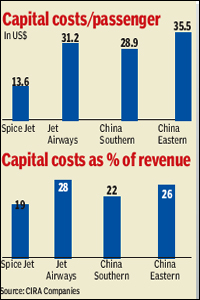

Utilising Jet Airways as a proxy for full service carriers (FSCs) in India, we note that capital costs (interest, depreciation and lease rentals, all below the Ebitdar line) are almost 30% of revenues.

Impart a sustainable competitive advantage to LCCs: Using Spice Jet as a proxy (given Indigo, Go Air are unlisted), we note that capital costs are ~20% of revenues for LCCs. In terms of cost per passenger, this translates into an almost extra Rs 800 per passenger that FSCs have to absorb and which LCCs can either pass through (which results in lower fares and higher growth) or retain, which results in higher profits. It?s essentially, a sustainable competitive advantage for LCCs.

The pricing power is with LCCs: Given the low fare base that LCCs enjoy, we expect they will be able to raise fares without sacrificing on loads?a proposition that is fairly binary for FSCs, especially in economy travel.

Balance sheet will be the key differentiator: This aviation cycle commences with five meaningful players (vs three in the previous cycle). FSCs have long argued that LCC cost structures are very similar to FSC?s, except that the former enjoy unit costs that are 15-20% lower, given greater seat density on fleet. We believe that capital costs, a reflection of balance sheet health, will be key differentiators in this cycle.

Recent trends indicate buoyancy in yields: After a sharp (m-o-m) decline in February, LCC fares (average on routes we survey) have risen c10% over January, implying that service charges and fuel costs have been passed through. FSC fares are up ~6.5% over the same period. Pricing differential between FSCs and LCCs has narrowed to ~ Rs 15,900, in line with the trend exhibited over the past few months.

The managements of FSCs have argued over the past five years that given the relative parity in costs for FSCs and LCCs, the latter?s unit costs are not structurally different, especially when adjusted for the difference in seat density. LCCs typically have around 180-200 seats per plane (vs FSC at ~140-150). Hence, given that costs are defrayed over a larger base, they are ~20% lower (per seat). Without this differentiation, there is little in terms of cost structure to differentiate.

We agree with this perspective, if one considers costs above the Ebitdar line-fuel, pilot charges (and also, salaries), maintenance provisioning, landing and navigation charges are fairly similar. That said, we think that capital costs, interest, depreciation and lease rentals, are now beginning to exhibit a meaningful difference and could well be the key differentiators between profit and loss in this cycle.

The data below corroborates our view: in FY06, Spice Jet and Jet Airways had capital costs that were fairly similar (as a percentage of revenues). In FY10 (nine-month data annualised), we note that capital costs for Jet as percentage of revenues are almost 10ppt higher?a structural overhang. LCCs will thus be better positioned to pursue growth and profit objectives, as they can utilise this 10ppt cushion to either price tickets lower?and attract more passengers?or raise fares and profitability, and still effectively compete with the FSCs. The capital costs per passenger are also escalating for FSCs. The cost per passenger is now around Rs 1400, vs around Rs 1,000 four years ago. For the LCCs, the costs have risen, but not at the same scale.

Domestic passenger growth is broad-based: Analysis of passenger movements over the last year and a half indicates that the recovery is broad-based across most metros, Tier-1 and even Tier-2 cities. On a two-year CAGR perspective, the numbers are far less impressive but still indicate that growth is marginally positive. As per data provided in the press (Source: Times of India), the traffic growth in February has been around 15.6%, lower than the growth exhibited over 3QFY10, but to be expected, given the base effect. Sequentially (m-o-m), February traffic (around 3.915 million) has dipped slightly, but this is also expected, given the seasonality, and given that 4Q is slightly weaker than 3Q. Overall trends remain fairly healthy.