The last two decades have witnessed a monumental transformation in the technology space. These developments have become ingrained in our daily life and often go unnoticed. Such is the impact of technology. Consider this, the amount of time spent online either on mobiles or on laptops has changed significantly. Everything is available at the touch of a button or a click. You have virtual assistants, chatbox, cloud computing, artificial intelligence etc. One can firmly assert that technology covers practically all sectors of the modern economy; and sectors too rely on technology to uplift their quality, productivity, and profitability. Today, the challenges an organisation would face are not about a lack of technology but identifying the right use and delivering value.

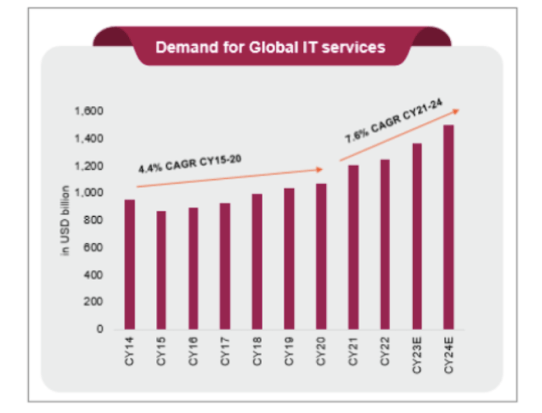

India is home to some of the top companies in Information Technology, globally. Driven by talent, favourable government policies, and an increasing demand for tech-enabled solutions, we are currently in the throes of a multi-decade development in data and analytics. Global demand for IT has grown significantly, with COVID and a pivot from traditional services being significant triggers.

Consider the composition of some of the top indices globally. More than half of the index weight for the NASDAQ Index is engaged in disruptive technology as a theme. Information Technology has one of the highest weightage attached to itself in the S&P 500 Index. All these are further proof of the growing influence of the sector. Certain heavyweights in this sector, who have demonstrated their prowess in the last decades, continue to enjoy a dominant position in mutual funds as well as

investor portfolios.

Also Read: Decoding Hybrid Mutual Funds: What are they and who should invest?

The Indian IT sector has played a significant role in cloud migration in recent years, demonstrating robust growth potential. IT spending remains strong globally and cloud services are expected to likely continue at this accelerated pace for the next few years.

Furthermore, the ‘internet economy’ has given rise to a new wave of digitally-native businesses whose foundation has been laid on the stronghold of technology and are now growing at warp speed. There are multiple sectors that have embedded technology to offer an inescapable investment opportunity, not only for corporate India but also the retail investor as well. Core themes like autonomous vehicles, automation in manufacturing, customer experience, mobility, artificial intelligence, etc., continue to drive growth in the digital revenues of IT companies.

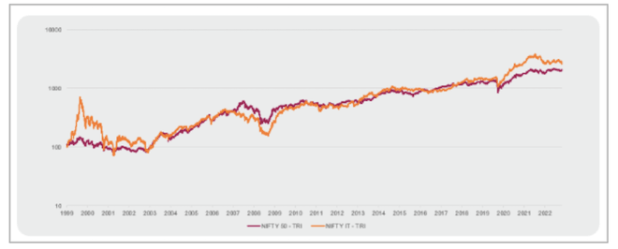

While recent performance does not favour the sector, entirely, it is imperative for investors to understand that investing in this sector requires a long-term perspective. If one were to look at the performance of the sector, in CY2021, IT was in focus for delivering augmented returns to investors, bringing it into the spotlight. In CY2022, the sector turned out to be one of the worst affected by market volatility, according to reports by Value Research. Nevertheless, from a longer perspective,

the sector has demonstrated its potential to be a long-term wealth creator, as showcased below.

From an investor’s standpoint

Despite recent events, we have reason to believe that India’s dominance in the IT sector, and therefore, its potential to deliver risk-adjusted returns to investors continues to remain strong. As compared to the peak investors witnessed before, valuations have evened out to reasonable levels at the beginning of CY2023. It is imperative to note that while the earnings growth is expected to remain strong, the ride may be bumpy, subject to several growth drivers.

There are many factors that are boosting the growth of this industry. The government, too, has made several efforts to augment the success of the Digital India program that is seeking to offer broadband connection to all residents and encourage the use of digital technology in the nation.

Considering these factors, one can assume that the information technology industry will have a key role to play in charting India’s economic trajectory; thereby providing an interesting opportunity for investors to leverage.

Also Read: How to report tax on gains from Equity Mutual Funds in Income Tax Return for AY 2023-24

When gaining exposure to the IT sector through a sectoral mutual fund, there are multiple fundamental parameters that investors must keep in mind.

First and foremost, is understanding the sector-specific risk, which is agnostic to both approaches. Any slowdown in IT spends, movements in currency, impact of global spending etc. are bound to have repercussions back here. However, investors must understand the importance of adopting a long-term view here as most of these (anticipated) interim changes are probably transient in nature.

Additionally, investors must understand their financial goals and risk profile. Allocating incremental money to a sectoral fund should be considered by those who are willing to play the long-term card and have the appetite for a higher risk. Since there is an added component of elevated risk, it is also imperative to time these opportunities through well-strategized bets. One of the easiest ways to invest would be through a SIP in one of these funds. Investors may also eventually add to their

investments, through the top-up SIP feature.

With several structural tailwinds to growth combined with the magic of compounding, one can wager that the Indian IT sector’s growth has the potential to reward long-term investor.

This column has been written by Ashwin Patni, Head Products & Alternatives, Axis AMC

Disclaimer: The views expressed in this article are that of the respective authors. The facts and opinions expressed here do not reflect the views of www.financialexpress.com. Please consult your financial advisor before investing in mutual funds and stocks.