Fixed deposits are a safe and secure way to earn guaranteed returns even in these uncertain times, and are offered by banks, non banking financial companies (NBFCs) as well as corporates. While bank FDs are the safest investment avenue, fixed deposits offered by NBFCs and corporates are considered a bit risky. Still many people prefer to invest in NBFC and corporate FDs because their rates are usually a bit higher than those provided by bank FDs.

Mahindra Finance, India’s leading rural finance company, is an NBFC whose FDs have become attractive among a section of investors because of higher interest rates. As per the company, its fixed deposits have a Crisil rating of ‘FAAA’, which indicates a high level of safety. Moreover, people investing in the company’s FDs are provided with a free accidental death insurance coverage of Rs 1 lakh for a year.

Anyone willing to invest in Mahindra Finance FDs can do so either offline or online. Interestingly, investors are eligible for 0.25% higher interest rates, if they prefer to invest online. Currently you can earn up to 8.75% by investing online.

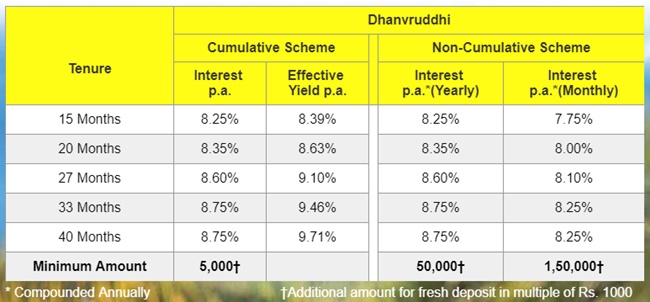

Mahindra Finance, in fact, offers two types of fixed deposits – Dhanvruddhi (online) and Samruddhi (offline). And both the schemes are available in two options – Cumulative as well as Non-cumulative. In the ‘Non cumulative scheme’ interest is payable on a half-yearly basis, while in the ‘Cumulative deposit scheme’, interest is payable along with the principal at the time of maturity.

Samruddhi Fixed Deposits offer 0.25% additional interest rate for senior citizens, and 0.35% additional interest rate for all Mahindra group company employees & employees’ relatives. In Dhanvruddhi deposits, senior citizens are entitled for 0.10% additional interest rate.

How to invest in Mahindra Finance FDs online

Apart from investing in Mahindra Finance FDs through the offline mode, you can invest via online also. Here’s how you can invest online in 4 easy steps:

1. Visit the Mahindra Finance website, enter your basic details like your name, date of birth, mobile number, e-mail address etc, and choose your desired FD amount.

2. Confirm your details and select the payment mode

3. Make payment

4. Upload KYC and additional details

For Resident Individuals – ID & Address proof

# Passport

# Driving licence

# Permanent Account Number (PAN) Card,

# Voter’s Identity Card issued by Election Commission of India

# Job card issued by NREGA, duly signed by an officer of the State Government

# Letter issued by the Unique Identification Authority of India containing details of name, address and Aadhaar number or any document as notified by the Central government in consultation with the regulator.