

-Committee to review New Pension Scheme to evolve solution which addresses relevant issues while maintaining fiscal prudence

In Labour Reforms, Union Budget 2024-25 proposes e-shram portal to be integrated with other portals to provide one-stop labour services solution; will include mechanism to connect job-seekers with potential employers and skill providers

Long term gains on financial and non-financial assets will attract tax rate of 12.5 pc, says Finance Minister Nirmala Sitharaman.

Union Budget 2024-25 proposes:

-Anusandhan National Research Fund to be set up for basic research and prototype development

-Financing pool of Rs. 1 lakh crore to spur private sector-driven research and innovation at commercial scale

-Venture Capital fund of Rs 1,000 crore to expand space economy by 5 times in the next 10 years.

-Reforms in land administration, urban planning, usage and building bylaws in both rural and urban areas

-All lands in rural areas to be assigned Unique Land Parcel Identification Number

-Land registry to be established in rural areas

The FM proposes abolishing the angel tax. Highlights from FM Sitharaman's speech.

-Govt proposes Vivad Se Vishwas Scheme 2024 to reduce tax litigation tax rate of 12.5 pc

-Govt abolishes Angel tax for all classes of investors in startups

-Govt proposes Vivad Se Vishwas Scheme 2024 to reduce tax litigation

Finance Minister Nirmala Sitharaman highlighted the government's commitment to enhancing the Goods and Services Tax (GST) tax structure by simplifying and rationalising it further.

The government intends to streamline customs duty rates, with specific reductions in tariffs on mobile phones and chargers to 15 per cent.

Moreover, in a move to support healthcare, the government has exempted three additional cancer treatment drugs from Customs duty.

-Gross and net market borrowing pegged at Rs 14.01 lakh crore and Rs 11.63 lakh crore in FY25

-Fiscal deficit is estimated at 4.9 per cent of GDP

-Net tax receipts estimated at Rs 25.83 lakh crore in FY25

-Government aims to reach 4.5 per cent fiscal deficit in 2025-26

-Total receipts estimated at Rs 32.07 lakh crore, expenditure at Rs 48. 21 lakh crore in FY25

The Union Budget for 2024-25 introduces ambitious proposals aimed at enhancing cultural and tourism infrastructure in Bihar. It outlines plans to elevate the Vishnupad Temple Corridor and Mahabodhi Temple Corridor into premier pilgrim and tourist destinations, aiming to attract visitors from around the globe.

Rajgir is slated for comprehensive development initiatives, while Nalanda is earmarked to become a prominent tourist centre with efforts focused on restoring Nalanda University to its illustrious historical stature. These initiatives aim to bolster tourism, preserve cultural heritage, and stimulate economic growth in the region.

-Phase IV of Pradhan Mantri Gram Sadak Yojana to provide all-weather connectivity to 25,000 rural habitations

-Accelerated Irrigation Benefit Programme to provide support of *11,500 crore for projects such as Kosi-Mechi intra-state link

-Assistance to Assam & Himachal Pradesh for flood management and for Uttarakhand & Sikkim for losses due to cloud bursts, flash floods and landslides.

Union Budget 2024-25 proposes:

-Government’s endeavour to maintain strong fiscal support for infrastructure over the next 5 years

-Capital expenditure to be Rs. 11,11,111 crore @ 3.4% of India's GDP

-Provision of Rs. 1.5 lakh crore for long-term interest-free loans to support Infrastructure Investment by the State Governments

Fiscal deficit is seen at 4.9% of GDP. This is lower than the projections in the interim Budget. During her interim Budget speech presentation on February 1 this year, she had highlighted a projection of 5.1%.

Union Budget 2024-25 proposes:

-More than 1.28 crore registrations and 14 lakh applications received under PM Surya Ghar Muft Bijli Yojana

-Pumped Storage Policy to be brought out for electricity storage and smooth integration of #renewableenergy in the overall energy mix

-Joint venture between NTPC & BHEL to set up a full-scale 800 MW commercial thermal plant using AUSC technology

Union Budget 2024-25 provides special attention to MSMEs and manufacturing, particularly labour-intensive manufacturing.

-New mechanism announced for facilitating continuation of bank credit to MSMEs during their stress period

-Limit of Mudra loans increased from Rs 10 lakh to Rs 20 lakh

Prime Minister's Package: 3 schemes announced under 'Employment Linked Incentive'

-Scheme A: First Timers

• Direct benefit transfer of 1-month salary in 3 installments up to 15,000 to first-time employees registered in EPFO

-Scheme B: Job Creation in Manufacturing

• Incentive to be provided directly to both employee and employer as per their EPFO contribution, in the first 4 years of employment

-Scheme C: Support to Employers

• Reimbursement to employers up to 3,000 per month for 2 years towards their EPFO contribution for each additional employee

The Union Budget 2024-25 outlines sustained efforts across 9 priorities aimed at creating abundant opportunities for all segments of society.

Budget Priorities

— PIB India (@PIB_India) July 23, 2024

🔹 The Budget envisages sustained efforts on 9⃣ priorities for generating ample opportunities for all #unionbudget2024 #budgetforviksitbharat #budget2024 pic.twitter.com/X6fo507LzX

Finance Minister Nirmala Sitharaman says, "Turning attention to the full year and beyond, in this budget, we particularly focus on employment, skilling, MSMEs, and the middle class. I am happy to announce the Prime Minister’s package of 5 schemes and initiatives to facilitate employment, skilling and other opportunities for 4.1 crore youth over a 5-year period with a central outlay of Rs. 2 lakh crore."