If you are looking to follow a high-conviction approach when investing in the Indian equity market, then focused funds may be a choice.

They are a sub-category of diversified equity funds, but unlike those that hold over 80-100 stocks, focused funds limit their portfolio holdings.

The capital market regulator has defined focused funds that allocate a minimum of 65% of their total assets in equities, investing in a maximum of 30 stocks at any given point.

A focused approach is followed, wherein the fund mainly concentrates on stock ideas that have winning potential, usually pursuing a buy-and-hold strategy.

The investments may be across market capitalisations (largecaps, midcaps, and smallcaps) and sectors, thereby enabling diversification.

When the underlying stock performs, returns can be remarkably high compared to the broader market. But if they don’t, it will weigh down on the returns of the fund.

The outcome is shaped by market conditions and how cleverly the fund manager finds the investment opportunities and has structured the portfolio.

Since a concentrated portfolio is held, the risk is high. It is possible that high conviction bets of the fund manager do not pay off as expected. The risk taken doesn’t necessarily get justified by returns.

They can be highly volatile if the portfolio comes under pressure. Hence, focused funds are placed at the higher end of the risk-return spectrum, a notch below mid cap funds and small cap funds.

If you are an aggressive investor looking to potentially generate substantial wealth over a period of 5 years or more, focused funds may be a choice.

In this editorial, we will compare two focused funds: HDFC Focused Fund and SBI Focused Fund.

These are among the popular ones in the focused funds subcategory.

Read on…

HDFC Focused Fund vs SBI Focused Fund

HDFC Focused 30 Fund, with effect from June 2025, is known as HDFC Focused Fund.

This scheme was launched in September 2004 as HDFC Core & Satellite Fund and was rechristened as a focused fund after the mutual fund categorisation and rationalisation came into effect in October 2017. Today, as per the June 2025 portfolio, it manages AUM of about Rs 209 billion (bn).

SBI Focused Fund, on the other hand, was launched in October 2004, as SBI Emerging Businesses Fund – a mid and small cap fund.

However, after the mutual fund categorisation and rationalisation norms, SBI Mutual Fund was reclassified as a focused fund and renamed SBI Focused Equity Fund.

And very recently, in measure to simplify and standardise the product label with the industry, it was renamed as SBI Focused Fund with effect from 30 June 2025. As of June 2025, the fund has an AUM of about Rs 386 bn.

While following their mandate, both these follow distinctive investment approaches or strategies for stock picking…

Investment Strategies

HDFC Focused Fund primarily targets well-established large-cap stocks for the core portion of its portfolio. It focuses on identifying quality stocks available at reasonable valuations. At times, it also pursues growth opportunities with allocation to small and mid-cap stocks.

The fund aims to manage risk by holding a diversified portfolio spread across market caps and sectors.

It follows a bottom-up approach to identify high-quality growth-oriented stocks for the long term. It’s agnostic to benchmarks and determines overweight/underweight positions based on the market outlook.

The fund prioritises investing in fundamentally strong companies having a competitive advantage, a track record of corporate governance, ESG sensitivity, and transparency.

Due to portfolio concentration, the fund’s emphasis is also on a reasonable margin of safety. But when doing so, it does not rely on only price to equity (PE) and price to book (PB) as the parameters, and instead, prefers following a holistic approach.

SBI Focused Fund also follows a disciplined approach. It’s actively managed to achieve its investment objective of long-term capital appreciation. The fund follows a bottom-up approach.

It takes high conviction bets, limits the total securities to or under 30 but also diversifies across market capitalisations and sectors.

The fund also has the mandate to invest up to 35% of its assets in foreign securities (viz. ADRs / GDRs / Foreign equity and debt securities).

Besides, it may deploy up to 50% of the net assets in derivative strategies, which may result in disproportionate gains as well as losses.

It also has the flexibility to invest up to 35% of its assets in debt and money market instruments and up to 10% in REITs & InvITs.

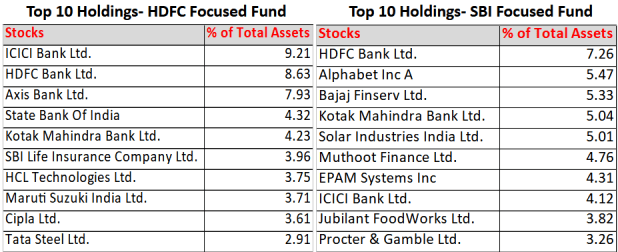

Here are the top 10 holdings of the two schemes as of 30 June 2025.

Top Portfolio Holdings

As per the June 2025 portfolio, the HDFC Focused Fund currently has 28 stocks. A dominant portion (about 65%) is in largecaps, while around 19% in midcaps and smallcaps.

The top 10 stocks comprise 52.3% of the portfolio and include names such as ICICI Bank (9.2%), HDFC Bank (8.6%), Axis Bank (7.9%), etc.

The top 3 sectors of the fund are banks, auto & ancillaries, and healthcare, which comprise around 60.1% of the portfolio.

Other than equities (which are 83.9% of the portfolio), HDFC Focused Fund has 2.7% of its assets in REITs & InvITs, 0.2% in government securities (G-secs), and is currently holding 13.1% in cash & cash equivalents.

The portfolio turnover ratio of the fund has ranged from around 23-38%, which is indicative of its buy-and-hold strategy.

SBI Focused Fund, on the other hand, at present has 88% of its net assets in equities (including overseas equities of 9.8%).

In the last one year, the fund has taken higher exposure to midcaps and smallcaps, aiming to benefit from high-growth opportunities. Along with that, it has exposure to largecaps. Typically, a multi cap approach is followed.

The June 2025 portfolio reveals that the fund is holding 47.1% in largecaps, 23.5% in midcaps, and 7.6% in smallcaps.

It has 24 stocks in its latest portfolio, wherein the top 10 comprise 48.4% and include names such as HDFC Bank (7.3%), Alphabet Inc. (5.5%), Bajaj Finserv (5.3%), etc. Banks, auto & ancillaries, and FMCG constitute the top 3 sectors of the fund, which are 40.5% of the portfolio.

Like many of its peers, the fund follows a buy-and-hold strategy, as indicated by the portfolio turnover ratio, which has been in the range of 30-50%.

Other than equities, SBI Focused Fund is currently holding 1% in debt & money market instruments, and 5.5% each is held in rights and cash & cash equivalents.

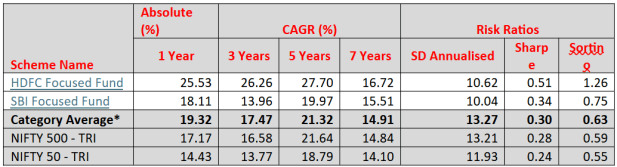

Performance of HDFC Focused Fund and SBI Focused Fund

HDFC Focused Fund with a reasonably diversified and quality-focused and largecap biased approach has rewarded investors.

Over 3 years and 5 years, the compounded annualised rolling returns delivered are 26.3% and 27.7%, which are noticeably higher than the category average and the benchmark Nifty 500 – TRI.

What’s more, to deliver such returns, the fund hasn’t exposed its investors to high risk (as denoted by the standard deviation). The SD of 10.62 is less than the category average and that of the benchmark index.

Thus, on a risk-adjusted basis (as denoted by the sharpe and sortino ratios), the fund has fared very well, the best in the category.

SBI Focused Fund, although it seems to have delivered a decent performance, the 3-year and 5-year compounded annualised returns of 14% and 20%, respectively, are lower than the category average.

While the risk taken by the fund is comparatively lower (as denoted by the SD of 10.04), the risk-adjusted returns also seem a bit muted when compared with the HDFC Focused Fund.

Fund Report Card Vis-à-vis Its Category Peers and Benchmark Index

Rolling period returns are calculated using the Direct Plan-Growth option. Returns over 1 year are compounded annualised.

Standard Deviation indicates total risk, while the Sharpe Ratio and Sortino Ratio measure the Risk-Adjusted Return. They are calculated over 3 years, assuming a risk-free rate of 6% p.a.

*All focused mutual fund schemes are considered to compute the category average returns.

Please note that this table represents past performance. Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Speak to your investment advisor for further assistance before investing.

Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully.

Source: ACE MF

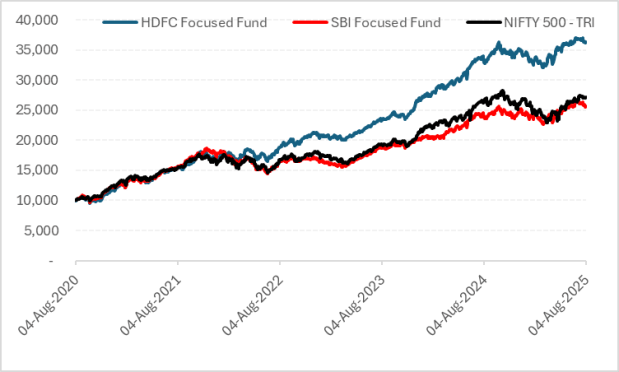

Rs 10,000 invested five years ago in HDFC Focused Fund would have yielded Rs 36,362, whereas in SBI Focused Fund, Rs 25,705 as of 4 August 2025. Investment in Nifty 500 – TRI would have yielded Rs 27,105.

Rs 10,000 Invested in HDFC Focused Fund and SBI Focused Fund

Direct Plan-Growth option considered

Data as of 4 August 2025

Past performance is not an indicator of future returns.

The securities quoted are for illustration only and are not recommendatory.

Source: ACE MF

HDFC Focused Fund has been managed by Roshi Jain since June 2022. He has over 2 decades of experience in fund management and is a CFA charter holder, CA, and has done PGDM from IIM Ahmedabad.

SBI Focused Fund has been managed by R. Srinivas since May 2009. He holds more than 31 years of experience in equities and is currently the Chief Investment Officer (CIO) – Equity at SBI Mutual Fund. He is a postgraduate in commerce (M.Com) and financial management (MFM).

The expense ratio under the direct plan of HDFC Focused Fund is currently 0.60%, while that of SBI Focused Fund is 0.75%.

Conclusion

Both these focused mutual fund schemes are from fund houses following robust investment processes and systems.

They have held their portfolio with conviction in line with the mandate of the scheme and following risk management measures in their endeavour to achieve their investment objectives.

Nevertheless, you need to be mindful of the fact that the risk in a focused fund is high to very high and accordingly approach them.

Consider your personal risk profile, broader investment objective, the financial goals you are addressing, and the time in hand to achieve those envisioned goals.

Be a thoughtful investor.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.