A close friend from college, an engineer who topped our class recently had a baby boy. I called to congratulate her, and it was a call that lasted 105 minutes, out of which only about 10 were college time banter. Let us call her Anu. Anu told me how sleep is luxury, and she cannot afford it. And this exact comment opened a whole new can of worms. As a father of two, it was my responsibility to tell her, it is too soon to be cribbing about unaffordable luxuries. Because the biggest luxury in today’s India according to me is PARENTHOOD.

And boy did this rub her the wrong way. She was furious! You might now get the hint why the call lasted over 100 minutes. I had to break it down to her. She had left the workforce behind to be with her child. And I respect that. But that meant their household is now about Rs 12 lacs a year weaker.

I had to then drop the hammer, and I got her listing things. Diapers and other essentials at Rs 5,000 a month. Organic formula milk, another Rs 5,000. An unexpected paediatrician’s visit that burnt a Rs 2,500 hole in her pocket.

“Now I know how we are Rs 50,000 short already?”

Anu’s story is not isolated and there are many Indians like her and her husband. The fact is financial planning goes out the window after a kid, more often than not.

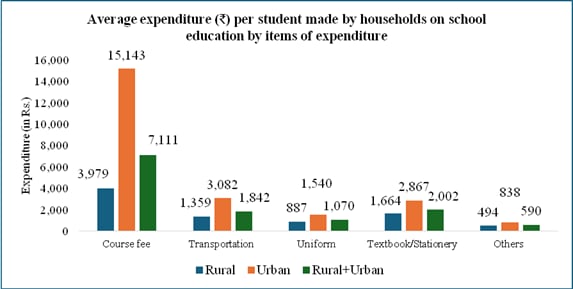

Countless Indian parents are caught in a tug-o-war of love and ledger. In 2025, raising a child in urban India isn’t just a “growth journey”; it’s a financial tightrope both parents must master. From cradle to college, costs can go to Rs 50 lakh or even Rs 1 crore, on a conservative scale. School fees are growing faster than a money plant, extracurricular activities demand wallets as wide as the Grand Canyon, and kids barely out of diapers, want brands that scream status.

For middle-class families, the joy of parenthood is more often than not overshadowed by financial instability.

The School Bill Heartbreak

Let’s go back a few decades. When I was in school back in the 90s, my school fee was Rs 5 a month in the 5th class, Rs 6 a month in 6th class and so on.

Cut to 2012, when my first kid was ready to start pre-school and me and my wife were looking for a school for him. The closest one to our house in South Mumbai was a so-called “posh” school. And here comes the shocker. The fee for play school was Rs 1.5 lacs a year. And if you think that is bad, the nearest international school was charging Rs 3 lacs a year. And remember this was 2012.

It was a shock to me and my wife, both engineers, whose overall engineering cost less than the 1-year fee of the international school.

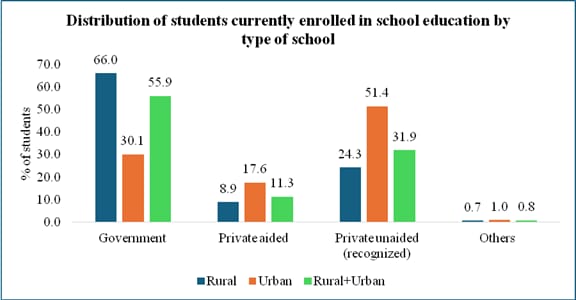

Here it would make sense to look at a few data points. Some figures from the 80th round of NSS (National Sample Survey) will help set some context.

As one can see, while the enrolment in government schools in rural India is higher, the image in urban India is an exact mirror flip. Over 51% students in urban areas are enrolled in private unaided schools.

The “Global Citizen” Nightmare

One might think that it just ends with the school fees and other associated school costs. But think again. Extracurriculars that were once fun escapes for kids and parents alike have now turned into a race to build “future-ready” kids. Also called “Global Citizens” in many cities. Abacus, Mental Math, Contemporary dance, Parkour, Theatre… The list just goes on, and these add another Rs 1-2 lacs yearly per child, turning play into pressure.

Divya Gupta from Bengaluru shared on Reddit’s FIREIndia, “Coaches say it’s for college resumes. But with Rs 2 lakh school fees, we’re eating into savings.” Her post got a ton of replies with other parents agreeing. For most city parents, these extras are not optional, they’re essentials now.

Private schools add fuel to this already raging fire. “Activity fees” for in-house clubs go to the tune of Rs 10,000 to Rs 20,000 per term, while outside academies charge premium for “certified” skills. A Hyderabad mom’s X post said: “My 12-year-old begs for tennis lessons. Rs 60,000 a year. We skipped our anniversary getaway. Is this love or a race?”

Pranksters to Brandsters

Raising a child today isn’t just all play. Clothing costs hit a new high yearly, but for brand-hungry tweens, it’s double, driven by Instagram and playground flexes.

Globalization opened an unwanted but unavoidable floodgate. Malls and online stores brought luxury to kids’ closets, but at a price. One trip to the mall will burn a minimum of Rs 10,000 in a single day. Food, clothes, sneakers, accessories, the new mobile, anime figurines and what not.

But mind you, this isn’t just fashion… It’s fitting in. In private school campuses, where kids flaunt their new AirPods (worth Rs 18,000), belonging means buying. The pressure to fit in your group is huge and kids cannot manage that. Over years, these “small” spends add lakhs, a quiet thief in the budget.

Which is why many young couples nowadays are opting for a highly debated idea.

The DINK Escape: Freedom or Void?

Some couples together decide they are not cut out for this. There’s even an acronym for this. DINKs: Dual Income, No Kids. A growing tribe in Indian cities. They want to savour the freedom. “No fees, no coaching chaos, they travel, save lakhs a year. Kids? Maybe never…” DINKs bank on choice. Financial gurus praise their high-growth investments, free from child costs that eat up to 50% of incomes.

But What if We Don’t Want to Be a DINK Couple

Raising a child in 2025 India is a war between heart and wallet. Fees have quadrupled since our school days. Private education’s is claiming new heights when it comes to fees. Extras and brands eat away at dreams.

Having a child or not having one is a personal choice. The issue begins when the child comes before a solid plan for their future is in place. Here are some expert-suggested ideas that could guide

Beat The Fee Monster: Start early SIPs in child specific mutual funds for 12% returns so that you can beat the 10% education inflation.

Plan the Contingencies: Get a good child education insurance plan that provides a secure, tax-advantaged way to build a dedicated fund for your child’s higher education expenses while offering life coverage to ensure uninterrupted financial support even in your absence

Beti Padhao: For a girl child, start with Government-Backed Savings Schemes Like Sukanya Samriddhi Yojana (SSY), a tax-free scheme offering 8.2% interest (as of 2025), with contributions up to Rs 1.5 lakh annually.

Save While You Can: For boys or general use, opt for Public Provident Fund (PPF) at 7.1% interest, lock-in for 15 years but extendable.

The Sustainable Kid Model: Build Skills and Explore Scholarships for Cost-Effective Education for your kids

The Safety Net: Create a Diversified Emergency Fund that helps you stretching yourself in times of need and keeps you away from a debt trap.

Practice and Preach: Show your kids how to save money, how and where to invest, how to stay away from scams. Teach them financial literacy early on in life.

Stretch Only Where You Can: Choose the right schools as per your budget. Remember what you can afford today by pushing boundaries, might not be possible to pull off every time.

Smartest Bet: It might sound too cliched, but teach the kids early on the difference between need and want. It helps in the long run.

All the best!

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.