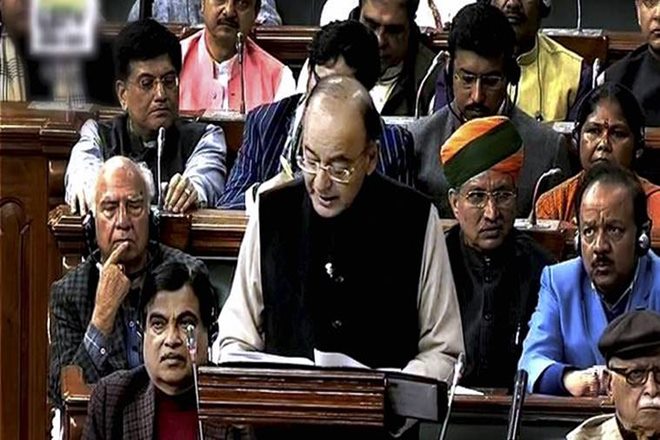

Budget 2018: The Narendra Modi government’s union budget will be presented on February 1. Finance Minister Arun Jaitley will need to address several issues as Budget 2018 will be the Modi government’s fifth and final full budget before the 2019 Lok Sabha polls. Suggestions are pouring in and expectations are high over the Union Budget. The Modi government should look into revising the limit of advance tax, the Institute of Chartered Accountants of India (ICAI) suggested. Advance tax payment is as important as filing income tax returns and fixing advance slab is very important. Knowing advance tax rules, advance tax section, advance tax challan and advance tax dates is mandatory. “The Finance Act (No. 2), 2009 raised the limit to pay advance tax under section 208 to Rs. 10,000. Considering the inflationary conditions prevailing in the country, it is felt that the said limit needs to be revised upwards so that the amount payable in one instalment of the advance tax exceeds at least Rs. 5,000,” ICAI suggested in its pre-budget memorandum. “The present amount of Rs. 2,500 is too low. In fact, any assessee whose advance tax payable does not exceed Rs. 30,000 should be allowed to pay the full amount in the last instalment. It is appreciable that the Finance Act, 2016 has provided for an exception to an eligible assessee in respect of an eligible business referred to in section 44AD to pay the whole of the advance tax in one go by 15th March of the financial year itself,” the renowned accountants’ body suggested.

ICAI has recommended that FM Arun Jaitley must address the issue on February 1 during the budget announcement. It has suggested that The limit to pay advance tax under section 208 be raised appropriately. “In fact, any assessee whose advance tax payable does not exceed Rs. 30,000 may be allowed to pay the full amount in the last instalment,” ICAI further suggested.

Read Also- Budget 2018 date: Day, time of FM Arun Jaitley’s budget speech, economic survey and Budget session

Watch this video

It has been learnt that ahead of the Budget 2018, the Modi government has collected Rs 6.56 lakh crore in direct taxes, up 18.2 per cent on hefty advance tax mop up, for the April-December period of the current fiscal. The net collections represent 67 per cent of the total Budget Estimate of Rs 9.8 lakh crore for direct taxes in 2017 -18. Direct taxes comprise income tax paid by individuals, corporate tax and wealth tax. Refunds amounting to Rs 1.12 lakh crore have been issued during the first nine months of the current fiscal. Gross direct tax collections (before adjusting for refunds) have increased by 12.6 per cent to Rs 7.68 lakh crore. “The provisional figures of Direct Tax collections up to December, 2017 show that net collections are at Rs 6.56 lakh crore which is 18.2 per cent higher than the net collections for the corresponding period of last year,” the finance ministry had said.

Watch this video

Read Also- Budget 2018: 5 things expected from Modi government on February 1

An much as Rs 3.18 lakh crore has been received as advance tax up to December 2017-18, reflecting a growth of 12.7 per cent over the year ago period. Growth in advance tax paid by corporates is 10.9 per cent, while in case of personal income tax it is 21.6 per cent. The government had last fiscal exceeded the direct tax collection target set in the Budget. It had collected over Rs 8.49 lakh crore against the Budget estimate of Rs 8.47 lakh crore.

The date for the Budget 2018 has been announced by the Modi government. The Union Budget 2018 will be presented by FM Jaitley. Notably, the budget 2017 was presented on February 1. This year too, the Modi government has chosen the same date for presentation of Budget 2018. It is likely that FM Jaitley will ‘rise to present’ budget 2018 at noon.