The rupee is expected to touch 44 to a US dollar by March 2010, a rise of over 8% from the current 48, says a research report from Axis Bank. The report makes the conclusion based on the consistent upswing in foreign investment inflow into the stock markets and ?a high likelihood of surplus in current account, against a $30 billion deficit in 2008-09?.

A rise of such a magnitude will force a large segment of the corporate sector to take fresh guard in the foreign exchange market to hedge their currency risks. And there are already signs that this is happening.

In the Non Deliverable Forward (NDF) markets for the rupee in Singapore and Dubai, the three-month forward rates indicate that the market players expect the rupee to rise, but marginally.

But more significantly, the report notes that ?the NDF and onshore forward premia have converged in the last few months, providing no arbitrage opportunity?. Such opportunities occur when the RBI intervenes in the domestic forex market to keep the rupee-dollar exchange rate in a narrow band. The offshore markets have to contend with no such pressure and move independently. So, forex traders can take advantage of the differences to earn a profit.

The rise in the value of the rupee will be a return to the trend that had peaked in 2007-08, as the GDP growth rate had pushed 8%.

The rise in the value of the rupee will be a return to the trend that had peaked in 2007-08, as the GDP growth rate had pushed 8%.

The rise will, therefore, be a signal of a possible return to the same conditions that had been snapped by the global meltdown, since September 2008. In his Independence Day speech on Saturday, Prime Minister Manmohan Singh has already underscored the need to move to a 9% rate of growth soon for the economy.

For companies in the manufacturing sector, the rise will translate into reduced costs for their imports of machinery and also raw materials. This also means more headroom for the finance ministry to plan government expenditure, as the oil bill, will hold steady or could come down. Since oil prices are on the upswing, climbing to $72 a barrel and expected to cross $80 by the year-end, the Indian economy stands to benefit enormously.

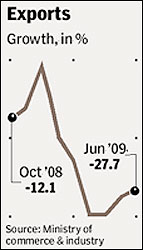

But the exporter community will have to contend with another pressure to add to their problems of weak recovery in the global market.

Rajesh Chakrabarti, assistant professor of finance at the Indian School of Business said the rise in rupee was pretty much on. ?The flight to safety of the FIIs is over, so the rise in the rupee has to be factored in?.

The phenomenon, Chakrabarti alludes to, is the increase in the attraction of the dollar as a safe haven, against worldwide volatility. A Bloomberg analysis shows that since March this year, the dollar index, a measure of the attractiveness of the currency against other international currencies has instead fallen by over 10%. As the dollar has come off its high, the foreign investors are uncoupling their investment in the currency and pouring into markets like India.

At the same time, there has also been a reduction in volatility in the movement of the rupee, which has also helped. The rate of volatility of all currencies had peaked in the aftermath of the Lehman Brothers bankruptcy in September 2008.

For Reserve Bank of India (RBI), the leverage to intervene in the forex market to cut down the dollar inflow is very limited this time around. The balance in the capital account, even assuming the same current level of inflows from FIIs is expected to touch $45 billion, up from just $9 billion at the end of March this year. If RBI attempts to neutralise this by buying dollar and releasing more rupee, it will create an enormous challenge for inflation control.

If it tries to forestall this by selling Market Stabilisation Scheme papers in the bond market, it risks creating a massive glut, on top of the humungous government borrowing, that has risen by 54% over last year.