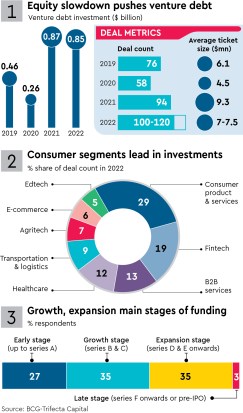

Indian venture debt investments grew at a compounded annual growth rate (CAGR) of 22% between 2019 and 2022 as startups are now increasingly looking favourably at debt as a form of financing, especially at a time when they face what has been termed a ‘funding winter’.

Penetration of venture debt, which offers capital with limited dilution to founders and flexible payment structures, is the highest in the fintech and consumer segments.

The investment focuses on firms that are in the growth and expansion stages.