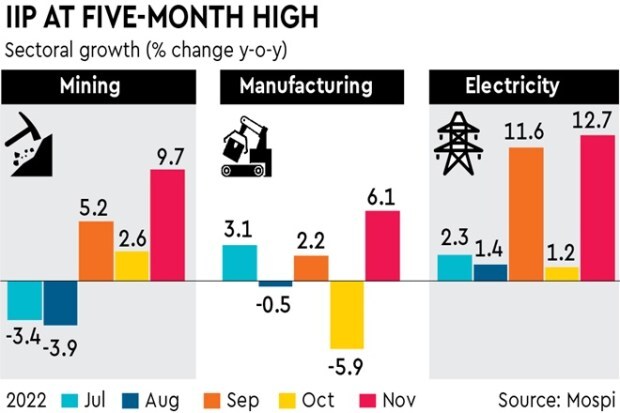

India’s factory output shot up to a five-month high in November 2022, with robust growth in the manufacturing sector but whether the momentum will be sustained as festive demand fades is yet to be seen.

The index of industrial production (IIP) increased by 7.1% in November 2022 from a year ago, its highest level since June when it was at 12.6%. It was pleasantly back in the positive territory after contracting by 4.2% in October. Along with festive season demand and strong sequential growth across sectors, the expansion in IIP also seems to have been aided by a favourable base effect. IIP expanded by 1% in November 2021.

Aditi Nayar, chief economist, Icra, said the year-on-year growth of most available high frequency indicators has moderated in December compared to November, partly reflecting an unfavourable base related to the post-festive season rebound seen in December 2021. “In line with this, we expect the overall IIP growth to moderate to low single digits in December 2022,” she said.

Also read: Capex loans: Rs 85k cr sanctioned to states so far

DK Joshi, chief economist, Crisil noted that the rise in lending rates will test the resilience of domestic demand in the coming years.

On a cumulative basis, the IIP expanded by 5.5% between April and November 2022, according to data released by the ministry of statistics and programme implementation on Thursday.

Amongst sectors, mining grew by 9.7% in November and manufacturing surprised with a 6.1% growth. Electricity generation expanded at the sharpest pace of 12.7% in November on a y-o-y basis.

In terms of use-based industries, capital goods shot up by 20.7% in November while infrastructure grew by 12.8%, which analysts said reflect the government’s support to capital expenditure.

Also read: Economists forecast 6% GDP growth next fiscal

Both durable and consumer durables registered healthy growth at 5.1% and 8.9% in November on a year-on-year basis. Sunil Sinha, principal economist, India Ratings said both these segments are expected to face headwinds from erosion of household income due to high inflation and reversal of interest rate cycle going forward.

Another cause of worry is the contraction in export dependent sectors in November such as textiles (-9%), wearing apparel (-11.7%) and leather and related products (-2%).