These days the market is full of options for two-wheelers. You can buy a wide variety of two-wheelers with multiple features. However, all two-wheelers are not cheaper. They come with a premium especially those with premium features. This is where two-wheeler loans come into play, offering a financing solution. Yet, before opting for a loan, several crucial considerations should be weighed.

Owning a two-wheeler offers convenience and flexibility, making it a popular choice for personal transportation. It is important to consider these essential things before purchasing a two-wheeler on a loan this festive season.

Affordability and Budget

Before committing to a two-wheeler loan, evaluate your financial situation. Analyse your monthly income, expenses, and existing financial commitments. Consider the monthly installment payment, interest rates, and the down payment required. Ensure that the loan fits comfortably within your budget without straining your finances.

Research and Comparison

Thoroughly research the loan options available from various lenders, including banks and non-banking financial companies (NBFCs). Compare interest rates, processing fees, and repayment terms. Each lender may offer different terms, and finding the best deal can save you money in the long run.

Also Read: 5 essential strategies to be financially ready for a job loss

Credit Score and Eligibility

A good credit score significantly influences the loan approval and interest rates. Check your credit score before applying for the loan. Lenders prefer individuals with a good credit history, so try to improve your credit score if it’s low. Additionally, meet the eligibility criteria of the lender, including age, income, and employment stability.

Loan Tenure and EMI

Choose a loan tenure that aligns with your financial goals. Longer tenures might reduce the monthly EMIs but increase the total interest paid. Use online EMI calculators to estimate the monthly payments and choose a tenure that suits your repayment capacity.

Documentation and Transparency

Understand the documentation required for the loan application. Ensure transparency in the terms and conditions of the loan, including hidden charges, penalties, and prepayment conditions. Read the loan agreement thoroughly to avoid any surprises.

Down Payment and Additional Costs

Save for a substantial down payment to reduce the loan amount and subsequent EMIs. Consider additional costs like insurance, registration, and maintenance. Some lenders might bundle insurance with the loan, so compare these costs as well.

Loan Repayment

Check if there are any prepayment penalties. Making additional payments or paying off the loan early can save on interest costs.

Financial Planning

A two-wheeler loan is a financial commitment. Consider its impact on future financial goals, such as saving for emergencies, other purchases, or investments.

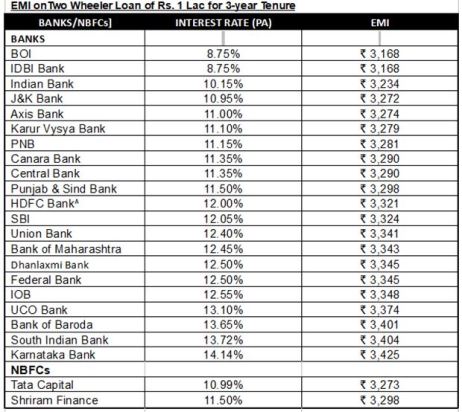

Before taking a two-wheeler loan, it is important to assess whether your existing financial situation can handle it without any stress. You must be able to repay the loan without delay and default. In the table below, compare two-wheeler loan interest rates and EMIs on a Rs 1-lakh loan for 3-year tenure. Choose your option based on your requirements.

Interest Rates & EMI on Two Wheeler Loan

Compiled by BankBazaar.com

Note: Interest rate on Two-Wheeler Vehicle Loan for all listed (in BSE) banks along with selected NBFCs considered for data compilation (except foreign and small finance banks). Entities for which data is not available on their website are not considered. Data collected from respective institution’s website as on 31 Oct 2023. Banks and NBFCs are separately listed in ascending order on the basis of interest rate i.e. bank offering the lowest interest rate on two wheeler loan is placed at top and highest at the bottom. Lowest interest rate offered by the lenders on two-wheeler loan is shown in the table, irrespective of the loan amount and tenure. EMI is calculated on the basis of interest rate mentioned in the table for Rs 1 Lakh Loan with a tenure of 3 years (processing and other charges are assumed to be zero for EMI calculation). Interest mentioned in the table is indicative and may vary depending on the bank’s/NBFC’s T&C.^Rack Interest Rate.