-

5. Budget 2016: The 0.5 per cent Swachh Bharat cess on all taxable services, introduced last November to fund cleanliness drive of the government, will garner Rs 10,000 crore next fiscal, as compared to Rs 3,750 crore this year. The only place where the government will lose revenue is in converting the specific rate of Rs 4,500/tonnes of oil development cess into an ad-valorem rate of 20 per cent. At USD 35 per barrel oil price, the 20 per cent cess translates into Rs 3,500/tonne. On this account, the government will get Rs 10,303 crore next fiscal as compared to Rs 14,962 crore this year.

-

1. Budget 2016: New cesses and duty hikes may have made cars and garments costlier but Finance Minister Arun Jaitley's focus in the Budget 2016-17 was job creation and making taxation simpler, not resource mobilisation, Adhia said. (Reuters)

-

EPF tax rollback: According to the budget proposal, an employee will have to invest 60 per cent of the EPF in annuity "as per wishes of government" if he does not want to pay tax on the amount he receives at the time of retirement. Congress claimed the move was aimed at helping insurance companies, particularly private ones. (Reuters photo)

-

Arun Jaitley: "When oil prices went down, a large share (of profit) went to consumers. Second part of it went to oil companies as they bought oil for future on prevailing prices and when the price came down they had to sell that oil on the reduced prices. So some relief for them was needed for them."

-

EPF tax rollback: Jaitley had in his Budget for 2016-17 proposed to tax withdrawal of 60 per cent of accumulations in the employee provident fund after April 1, 2016. This was criticised by all employees unions as well as political parties. "In view of representations received, the government would like to do a comprehensive review of this proposal and therefore I withdraw the proposal," Jaitley said in a suo motu statement in Lok Sabha. (Reuters photo) <br><a href="https://www.financialexpress.com/article/budget-2016/fm-arun-jaitley-withdraws-controversial-budget-2016-epf-tax-proposal-nps-tax-exemption-to-remain/220780/"><strong>Budget 2016 EPF tax proposal withdrawn; NPS tax exemption to remain</strong></a></br>

5. Budget 2016: Incentives have been given to housing sector as well as first time home buyers to boost growth, he said. Besides, he said, the Budget provides relief to small tax payers in the form of higher rebates and a simpler tax procedure for professionals. Secondly, incentives for housing is aimed at fueling demand that can lead to pickup in construction activity and in turn more requirement of steel, cement etc and creation of jobs. (Reuters) -

Jewellers strike: FM Arun Jaitley has done well by not succumbing to the pressure to withdraw the proposal and he should stick to his stance; after all, this is not the EPF tax that hurts millions of taxpayers. What this does is hopefully bring some degree of sanity to jewellery purchases in the country and is essential for a movement to the goods & services tax (GST). (Image Source: PTI)

-

In Budget 2016, Finance Minister Arun Jaitley has cut Tax Deducted at Source (TDS) rates on several deductions, and rationalised others including that of Employees' Provident Fund (EPF), with a view to improve cash flow, especially of small income tax payers. Check out how here:

-

Stating that setting up a model retail policy for the retailers is "a great announcement", Deloitte Haskins & Sells LLP Partner Anil Talreja said it will bring about standardisation of the state level reforms. "In India, people are very hard working and will never have a problem in keeping their shops open for seven days in a week so as to do more business and flourish," he added.

-

Expressing similar views, Walmart India President & CEO Krish Iyer said recognition of retail trade as the largest service sector employer in the country and proposed focus to simplify the regulations for retail sector is very laudable. "The retail sector in India is currently the hotbed of economic growth… India is a domestic consumption driven growth story and therefore this support and encouragement to the retail trade will surely further drive consumption, which in turn will help manufacturing sector and job creation," he said.

10. Budget 2016: "So cess or surcharge is one way for government to have a separate kitty of its own and this kitty is available only till be have GST. It is a limited period exercise of legislative power which Government has got," Adhia said. Stating that cesses are for specific purposes, he said a lot of spending has been earmarked for farm and rural sector. "So the Kisan Kalyan cess." Infrastructure cess was borne out of pollution and traffic congestion in cities and so the levy on cars and SUVs. "We have too much traffic jams on the roads and so we can indirectly discourage people to buy expensive cars or they pay for it." (Reuters)

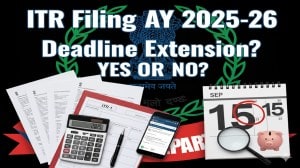

Income Tax Return Deadline, Due Date Extension 2025 LIVE: Will govt extend ITR filing last date as glitches continue? Latest updates