When a Noida resident’s wife casually remarked, “We spend too much but it doesn’t show in our lifestyle,” it led to a digital deep dive into the family’s monthly finances — with a little help from AI. What followed was a detailed expense analysis using ChatGPT, which compared their monthly budget to that of a typical family of four living in Noida with their own home.

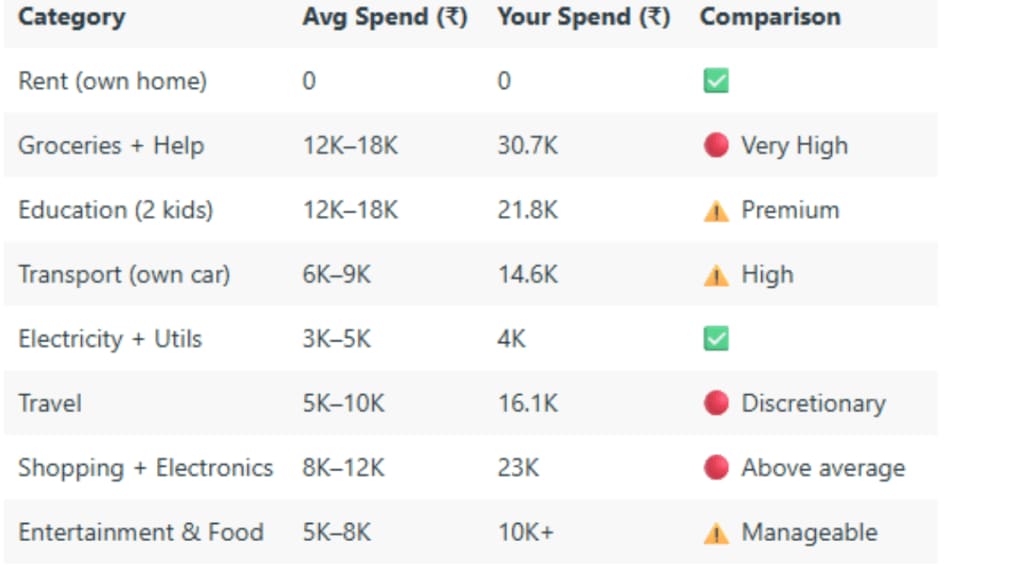

The user shared the detailed breakdown on Reddit, highlighting how ChatGPT categorized their expenses into essentials and discretionary spends. Using a custom prompt — “Compare it to expenses of a family of 4 (2 adults 2 kids) in the city of Noida, assuming own home (no rent)” — ChatGPT flagged several categories as “very high” or “above average.”

Groceries, Gifting, and Shopping Raised Red Flags

The standout categories included groceries and domestic help (₹30.7K vs typical ₹12K–18K), gifts and festivals (₹16.1K vs ₹4K–6K), and shopping plus electronics (₹23K vs average ₹8K–12K). ChatGPT labeled these expenses as significantly above average, prompting the user to reflect on budgeting culture and spending habits.

Meanwhile, expenses on education (₹21.8K) and transport (₹14.6K) were marked “premium” or “high,” whereas essential costs like electricity and house maintenance were within expected limits. The total monthly spend stood at ₹1.46–₹1.58 lakh — nearly double the typical ₹75K–₹1L budget for a similar family.

AI vs. Other Tools: ChatGPT Wins for Insights

The Reddit user also compared ChatGPT’s performance with that of Perplexity and Microsoft’s CoPilot, finding ChatGPT to be far more contextual and nuanced in analysis. Additional prompts yielded insights on budgeting, discretionary spending patterns, and even cultural considerations around gifting.

The takeaway? AI can be a surprisingly handy tool for financial introspection. “Maybe more prompts can get better analysis,” the user noted, adding that the AI gave not just raw comparisons but suggestions too.

The post has resonated with many on Reddit, especially urban families juggling rising expenses and lifestyle expectations — all while trying to answer that eternal question: Where does all the money go?