Bad news for buyers looking to buy their dream home or invest in Gurugram’s realty market. For, the Haryana government has again proposed to increase the circle rates in Grurugram, which will negatively impact the housing market by further dampening the end-user and investor sentiments in the region.

According to industry experts, the circle rates – also known as collector rates in Haryana – are usually revised twice a year by the state government. In line with this, the government recently released the proposed list with new collector rates (second half of 2019-20) for all regions, including Gurugram, Harsaru, Manesar, Wazirabad and Sohna. Contrary to expectations, however, the circle rates in a few major markets in Gurugram are proposed to be more than doubled.

“As it is, both demand and liquidity in the market are tepid. This proposed hike would further dampen the end-user and investor sentiments, and thus the overall prospects of these markets in the new year. Both the primary and secondary housing markets will be negatively impacted by the hike,” says Santhosh Kumar, Vice Chairman – ANAROCK Property Consultants.

ANAROCK research also indicates that Gurugram has the highest unsold stock in the entire NCR at about 57,950 units as on 2019-end. This hike, more than double in major areas, will only worsen the situation for developers looking to shed their unsold stock.

“The decision to revise collector rates twice a year was essentially taken in order to keep the market prices in tune with the circle rates, and maintain a minimal gap between the two. Given that the market rates have hardly seen any changes in recent quarters, it was expected that circle rates will largely remain unchanged or even see some marginal drop. While a major hike in circle rates impacts all segments of real estate, the most immediate impact will be on the luxury housing market in many up-scale areas along the Golf Course Road and various other sectors in the city,” informs Kumar.

A preliminary assessment of the proposed revisions, according to Colliers International, reveals some key points:

# For some locations, the circle rates breach the limits of fair market rates by a fair margin, which is not in line with the market and such a step might fail to meet the actual purpose of revision.

# In some of these proposed revisions, the new proposed circle rate is almost double the existing circle rate, which has not been the case of appreciation of such properties.

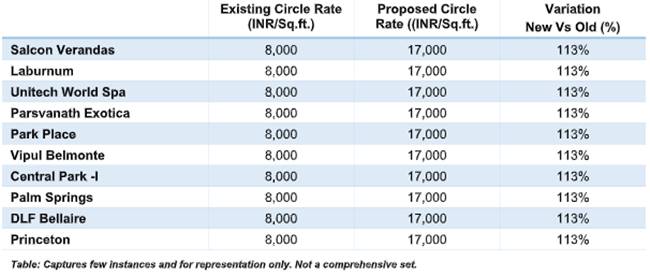

Some instances of identified abrupt proposed revision:

The abrupt increase in some of the cases seem quite divergent from the market scenario and would be detrimental to transactability of these properties. Also, higher circle rates translate into higher registration cost, which further translates into a higher acquisition cost and impacts transactability of the property. Although the notion of upward revision is pragmatic (helps in eradicating the cash component for secondary transactions), the extent and consistency of this revision in some cases fails to capture the average rates in the market.

“For some locations the administration has proposed a blanket rate applicable for all assets in that location. This, however, will fail to address the inconsistency in rates/pricing of assets in that location. By applying a blanket rate, the government might overvalue some assets and undervalue others. Higher acquisition cost owing to higher circle rates might dampen the already-struggling residential real estate domain, with secondary market facing more severe repercussions. A reconsideration of the proposed rates would be desired in order to capture the market rates of properties more objectively,” says Ashutosh Kashyap, Associate Director, Valuation & Advisory Services at Colliers International India.

Impact on other NCR markets

However, while the proposed hike in circle rates is likely to negatively impact the housing market in Gurugram, some other realty markets of the National Capital Region (NCR) may hugely benefit from this move.

“On the positive side, this hike could give a major lifeline to the real estate market in Noida and Greater Noida, which have already seen a decent uptick in 2019. Both Noida and Greater Noida saw their unsold inventory go down by a whopping 17% and 20%, respectively, during 2019 as against 2018. Gurugram, on the other hand, saw its unsold stock increase by 12% in 2019 compared to 2018 – from 51,840 units as on 2018-end it rose to over 57,950 units in 2019-end,” says Kumar.

A few industry experts feel that the hike in circle rates will not only hit the luxury segment, but the mid-segment housing as well.

Mani Rangarajan, Group COO, PropTiger.com, Housing.com and Makaan.com, says, “Though it is a proposal, yet the move is very surprising considering Gurugram has high inventory levels and the demand for properties is low, which may get further dampened as a result of the proposed move. The move will effectively increase the cost of properties and make cities like Noida, Greater Noida and Faridabad, where the prices of properties are lower, emerge as preferred destinations. Among the various segments, it is the luxury segment which will be the biggest hit, but the mid-segment housing will also face the pinch.”

Keeping these facts in view, some developers have even urged the government to take a look at their decision again.

Nayan Raheja, Executive Director, Raheja Group, says, “Property prices have remained stable for the last few years. In fact, in many cases, the prices have actually fallen. Yet the demand has remained subdued. In such a scenario, raising the circle rate so sharply is the last thing that is required and is out of sync from the current market dynamics. If implemented, the move will adversely impact the government’s aim of providing ‘Housing for All’ as it will make housing dearer for customers. Also, with the real estate industry currently passing through a tough phase, there is a case for reduction in both circle rates and stamp duty. Accordingly, we urge the administration to revisit the proposed hike.”