By Chirayu Sharma and Dr. Badri Narayanan Gopalakrishnan

In recent months, the United States has reignited global trade tensions by proposing a new wave of tariffs, sparking renewed volatility in financial markets. While markets had shown signs of stabilization after the initial shock, the latest round of tariff threats has once again unsettled investors. Trump has proposed a 50% tariff on European Union goods and a 25% levy on smartphones if major manufacturers such as Apple Inc. and Samsung Electronics Co. do not shift their production to the U.S. These latest announcements have had a pronounced impact on the bond market—10-year U.S. Treasury yields have surged past 4.6%, while 30-year yields have climbed above 5.1%, marking their highest levels since November 2023. This sharp rise in yields carries significant economic implications for the U.S. and global economy alike.

Source : Trading Economics

Rising bond yields have far-reaching implications for the economy, particularly in terms of government borrowing and monetary policy. Higher yields translate to increased interest costs for the government on newly issued debt, which in turn inflates the fiscal deficit and raises the national debt burden. As debt levels grow, governments may face pressure to stimulate the economy through measures such as quantitative easing (QE) or more accommodative monetary policies. However, such stimulus efforts—especially in a high-debt environment—can lead to higher inflationary pressures. In response, central banks may be forced to hike interest rates to contain inflation, which pushes bond yields even higher. This creates a self-reinforcing cycle: higher yields lead to higher interest expenses, which can necessitate policy easing, only to trigger inflation and tighten financial conditions again. The result is a volatile and delicate balancing act for policymakers, where every action has compounding consequences for both economic stability and investor confidence.

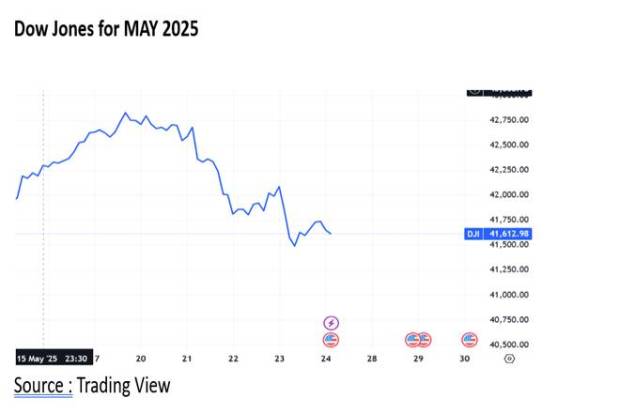

In the past week, the three major U.S. stock indices have experienced notable declines amid rising bond yields, which have exerted pressure on equity markets. The Dow Jones Industrial Average (^DJI) slipped by 0.6%, the S&P 500 (^GSPC) dropped approximately 0.7%, and the tech-heavy Nasdaq Composite (^IXIC) retreated around 1%. This downward trend reflects a broader shift in investor sentiment as rising bond yields reduce the relative appeal of equities. Elevated bond yields make fixed-income securities more competitive compared to equities, which are generally considered riskier investments. This shift in relative attractiveness prompts portfolio rebalancing, with investors moving capital out of stocks and into bonds, thereby exacerbating the downward pressure on equity markets. The technology sector, which had led much of the market’s rally in recent months, has been among the hardest hit due to its sensitivity to interest rate fluctuations. Higher yields increase the discount rate applied to future earnings, which disproportionately impacts growth and technology stocks—sectors whose valuations are heavily reliant on long-term earnings projections. As fixed-income investments begin to offer more attractive risk-adjusted returns, capital tends to flow away from equities, leading to a decline in overall market valuations.

This recent surge in bond yields has also significantly increased the cost of government borrowing, thereby raising debt servicing obligations and intensifying fiscal pressures. As interest rates climb, governments are compelled to allocate a larger share of their budgets toward interest payments on existing debt, reducing the fiscal space available for productive public expenditures such as infrastructure development, education, healthcare, and social welfare initiatives. This phenomenon, commonly referred to as “crowding out,” can hinder long-term economic growth by diverting resources away from investments that generate future returns.

Moreover, persistently high yields may lead to the accumulation of additional fiscal debt, particularly if governments continue to borrow to finance budget deficits or stimulate slowing economies. An expanding debt burden not only increases vulnerability to future rate hikes but can also erode investor confidence, potentially triggering credit rating downgrades or rising risk premiums, Moody’s downgraded the U.S. credit rating one notch to Aa1 from Aaa on May 16, 2025. Over time, this can create a self-reinforcing cycle where higher debt leads to higher interest costs, which in turn further widen fiscal deficits. In the long run, such dynamics may compel policymakers to consider austerity measures or tax hikes, both of which could dampen economic activity and weaken consumer and business sentiment. Thus, the rise in bond yields has far-reaching implications beyond financial markets, posing structural challenges to fiscal sustainability and macroeconomic stability.

In the short term, rising bond yields tend to attract increased foreign capital inflows into the domestic bond market, as investors seek higher returns on relatively safer fixed-income assets. This surge in demand for government securities, particularly U.S. Treasuries, simultaneously drives up demand for the U.S. dollar, leading to its appreciation in global currency markets. While a stronger dollar can help temper imported inflation, it also poses challenges for U.S. exporters by making American goods more expensive abroad, potentially widening the trade deficit.

The rise in U.S. bond yields is also exerting significant pressure on emerging economies, with India being a prime example. India’s bond yield premium over U.S. Treasuries has narrowed to its lowest level in nearly two decades, raising concerns about potential capital outflows from the domestic debt market. According to data compiled by Bloomberg, the spread between India’s benchmark 10-year government bond and its U.S. counterpart has shrunk to approximately 173 basis points—a level last observed in 2004. This diminishing yield differential reduces the relative attractiveness of Indian bonds to foreign investors, increasing the risk of capital flight.

Such outflows can have several adverse effects on the Indian economy. Firstly, a withdrawal of foreign funds tends to put downward pressure on the Indian rupee, leading to currency depreciation. A weaker rupee raises the cost of imports—particularly crude oil and other essential commodities—thereby contributing to higher inflation. It can also increase the external debt burden, as repayments denominated in foreign currencies become more expensive. Secondly, currency depreciation often unsettles equity markets, as investor sentiment weakens amid rising macroeconomic uncertainty. Together, these factors can slow economic growth by eroding purchasing power, raising input costs for businesses, and tightening financial conditions. In this context, the narrowing bond yield spread is not merely a market indicator, but a potential trigger for broader economic challenges that warrant close policy attention.

Chirayu Sharma is an independent researcher based in Pune. Dr Badri Narayanan Gopalakrishnan is Founder, Infinite Sum Modelling LLC and Fellow, NITI Aayog. Views are personal.