Reliance Power reported strong operating performance led by higher generation at Sasan. Cost rationalisation at Rosa coupled with improved monsoon preparedness at Sasan ensured higher capacity utilisation for the company, even as they iron out coal availability issues at Butibori and see financial closure of the Bangladesh gas project. Raise target price to Rs 40/share. Sell Drop in generation cost aids earnings outperformance A drop in the cost of generation at Sasan and Rosa allowed for RPWR to report net income of Rs 2.7 bn, significantly ahead of estimates. We note that reduction in the cost of generation at Rosa resulted in a drop in revenues under the cost-plus regime. A sharp 35% y-o-y drop in generation in Butibori led to increase in tariffs and cost of generation. Operationally RPWR reported a 13.6% y-o-y increase in gross generation at 10 BU— the growth was driven by higher generation at Sasan (+32% y-o-y).

Bangladesh gas project sees further progress

RPWR has finalised the power purchase agreement for Phase I (745 MW) of gas-based capacities in Bangladesh. RPWR envisages an investment of $1 bn in Phase I, which also includes $300 m likely to be spent for setting up an LNG terminal. We note that the $700 m for the power plant includes cost of the main plant’s equipment that will be relocated from Samalkot to Bangladesh. The capital cost for the project appears on the higher side but will not impact profitability under the fixed return tariff (dollar denominated) regime being pursued by the company. We note that RPWR is in advanced stages of talks for financial closure with multi-lateral agencies and will likely sign the PPA for the project over the next few months. RPWR remains committed to commissioning the project within 24 months.

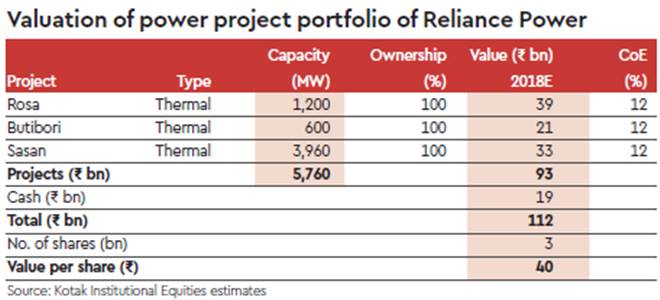

Raise target price to Rs 40/share

We maintain our Sell rating on RPWR with a revised target price of Rs 40/share. Progress on setting up gas-based capacities in Bangladesh is encouraging. Clarity on transfer of equipment from Samalkot instead of fresh procurement as was being previously considered, helps resolve our concerns. We have revised our earnings estimates for FY2018 downwards by 21% and FY2019 by +16%.