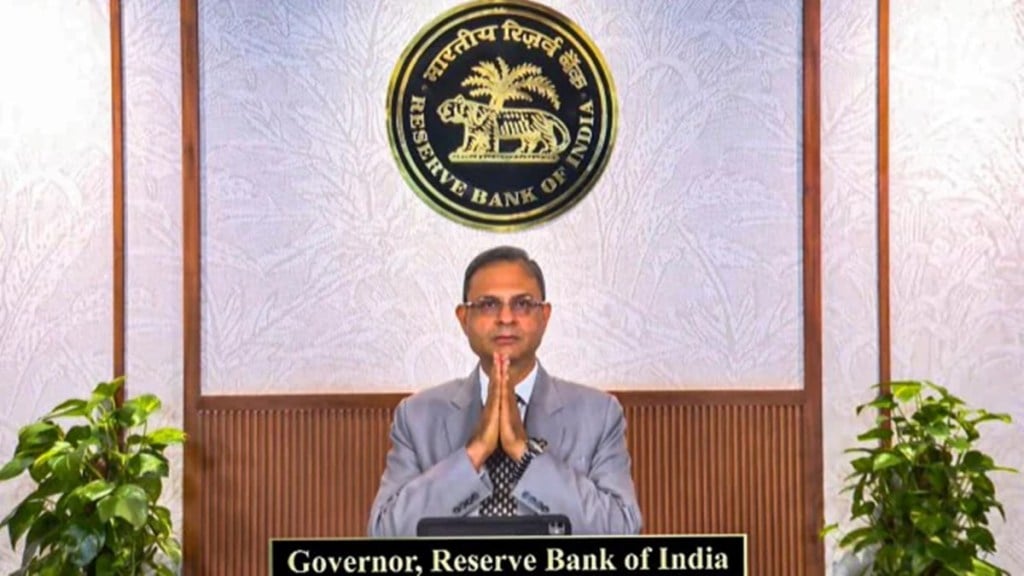

A day after India’s retail inflation fell to a more than six-year low of 2.1% in June, Reserve Bank of India Governor Sanjay Malhotra said the Monetary Policy Committee (MPC) will consider cutting interest rates further if inflation falls below its projection or growth comes under pressure.

In an interview to CNBCTV18 on Tuesday, Malhotra said, “We’re in a neutral stance, which means we can move in either direction depending on the outlook, not just the current data.” One cannot say inflation is more important than growth, it’s always the mix of both factors, he added.

The RBI has already delivered two consecutive rate cuts, including a surprise 50 basis points cut in June. Many had expected the central bank to pause in its monetary policy meeting which begins on August 4. The central bank will continue to be data-dependent going forward, the governor said, adding that there is an expectation that inflation for the current year could undershoot its 3.7% forecast.

Malhotra said the RBI’s policy framework seeks to keep overnight borrowing costs aligned with the benchmark repurchase rate, currently at 5.5%. It seeks to do that by injecting or absorbing liquidity as needed. The resultant fall in lending rates by banks may spur consumption and investment. “There’s been a 24 basis points transmission on new loans and 16 basis points on outstanding loans in the three months till May 2025,” he said.

The governor said that 6.5% growth is the latest number, in line with RBI’s latest estimate. “There are mixed signals but aligned with our expectations. The monsoon is favourable, optimism in consumer surveys is high, trade deals are ongoing — we will continue to review our growth projections,” he added.

Malhotra also said the central bank will examine if foreign banks can be allowed to own 26% in local banks “as a general matter of policy.”

Currently, while foreign investors, including portfolio investors, can own up to 74% in Indian banks, regulations cap a strategic foreign investor’s stake at 15%.

However, the RBI can review and allow request by an investor to raise the stake to 26%. These ambiguities will be addressed in the review as the RBI streamlines the norms, he said.

When asked whether the regulator would reverse its age-old concerns on letting business conglomerates to own banks, the governor said, “Conducting business and real economic activities within the same group has conflict of interest.”