The central government will seek to contain its already-elevated gross market borrowing in the next fiscal at a lower level of gross domestic product (GDP) than in FY23, as it intends to gradually reduce its elevated debt as well as interest burden, an official source told FE.

“A precise estimate of the borrowing through dated securities, in absolute terms, will be firmed up once the revenue and expenditure projections for FY24 are finalised. But as a percentage of GDP, it will be lower next fiscal than in FY23 – that’s the idea,” the source said. The Budget for FY24 will be presented on February 1, 2023. Given that the government aims to contain fiscal deficit at 4.5% of GDP by FY26 from the targetted 6.4% in FY23, its borrowing requirement is unlikely to shoot up.

Keeping the borrowing limit at a reasonable level by the Centre would ease pressure on bond yields and also prevent a “crowding out” of state governments as well as private firms in the bond market and help them raise funds at decent rates, especially in a rising interest rate scenario, according to analysts.

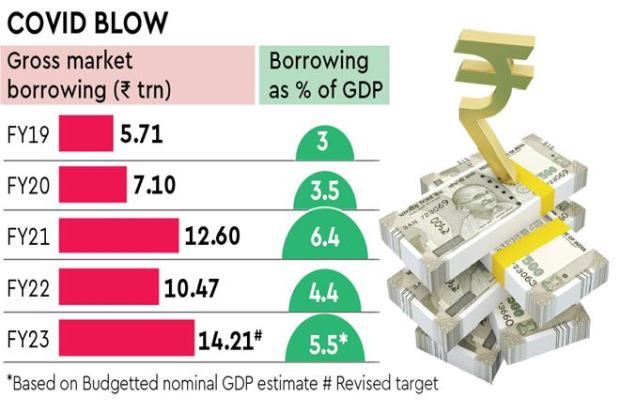

The central government has kept its FY23 borrowing target (revised) via dated securities at Rs 14.21 trillion, up from Rs 10.47 trillion a year before. This translates into 5.5% of the country’s nominal GDP (as projected in the Budget for FY23, although analysts expect it to be revised up), against 4.4% a year before.

It was forced to substantially raise its gross market borrowing to Rs 12.6 trillion in FY21 from Rs 7.1 trillion in the previous year, to meet a sudden spurt in its spending requirement to soften the Covid blow. Consequently, as a percentage of GDP, the borrowing jumped to 6.4% in FY21 from 3.5% in FY20, also because the size of the economy in nominal terms shrank in the wake of the pandemic.

Also Read: States to get capex loan of Rs 1 trn or higher in FY24

This led to a spike in the government’s interest costs, which is expected to surge to Rs 9.4 trillion in FY23 (3.6% of the budgetted GDP) from Rs 6.1 trillion (3% of GDP) in the pre-Covid year of FY20. India’s general government debt level, too, jumped to almost 90% of GDP in 2020 from 74% in the previous year, according to the International Monetary Fund. Of course, it is estimated to come down to 83.4% in 2022, mainly due to the nominal GDP expanding at a decent pace.

As for net market borrowing in FY23, the government had budgetted it at Rs 11.2 trillion, against Rs 7.8 trillion a year before. In the pandemic year of FY21, the net borrowing had spiked to Rs 10.3 trillion from Rs 4.7 trillion in the previous year.

Thanks to the pandemic-induced spurt in borrowing, the bond market has nervously awaited each time the Budget is presented since FY21. Any move to rein in borrowing will be good news for many bond market participants.

Although India’s government debt market has remained relatively calm, compared with other major sovereign debt markets, yields on the benchmark 10-year G-secs have still jumped by over 75 basis points in 2022 to 7.26%, the highest year-to-date rise since 2017. Of course, the jump in the G-sec yield is still modest, considering that the central bank has raised the benchmark lending rate by a total of 190 basis points to 5.9% since May.

In the current fiscal, although the government’s revenue mop-up will exceed the Budget estimate (BE), the revised estimate for expenditure, too, could cross the BE by about Rs 2.2-2.7 trillion from Rs 39.45 trillion, analysts have forecast. The FY23 Budgetted expenditure calculations went haywire after the Russia-Ukraine war broke out unexpectedly, and spurt in commodity prices, especially of fertiliser, on top of the continuance of a free ration scheme, substantially inflated the government’s subsidy bill. Of course, given the surge in revenue mop-up and compression of certain revenue expenditure, the government hopes to rein the FY23 fiscal deficit within the 6.4% target.