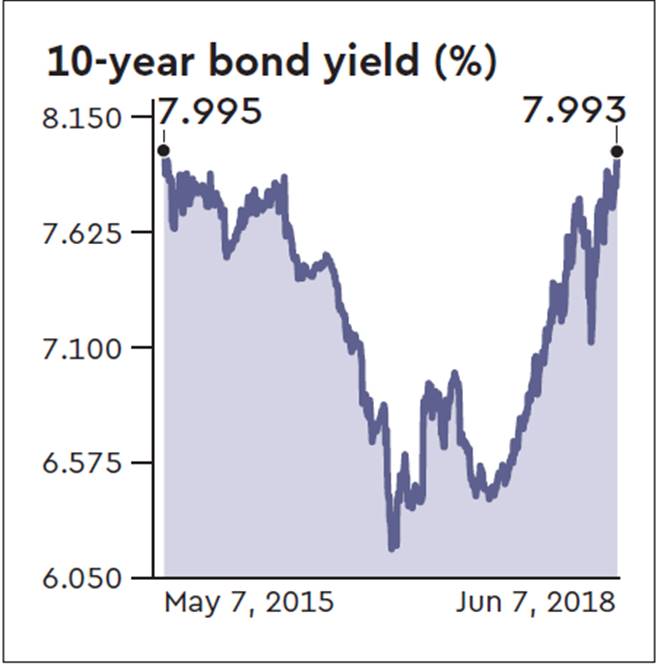

The benchmark yield, which rose after the Reserve Bank of India (RBI) raised the repo rate by 25 basis points on Wednesday, could hit 8% soon, bond market dealers believe. On Thursday, the yield closed at 7.993%, up 8 basis points over the Wednesday’s close of 7.917%.

The yield touched a new three-year high on an intra-day basis touching 7.993% levels in Thursday’s trading, the highest levels seen after 7.995% in May 2015. The price of Brent crude was up by more than a dollar per barrel and stood at $76.59/barrel. Compared to Wednesday, the rupee weakened by 22 paisa to close at 67.14.

Experts observed that the rise in the benchmark has taken place on the back of inflation and rate hike worries. While crude oil prices have risen from $66.57 per barrel in January to $76.59 per barrel on Thursday, they have moderated over the past couple of weeks though remain vulnerable to geopolitical tensions.

Sonal Varma, chief economist at Nomura, had observed on Wednesday after the monetary policy announcement, there could be another rate hike. “However, the ongoing tightening of financial conditions, higher oil prices and political uncertainty are likely to slow economic activity after September, in our view,” Varma said.

Ajay Manglunia, EVP and head of fixed income at Edelweiss Securities, believes the purchase of bonds will continue at the 8% mark too. He added, “The yields are very close to the 8% mark and may breach it sooner or later. Also with this hike and further fears of inflation, people are now prepared for a subsequent rate hike now either in August or in October.”

Ananth Narayan, professor of finance at SPJIMR, believes any positive news on inflation or crude oil prices could see a yield pullback and adds, “10-year bond yield closed just shy of 8%. The mood in bond markets remains morose — while RBI announcement on Wednesday relating to the Liquidity Coverage Ratio (LCR) dispensation and State Development Loans (SDL) valuation norms are good for the system as a whole, they do negatively impact bond market sentiment and flows in the short run. Market positioning is probably light. Otherwise global and domestic context are still bearish for Indian bond markets.”

Foreign portfolio investors (FPI) sold $4.5 million in the debt market on Wednesday. So far in 2018, they have sold a net $4.8 billion. Sameer Narang, chief economist, Bank of Baroda, observed that FPIs have been paring exposure to emerging markets, including India.

He said, “If global yields continue to inch up and oil prices increase further then yields are bound to increase. In addition, RBI has allowed banks to carve out another 2% of Statutory Liquidity Ratio Securities for computation of LCR. Hence, additional demand for bonds is muted.”