The times are such that India needs copious capital inflows, but the government on Monday raised doubts on participatory notes (PNs) for their suspected misuse by Indians to evade tax. ?Investment in the Indian stock market through PNs is another way in which the black money generated by Indians is re-invested in India,? said a white paper presented by finance minister Pranab Mukherjee in Parliament.

The white paper, which analysts dubbed as a damp squib, also highlighted the obvious: Many investors including Indian residents might be misusing the tax treaties with tax havens like Mauritius for escaping tax through what is called ?round tripping?.

The white paper, which analysts dubbed as a damp squib, also highlighted the obvious: Many investors including Indian residents might be misusing the tax treaties with tax havens like Mauritius for escaping tax through what is called ?round tripping?.

The 97-page white paper did not provide any names of the Indians with unaccounted funds in foreign bank accounts; nor did it give an estimate of the incidence of black money in the Indian economy (three independent studies will find this out by year-end), but listed out steps being taken to reduce the size of the parallel economy.

The Opposition parties decried the non-substantive nature of the white paper. Calling it ?disappointing? and a ?non-paper?, BJP leader Jaswant Singh said it hid the essentials and reveals only the less significant details.

Among the solutions, Mukherjee suggested tax incentives to encourage use of debit and credit cards and electronic transfer, rationalisation of stamp duty in real estate, amending laws to regulate the possession and transportation of cash above a particular threshold and tax at source on cash purchases. The goods and services tax network and special fast-track courts for financial offences are other measures expected to bring down the prevalence of black money. A professional national tax tribunal could be formed to deal with all tax litigation as these are large in number.

PNs are derivative products issued to overseas investors who cannot directly invest in Indian stocks.

Foreign institutional investors (FIIs) sell offshore derivative instruments (ODIs) to overseas clients to enable them have an indirect exposure in Indian stocks.

Money launderers consider it an attractive tool as their identity is not revealed. Around 10-15% of FII investment into India is routed through PNs.

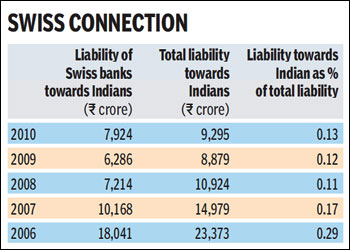

As per the paper, the total liabilities of Swiss banks towards Indians declined by more than Rs 14,000 crore during the 2006-10 period. The liabilities stood at Rs 9,295 crore at the end of 2010 compared with Rs 23,373 crore in 2006, According to the paper, although the source of generation of black money may lie in any sphere of economic activity, sectors like real estate, bullion and jewellery markets, financial markets, public procurement, non-profit organisations, trade, international transactions involving tax havens and the informal service sector are more vulnerable to this menace.

Taking a dig at Vodafone, the report said that corporate structure and transfer pricing norms have at times been misused for avoiding tax payment. ?Hutchison Group had made investments in India from 1992 to 2006 through a number of subsidiaries having ?separate corporate personality? but which were essentially post box companies based in the Cayman Islands, British Virgin Islands, and Mauritius,? it said.

Experts, however, disagreed with the idea that a multi-layered corporate structure is abused for tax evasion. ? It is unfortunate that corporate restructuring (with a specific reference to the Vodafone transaction) and transfer pricing are considered as some of the modes by which black money is generated,? Deloitte Haskins & Sells partner Sunil Shah said.

The white paper has asked for rationalisation of stamp duty in realty to prevent flow of illicit money into that sector. The sector is one of the biggest contributor of such wealth and so the provisions of tax collected at source on developers can also be considered as a possible policy measure.

The government fears that many unscrupulous elements are registering their organisations as non-profit organisations to evade taxes. For this, it has suggested that the Central Board of Direct Taxes may be assigned the role of a centralised agency with which every such organisation would be registered to get a unique number.

Many independent agencies had earlier come out with different estimates of India’s black economy. US-based watchdog Global Financial Integrity in 2010 estimated that a total of $213.2 billion has been shifted out of India through illicit outflows between 1948 and 2008.