-

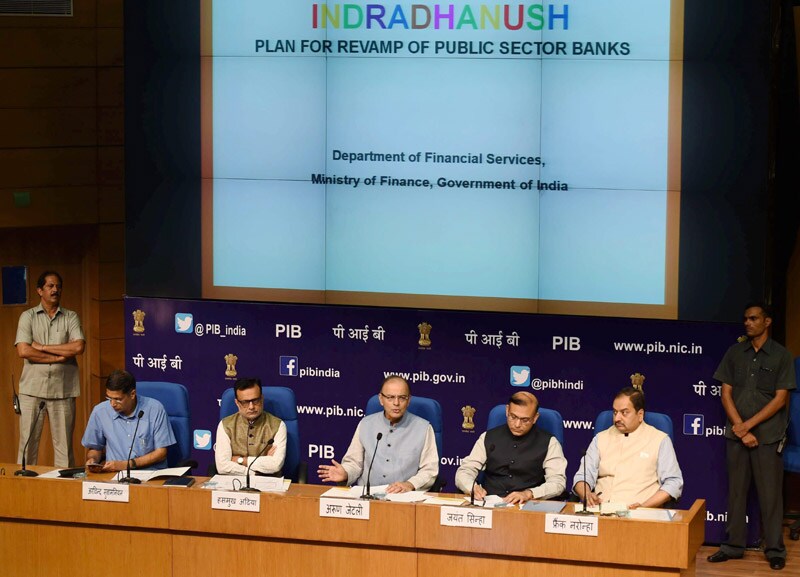

Image Caption: Finance Minister Arun Jaitley along with MoS Finance Jayant Sinha addressing a press conference in New Delhi on Friday. (PTI)</br><br> Government on Friday announced seven-points public sector banks' revival plan 'Indradhanush' that is expected to help these banks post better growth in the long-term.</br> The move was also welcomed by the Reserve Bank of India that has frequently underlined the deteriorating health of PSBs. “The allocation for the first year is adequate…it’s a good beginning,” said RBI governor Raghuram Rajan.

-

Image Caption: Finance Minister Arun Jaitley along with MoS Finance Jayant Sinha addressing a press conference in New Delhi on Friday. (PTI)</br><br> The government has accepted almost all major recommendations of P J Nayak Committee, except bringing down government stake below 51%. </br> We give a low down on the seven points in the revival plan Indradhanush:

-

Image Caption: SBI will get the highest Rs 5,511 cr, followed by Bank of India at Rs 2,455 cr, IDBI at Rs 2,229 cr, PNB at Rs 1732 cr and IOB at Rs 2009 cr. (AP)</br><br> Appointment:</br> Government implemented the much discussed split in Chairman and MD/CEO post to improve the governance standard in the public sector banking space. In the first round, it cleared appointment of Chairman for 5 banks and MD/CEO for equal number of banks. (Text courtesy: Reliance Securities)

-

Bank of Baroda shares: The stocks of the country’s second-largest lender, BoB defied the loss after the management said that all non-performing assets were accounted for and it could return to profitability next fiscal. Its newly inducted managing director and chief executive P S Jayakumar said through the clean-up and reorganisation exercise, the bank is confident of posting “reasonable level” of profit next fiscal year. The share price of Bank of Baroda settled 22.04 per cent up at Rs 139.55. [15-02-2016]

-

(Image Source: AP) </br><br> Capitalization: </br> The GOI announced first two tranches of capital infusion into 13 public sector banks to the tune of Rs200.1bn, which is part of an already announced comprehensive Rs700bn capitalisation plan over four years until 2019. Third tranche of Rs50bn will come in 4QFY16E, post the 9MFY16E result analysis, and preference will be given to those banks, which have not received capital in the current round. (Text courtesy: Reliance Securities)

-

Image Caption: SBI will get the highest Rs 5,511 cr, followed by Bank of India at Rs 2,455 cr, IDBI at Rs 2,229 cr, PNB at Rs 1732 cr and IOB at Rs 2009 cr. (AP)</br><br> De-stressing banks:</br> Government will continue to work towards solving problems of sectors, which are contributing major stress to the banking sector at this point of time. Further, the Government is also planning to take several steps to improve legal and risk management controls for banks. (Text courtesy: Reliance Securities)

-

Image Caption: SBI will get the highest Rs 5,511 cr, followed by Bank of India at Rs 2,455 cr, IDBI at Rs 2,229 cr, PNB at Rs 1732 cr and IOB at Rs 2009 cr. (Reuters)</br><br> Empowerment:</br> Government has issued a circular that it will not interfere in the functioning of public sector banks and encouraged them to take decisions independently, keeping the commercial interest of the organization in mind. In our view, key thing to watch out for will be the actual implementation of these much needed reforms on ground level. (Text courtesy: Reliance Securities)

-

(Image souce: Reuters)</br><br> Framework of Accountability:</br> New standardized “Key Performance Indicators” for measuring performance of public sector banks in place of earlier Statement of Intent has been set up. The GOI has published the whole framework and will evaluate the performance of the management team and capital allocation. (Text courtesy: Reliance Securities)

-

Image Caption: Finance Minister Arun Jaitley along with MoS Finance Jayant Sinha addressing a press conference in New Delhi on Friday. (Express Photo)</br><br> Governance Reforms:</br> Government has indicated that it will continue to pursue the governance reform and to discuss the same, it will hold next Gyan Sangam from Jan 14 – 16, 2016. Further, the government is planning to give higher independency to the board, which will drive the bank’s strategy going forward. GOI is also looking to launch ESOP scheme for top management of the public sector banks. (Text courtesy: Reliance Securities)

e-Passport launched in India: Who can apply, how to apply, application fee, benefits, key security upgrades and more