Lots of people are buying used cars these days and even financial experts suggest purchasing the used car owing to lesser entry cost and saving money if you are taking a loan for it. New cars are not just costly but overall expenses can be higher if you stretch your budget beyond your repayment capacity.

One of the primary reasons for buying used cars is their cost-effectiveness. New cars tend to depreciate rapidly in their initial years, but a used car’s depreciation is slower. Therefore, used cars come with a lower price tag, making them more accessible to a broader range of consumers.

Financial institutions often offer lower interest rates on used car loans compared to personal loans, making them a more affordable option for potential buyers. This means you can own your dream car without burning a hole in your pocket.

Also Read: Should you go for instant approval credit cards?

How to Choose Your Vehicle?

Physical Inspection: You must inspect the car inside and out. Look for signs of rust, dents, and scratches. Inspect the tires for wear and tear, and check for uneven wear patterns which might indicate suspension or alignment issues.Take the car for a test drive and pay attention to how it starts, runs, and handles. If possible, get a mechanic to inspect the car.

Legal Checks: It is crucial to verifythat all legal documents are in order. This includes the RC, insurance papers, pollution certificate, and any outstanding loans or dues on the vehicle.

Maintenance Records: Check for the car’s service and maintenance records. A well-maintained car must have regular servicing and repairs documents.

Negotiate the Price: Try to negotiate the final price based on the condition of the car and other issues which might help you reduce the cost. Never accept the quote price if you feel the vehicle requires additional repairs and maintenance costs.

Used Car Loan

Check Eligibility: Before you apply for a used car loan, check your eligibility by evaluating factors such as your credit score, income, and existing debts. Once you meet the criteria, proceed to the next step.

Credit Score: A good credit score is essential when applying for any loan. A high credit score demonstrates creditworthiness and can help secure a used car loan with favourable terms.

Documentation: Be prepared to provide documents such as proof of identity, address, income and your ITR papers to verify your eligibility and process the loan.

Choose A Lender: Explore the loan offerings from different banks and financial institutions. Compare interest rates, loan tenures, and terms and conditions to choose the lender that best suits your requirements.

Loan Application: Ensure that you provide all required documents and information accurately to expedite the approval process.

Loan Approval: After reviewing your application and documents, the lender will decide whether to approve your loan. If approved, lender will specify the loan amount, interest rate, and tenure. After formalities are completed, the lender will disburse the loan amount.

Before applying for a loan, research and select the used car you want to buy. Considering factors like your budget, loan interest rate, mileage, model year, and condition of the vehicle can help you make your purchase hassle-free.

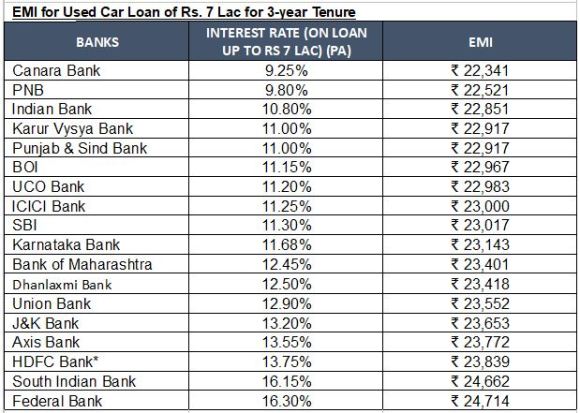

The table below helps you compare used car loan interest rates and EMIs on the loan amount of Rs 7 lakh for 3 years.

Used Car Loan Interest Rates & EMI

Compiled by BankBazaar.com

Note: Interest rate on Used Car Loan for all listed (BSE) Public & Pvt Banks considered for data compilation (Excluding small finance banks). Banks for which data is not available on their website are not considered. Data collected from respective bank’s website as on 29 Aug 2023. Banks are listed in ascending order on the basis of interest rate i.e. bank offering lowest interest rate on Used Car loan is placed at top and highest at the bottom. Lowest interest rate offered by the banks is shown in the table (irrespective of the loan amount or tenure). EMI is calculated on the basis of interest rate mentioned in the table for Rs 7 Lakh Loan with a tenure of 3 years (processing and other charges are assumed to be zero for EMI calculation). Interest mentioned in the table is indicative and may vary depending on the bank’s T&C. *Rack Interest rate.