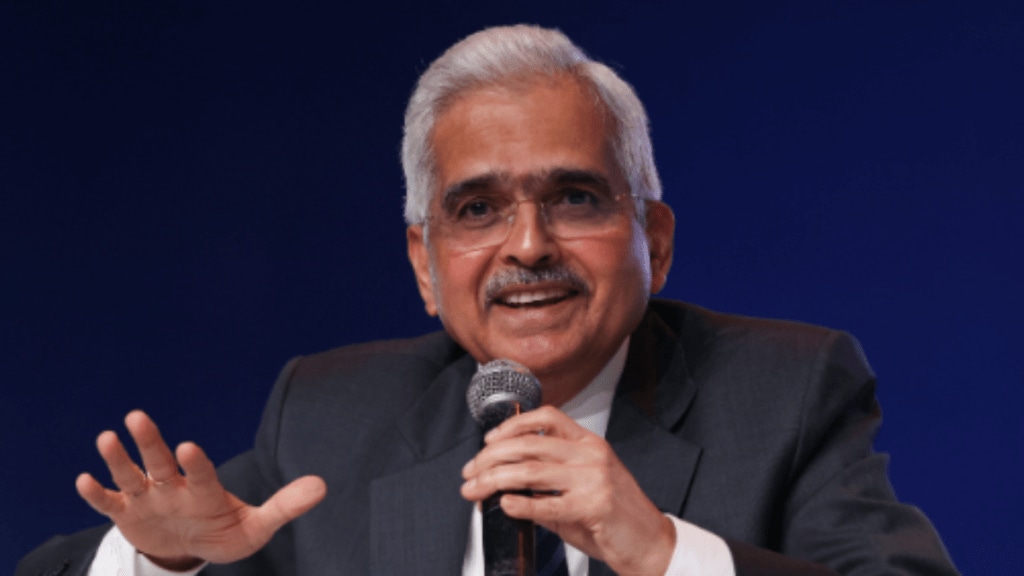

The capacity of the information technology systems of banks must keep up with the growth in their overall business, Reserve Bank of India (RBI) Governor Shaktikanta Das said in the post monetary policy press conference. The RBI is watchful of every aspect of the financial sector and will take regulatory measures when required. Excerpts:

Q. Will you take further measures to curtail the growth in unsecured personal loans?

DG Swaminathan: We are closely watching the incoming data and any measures if necessary would be based on the reading of the data.

Das: RBI is watchful of every aspect of the overall financial sector, especially in the banking sector. We are agile, we are watchful. Further measures will be taken if and when required. There is nothing more than that at this stage.

Q. Are you seeing any signs of overheating in the economy? If not, are rate hikes off the table?

DG Michael Patra: No, we are not seeing any signs of overheating because remember that the level of output had fallen very low during the pandemic and even these high rates of growth are enabling it to catch up to that level. Nothing is off the table.

Q. Growth projections for FY25 are lower than FY24 by 100 basis points (bps). What are the reasons for this?

Patra: It is a year-on-year growth rate so it will be influenced by the high base of 2023-24. But, the momentum is high.

Q. You have flagged several areas including high interest rates, and high CD ratio. Will this warning be followed by action?

DG Swaminathan: Essentially, it is our intention to flag any possible build-up of risks. We keep looking for potential areas of concern. It is our intention to communicate them to the regulated entities. We have requested the boards to relook and re-strategise business plans taking into account, the widening gap between growth in deposits and the growth in the loan book. It is left to the individual entities basis their business plans. If it is required, they will have to modify their business plans to suit long term sustainability. It is not our intention to micromanage businesses. We will only look at macro-level impact of the build-up of risks.

Q. Drawing from the analogy of elephant in the woods, where are we on the disinflationary process?

Das: The elephant as usual is walking very slowly. We are watchful and we would like the elephant to enter the forest and be there. We would like inflation to align itself with the target and be there on a durable basis. The last mile of our journey towards 4% is sticky and that is the case world over. We have to be very careful.

Q. How concerned is RBI on usurious practices by some lenders?

Das: We have a fair practices code. It is laid out that the Interest rates charged by banks, non-banking financial companies, and microfinance institutions are de-regulated completely. RBI guidelines mandate that the interest rate charged is fair and transparent. I am not saying that it is a systemic practice, but we have noticed some outliers. Our supervision department is undertaking discussions with these outliers. We trying to sensitise these entities to ensure that the interest rate levied by them is fair. Apart from this, there are some charges that are not annualized and are hidden. We have mandated lenders to provide a key fact statement, which will contain annualised interest rate.

Q. Are you taking any steps to address digital outages in banks?

Swaminathan: The system outages are under close monitoring by us. We have a portal in which, all regulated entities are required to report their outages, both planned and unplanned. At a system level, we are seeing a trend which is encouraging. If there are any outlier entities, we talk to them on a bilateral basis. We also issue a collective action plan to augment their infrastructure proportionate to the growth in business levels. This is an item that is under constant monitoring and any downtime will be dealt with.

Q. Are banks investing enough in technology?

Das: Banks should invest adequately. I am not saying they are not. It is necessary to see that the capacity of information technology systems to process data keeps pace with the growth in business. It is for the banks to assess how much investment is required to ensure this. It is a micro-aspect of their management. RBI does not prescribe how much they should invest. If there is a problem, we see whether the system has any deficiencies and we advise banks to take necessary corrective actions. Also the disaster recovery centers need to be kept active always.