The pitch was rough with the clamour for a repo rate cut growing by the day, especially after the shocking 5.4% GDP growth in the second quarter of this financial year. Even before that, at least two Union ministers went public with their call for a rate cut.

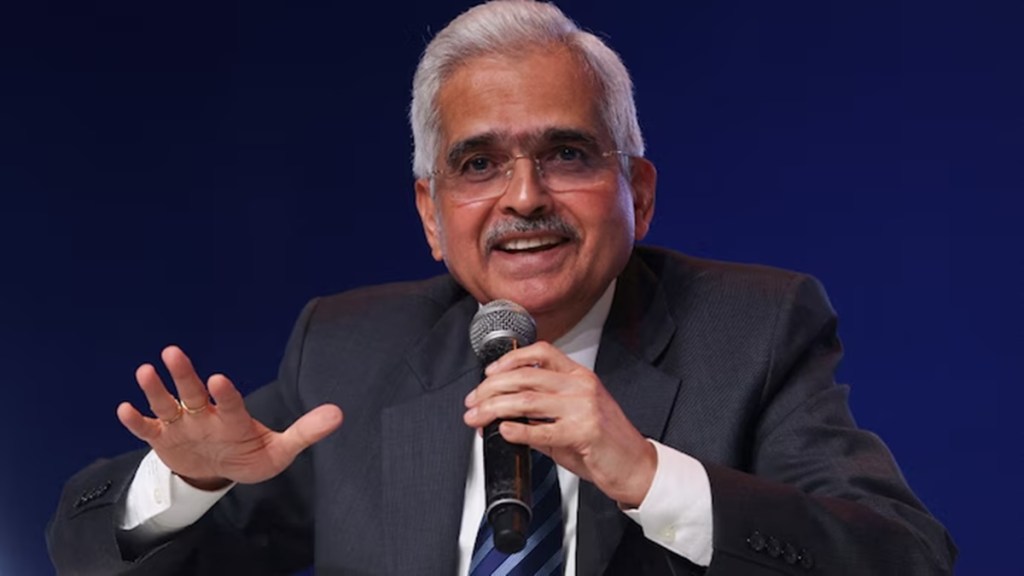

But in the last monetary policy of his current tenure, RBI governor Shaktikanta Das stood his ground firmly and left the benchmark rate unchanged at 6.50% for an 11th straight policy meeting. This, despite dissent from two members of the monetary policy committee (MPC) — Nagesh Kumar and Ram Singh.

“In the life of a central bank, there is no room for knee-jerk reaction,” said Das, adding more “credible evidence” is needed on the outlook for inflation. “Our effort has been to remain in line with the curve, never fall behind the curve and I think we are following that trend,” he said.

Like a veteran batsman, however, Das gave a glimpse of his flexibility by taking steps to boost liquidity in the banking system and stem a decline in the rupee. The cash reserve ratio — the proportion of deposits that banks must set aside with the RBI — was lowered by 50 basis points to 4%, to address a potential cash squeeze. The CRR cut — for the first time in four years —will inject Rs 1.16 lakh crore into the banking system.

“At this critical juncture, prudence and practicality demand that we remain careful and sensitive to the dynamically evolving situation,” Das said, adding a status quo is “appropriate and essential”, though if growth slowdown lingers beyond a point, “it may need policy support”.

The RBI reduced its growth projections for FY25 to 6.6% — a big downwards correction of 60 bps — while the inflation target has been revised upwards by 30 bps to 4.8%.

Das, however, said the deceleration in economic growth had bottomed out in the July-September quarter and activity has picked up in subsequent months, led by festival spending and strong agricultural output following a good monsoon.

Days away from completing his second term at the RBI’s helm, Das sidestepped a query on his future. “I’m not giving you any headline and I think it is better we stick to monetary policy,” he told reporters.

The stock markets stayed listless during the day, but the Sensex snapped a five-day rally to close at 81,709.12 points, down 56.74.

The 10-year G-Sec bond yields, which had softened 6 bps since the beginning of December, hardened by the same extent to close at 6.74%.

“While the RBI gave a liquidity boost today, especially in view of the rapidly tightening system liquidity becoming another drag on growth, it is likely waiting for lower inflation prints before cutting the policy repo rate,” said Pranjul Bhandari, chief India economist, HSBC.

Bhandari expects two repo rate cuts of 25 bps each over February and April, taking the repo rate to 6%. “However, the risk to the February rate cut call is a strong dollar or a rather slow disinflation process from here on. Either of these could push the easing cycle to later,” he added.

Aurodeep Nandi, economist at Nomura Holdings, told Bloomberg that the “policy decision continues to prioritise inflation control over growth rescue. However, there are indications that the policy paradigm could be shifting, which reflects in additional dissent within the MPC and Das’ commentary that the growth outlook warrants monitoring”.

Madan Sabnavis, chief economist at Bank of Baroda, believes that the rate cut cycle should start in February because of the benign CPI projection of 4.5% for Q4. He also expects an impact on bond yields once the CRR funds get released in the market.

SBI chairman CS Setty said the monetary policy moves were all positive for banks, while Zarin Daruwala, CEO, India and South Asia, Standard Chartered Bank, believes that the MPC is confident that economic growth will revive in the coming months on the back of government spending and improved industrial activity.

The policy also focused on several other aspects, including financial stability, in which Das spoke about banks being advised to address the issues of unclaimed deposits, inoperative accounts, and frozen accounts due to the pendency of KYC update and bring down the number of these accounts.

In addition, to attract more capital inflows, the interest rate ceilings on one- to three-year FCNR(B) deposits have been increased from 250 bps to 400 bps of the ceiling of the overnight Alternative Reference Rate (ARR). Similarly, for deposits of three-five year maturity, the ceiling has been increased to overnight ARR plus 500 bps, against 350 bps at present.

Besides the CRR cut, there were a whole host of other decisions by the RBI. These include expanding the reach of the forex retail platform through linkages with Bharat Connect to help users transact on the platform through mobile apps of banks and non-bank payment system providers.

To develop the interest rate derivatives market and improve the credibility of interest rate benchmarks, a new benchmark—the Secured Overnight Rupee Rate (SORR)—has been proposed. This will be based on all secured money market transactions—overnight market repo as well as TREPS.

The RBI has also decided to increase the limit of collateral-free agricultural loans from Rs 1.6 lakh to Rs 2 lakh per borrower to enhance the availability of credit to small and marginal farmers.