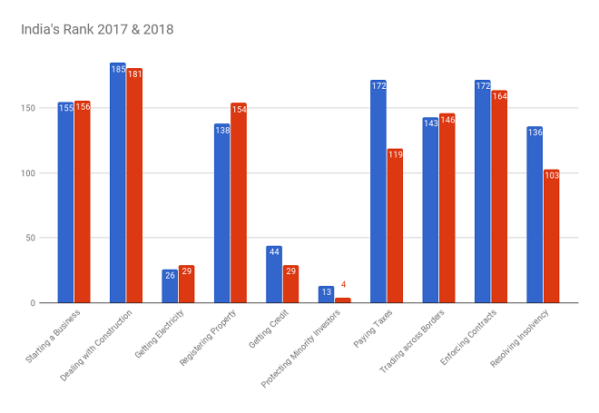

It’s official! India has made it to the coveted list of the top 100 countries in the World Bank’s Ease of Doing Business ranking for the first time ever, led by improvements in as many as eight fronts out of a total 10 on which the countries are assessed, significantly under ‘paying taxes’ (from 172 to 119), ‘resolving insolvency’ (from 136 to 103) and ‘protecting minority investors’ (from 13 to 4). India ranked 100th for the first time, leapfrogging 30 places from the last year’s 130, firmly aided by the implementation of reforms in crucial areas such as starting a business, paying taxes and resolving bankruptcy.

The World Bank’s Doing Business report assesses 190 economies on ten parameters — starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency. Here are the eight areas in which India made strides in the last year to vault 30 places, according to World Bank:

Starting a business: India made starting a business faster by merging the applications for the Permanent Account Number (PAN) and the Tax Account Number (TAN) and by improving the online application system. Mumbai also made starting a business faster by merging the applications for value-added tax and the Profession Tax (PT).

Dealing with construction permits: India reduced the number of procedures and time required to obtain a building permit by implementing an online system that has streamlined the process at the Municipality of New Delhi and Municipality of Greater Mumbai.

Getting credit: India strengthened access to credit by amending the rules on the priority of secured creditors outside reorganization proceedings and by adopting a new law on insolvency that provides a time limit and clear grounds for relief to the automatic stay for secured creditors during reorganization procedures. This reform impacts the data for both Mumbai and Delhi.

Protecting minority investors: Protections for minority investors were strengthened by increasing the remedies available in cases of prejudicial transactions between interested parties. This reform applies to both Delhi and Mumbai.

Paying taxes: In both Delhi and Mumbai, paying taxes was made easier by requiring payments to the Employees Provident Fund to be made electronically, and introducing administrative measures that make it easier to comply with corporate income tax regulations.

Trading across borders: In Mumbai, reducing the time taken to comply with import regulations at Nhava Sheva port made it much quicker to trade across borders. In Delhi and Mumbai, the elimination of merchant overtime fees and the increased use of electronic and mobile platforms reduced the time taken to comply with both export and import regulations.

Enforcing contracts: In both Delhi and Mumbai, the introduction of the National Judicial Data Grid made it possible to generate case management reports on local courts, thereby making it easier to enforce contracts.

Resolving insolvency: India made resolving insolvency easier by adopting a new insolvency and bankruptcy code that introduced a reorganization procedure for corporate debtors and facilitated the continuation of the debtor’s business during insolvency proceedings. This reform applies to both Delhi and Mumbai.